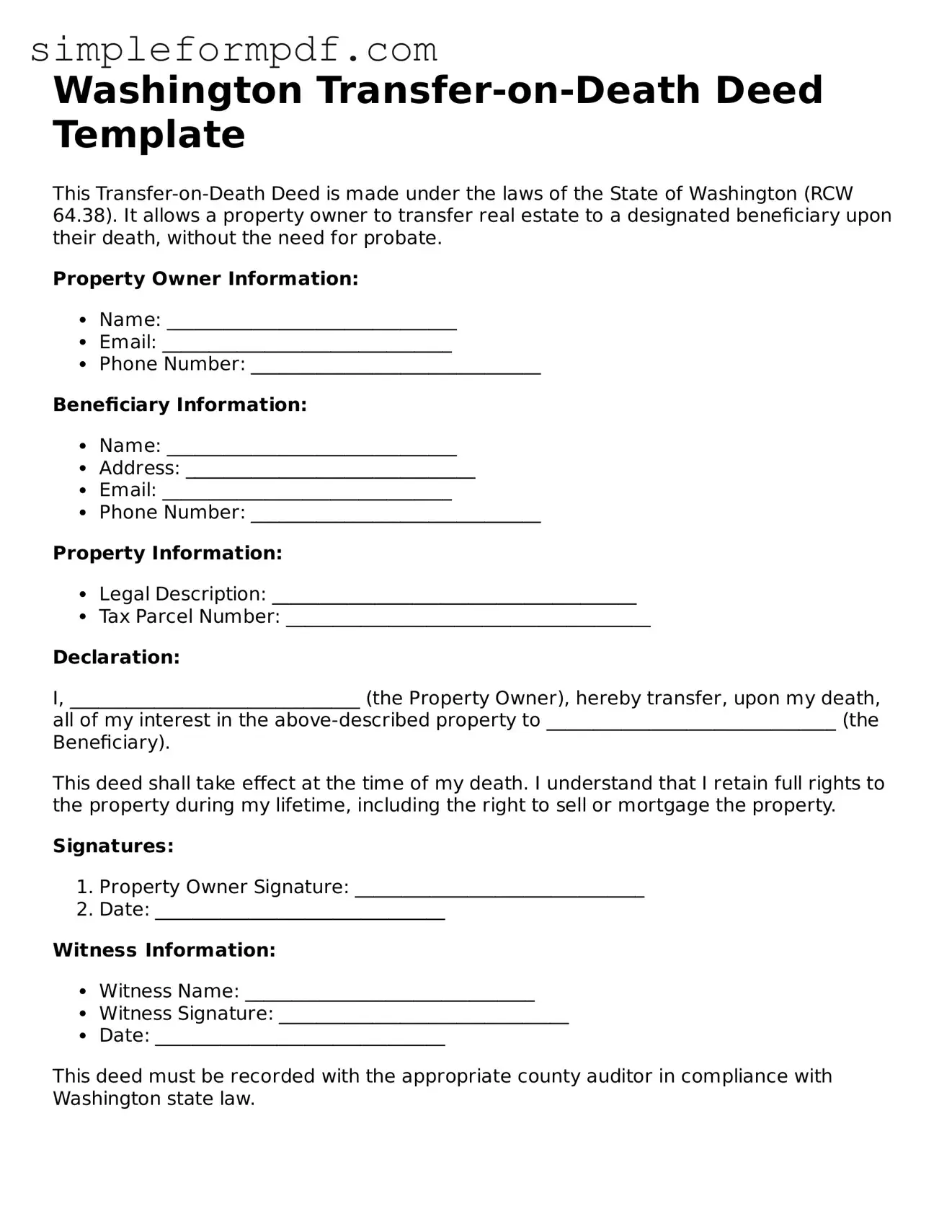

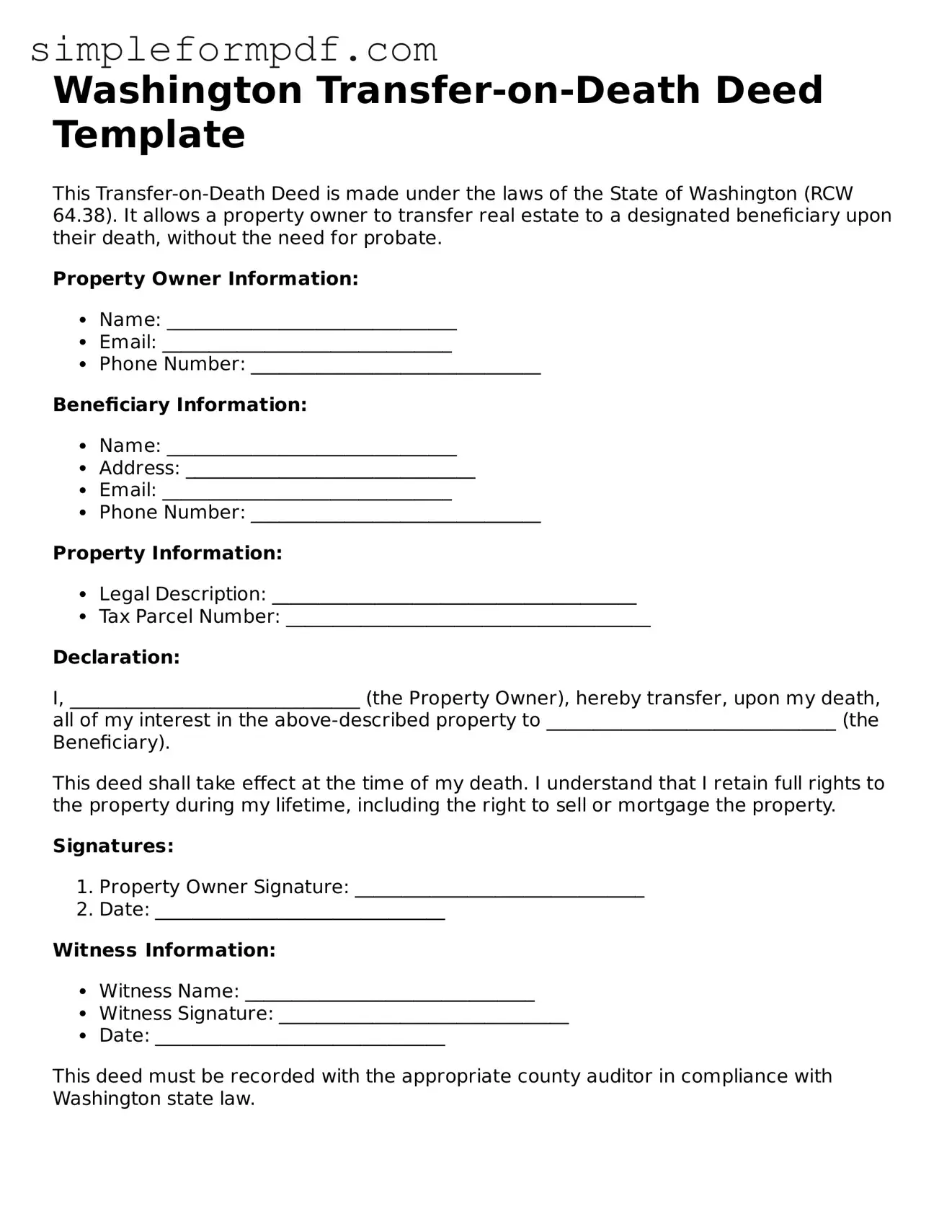

Free Transfer-on-Death Deed Form for the State of Washington

The Washington Transfer-on-Death Deed form allows individuals to transfer real estate to designated beneficiaries upon their death, bypassing the probate process. This legal tool provides a straightforward way to ensure that your property goes to the intended recipients without the complexities of a will. For those considering this option, filling out the form can be a significant step in estate planning.

Take control of your estate planning today. Click the button below to fill out the Transfer-on-Death Deed form.

Launch Editor

Free Transfer-on-Death Deed Form for the State of Washington

Launch Editor

Need instant form completion?

Finish Transfer-on-Death Deed online in just a few minutes.

Launch Editor

or

Download PDF