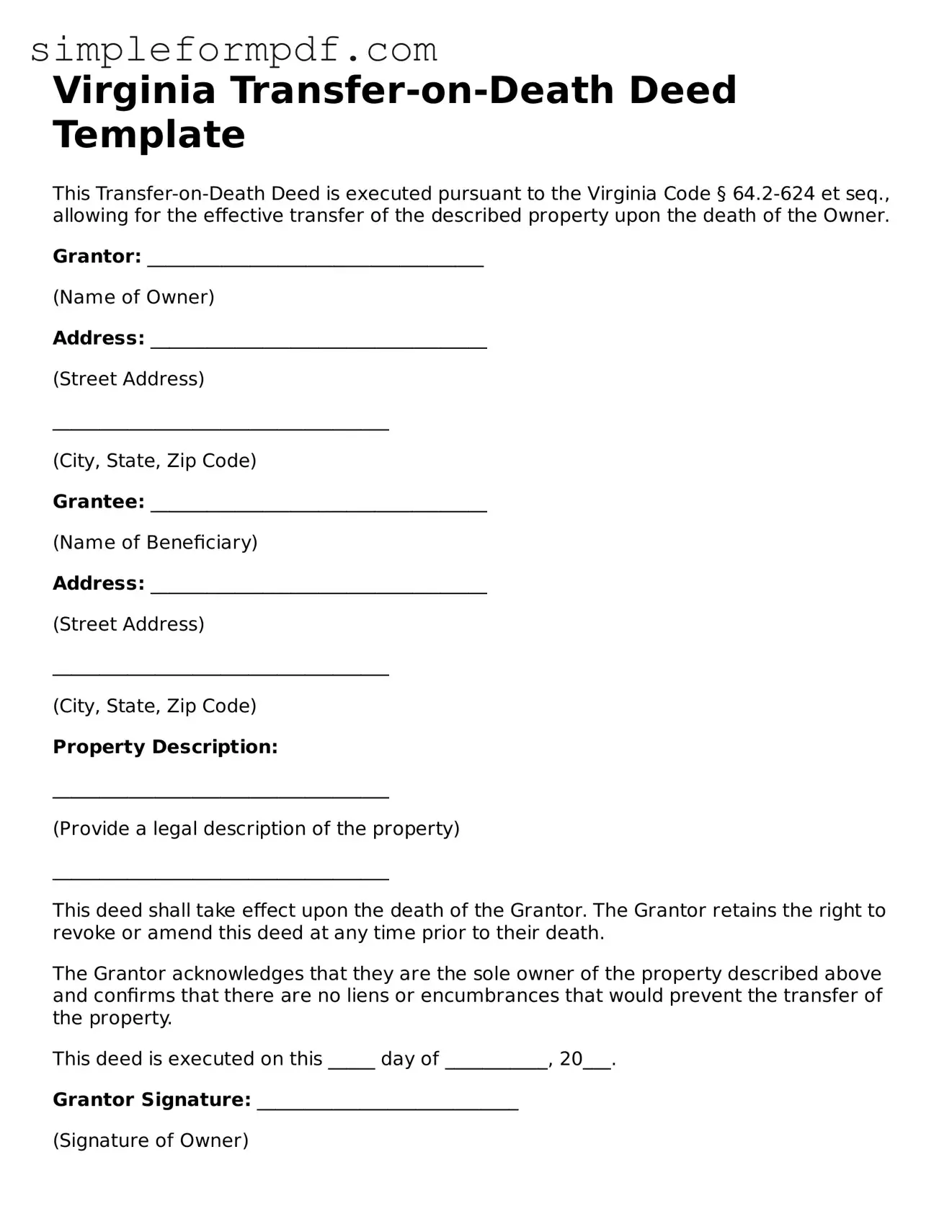

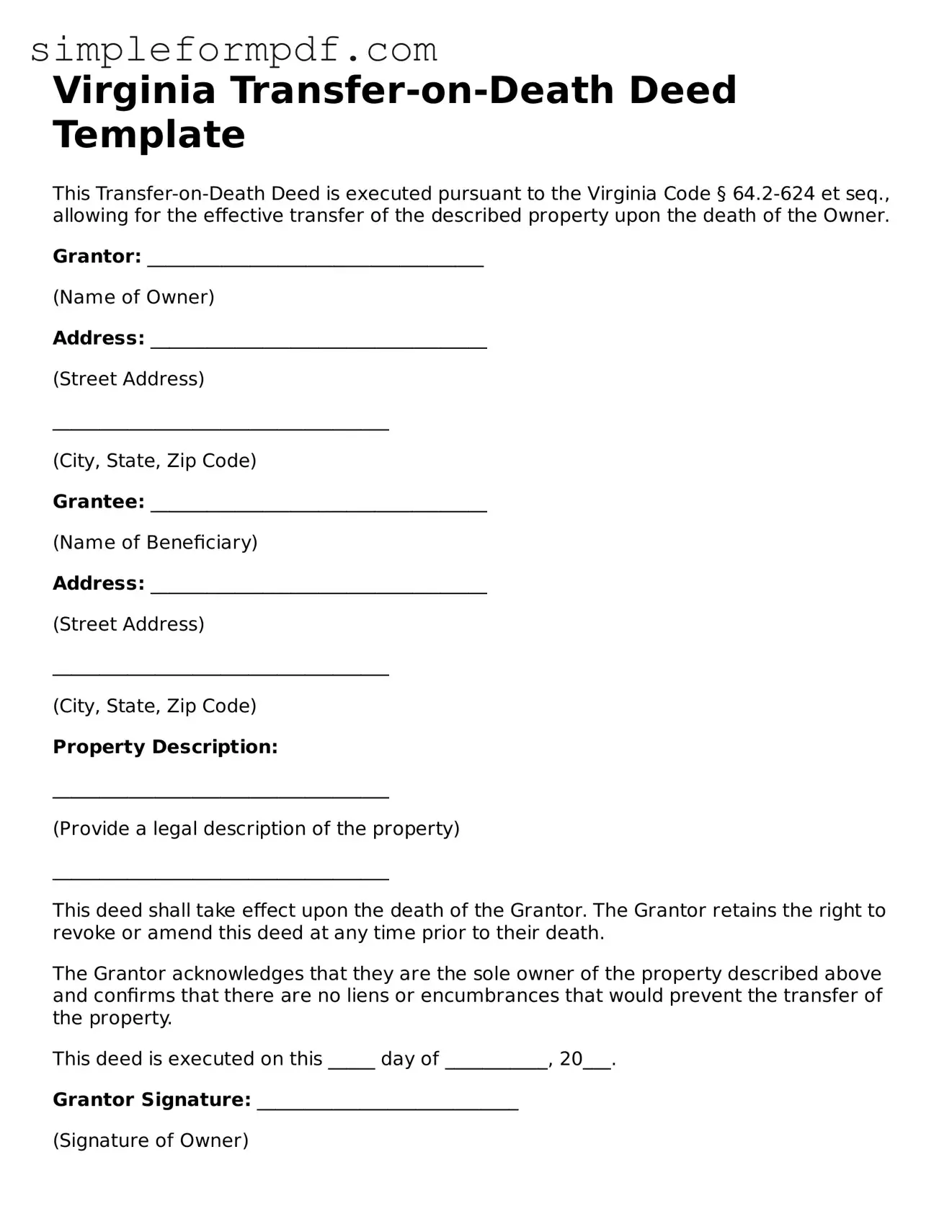

Free Transfer-on-Death Deed Form for the State of Virginia

The Virginia Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This simple yet effective tool ensures that loved ones receive property without the delays and costs typically associated with probate. To learn more and fill out the form, click the button below.

Launch Editor

Free Transfer-on-Death Deed Form for the State of Virginia

Launch Editor

Need instant form completion?

Finish Transfer-on-Death Deed online in just a few minutes.

Launch Editor

or

Download PDF