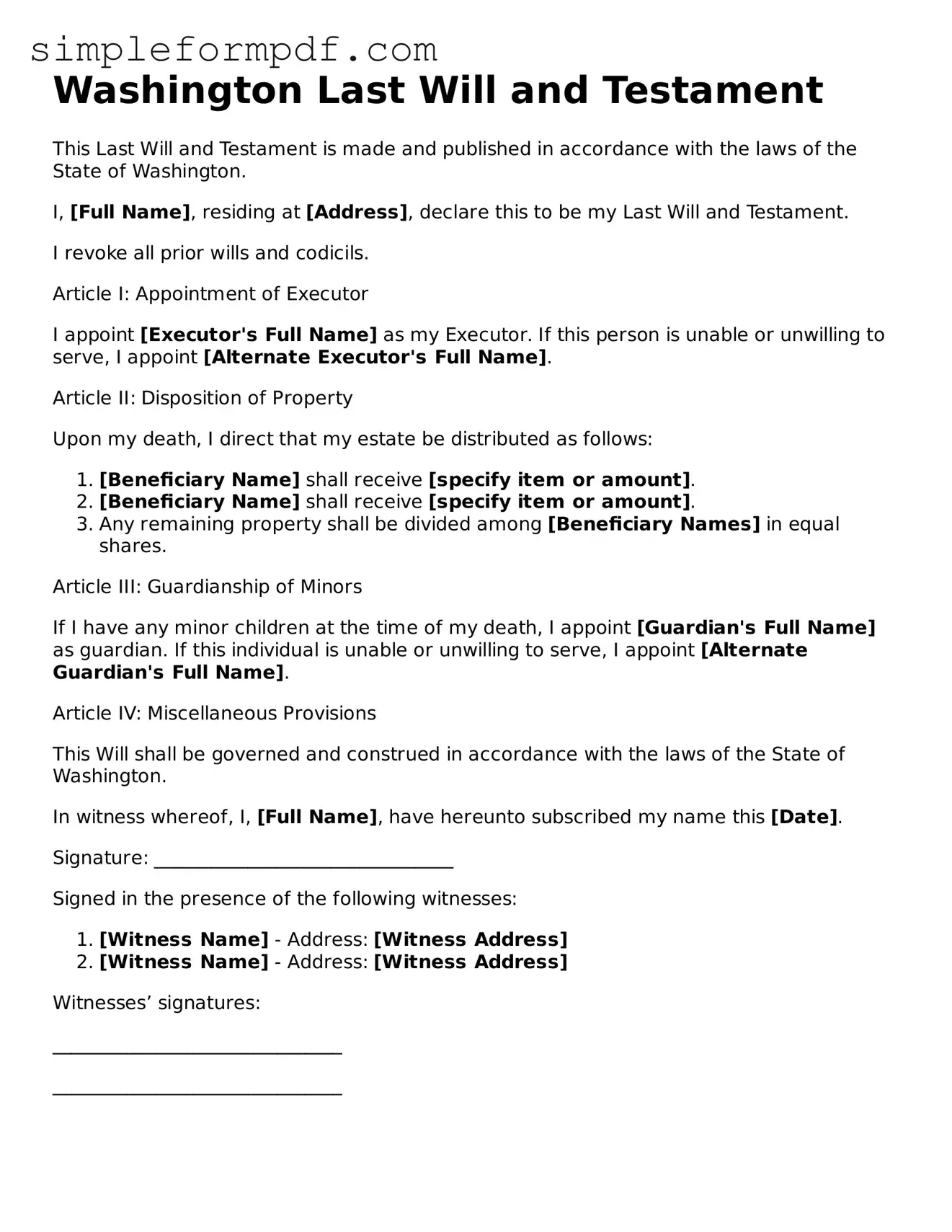

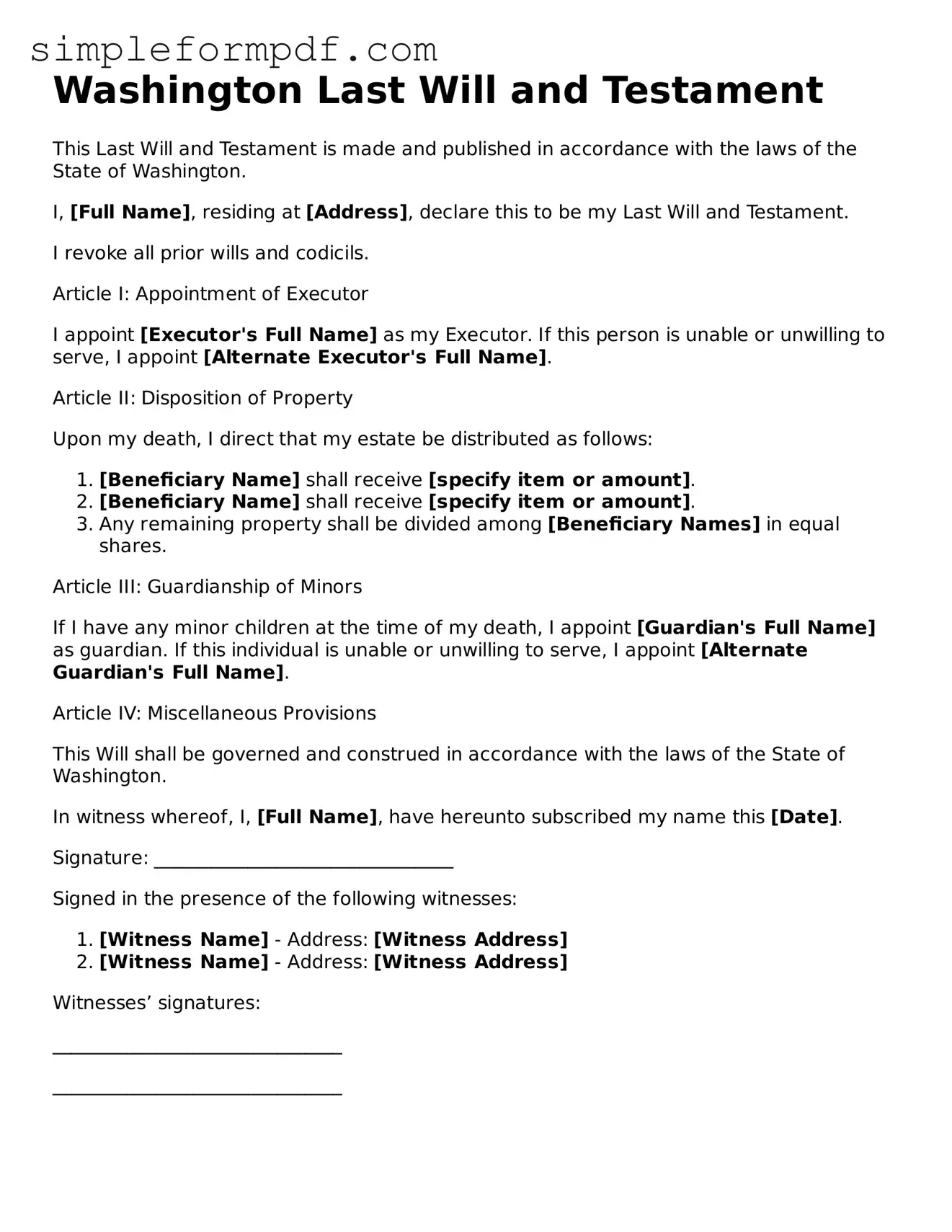

Free Last Will and Testament Form for the State of Washington

A Washington Last Will and Testament form is a legal document that outlines how a person’s assets and responsibilities will be managed after their passing. This important tool ensures that your wishes are honored and provides clarity for your loved ones during a difficult time. Ready to take control of your legacy? Fill out the form by clicking the button below.

Launch Editor

Free Last Will and Testament Form for the State of Washington

Launch Editor

Need instant form completion?

Finish Last Will and Testament online in just a few minutes.

Launch Editor

or

Download PDF