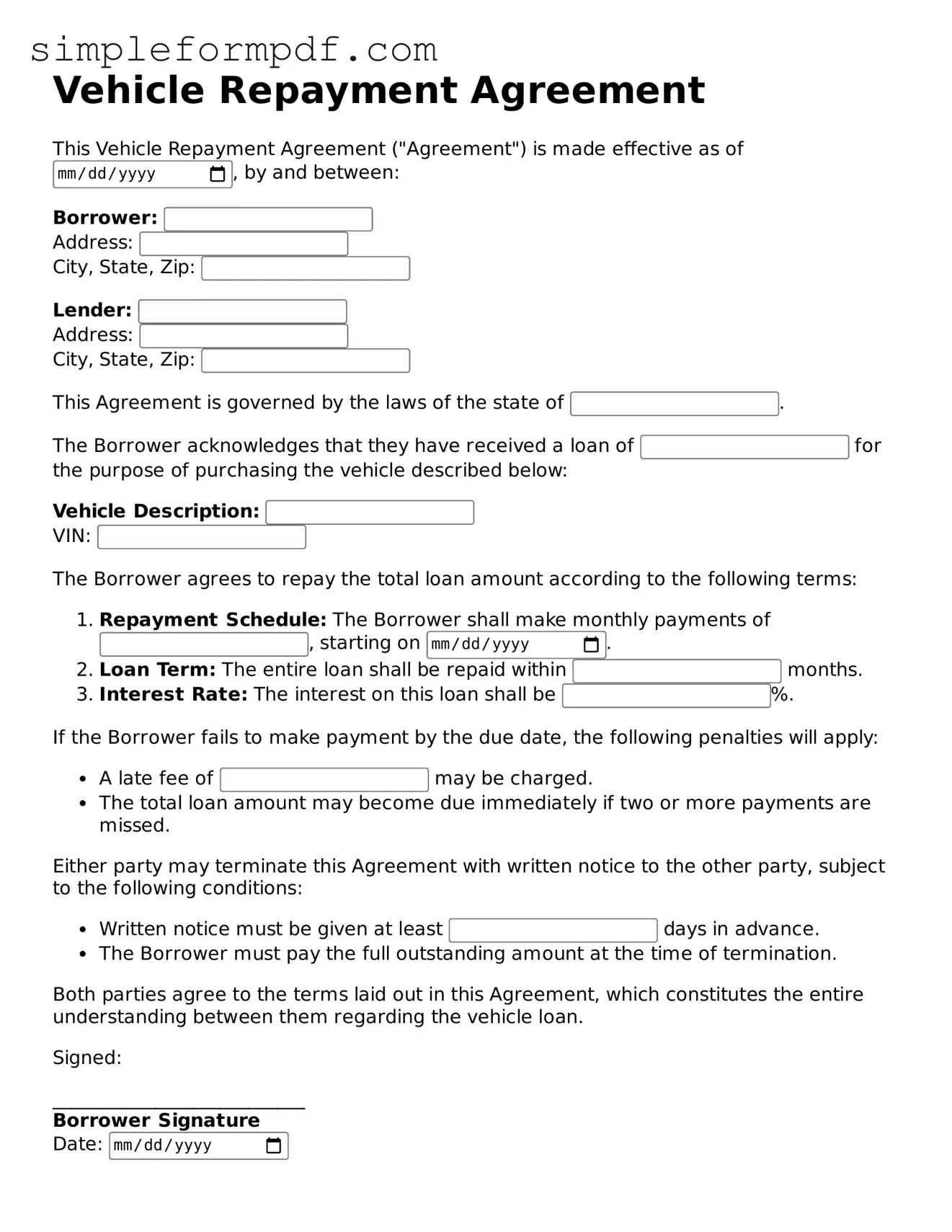

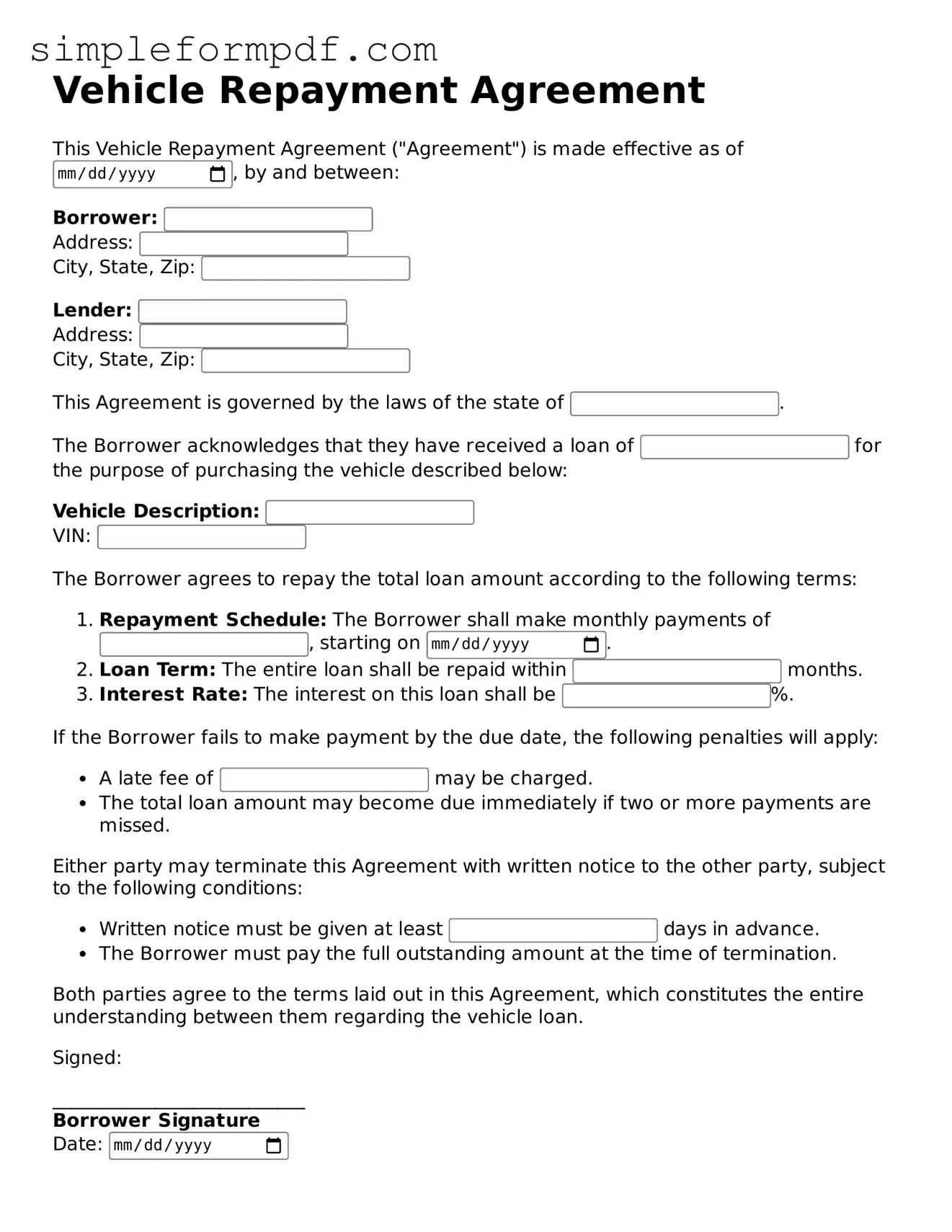

Fillable Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form is a crucial document that outlines the terms under which a borrower agrees to repay a loan for a vehicle. This agreement typically includes details such as the loan amount, interest rate, and repayment schedule. Understanding this form is essential for anyone entering into a vehicle financing arrangement.

Ready to get started? Fill out the form by clicking the button below.

Launch Editor

Fillable Vehicle Repayment Agreement Template

Launch Editor

Need instant form completion?

Finish Vehicle Repayment Agreement online in just a few minutes.

Launch Editor

or

Download PDF