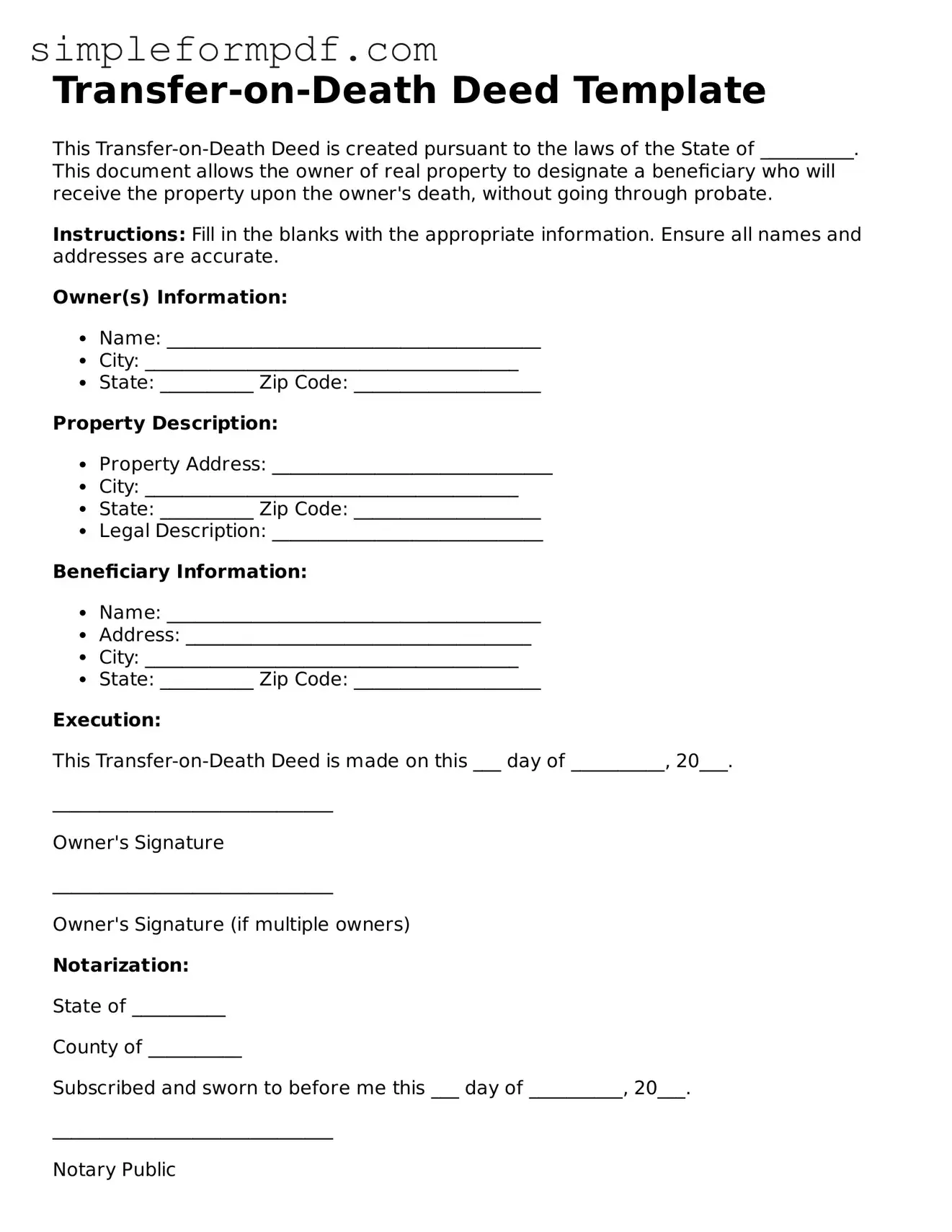

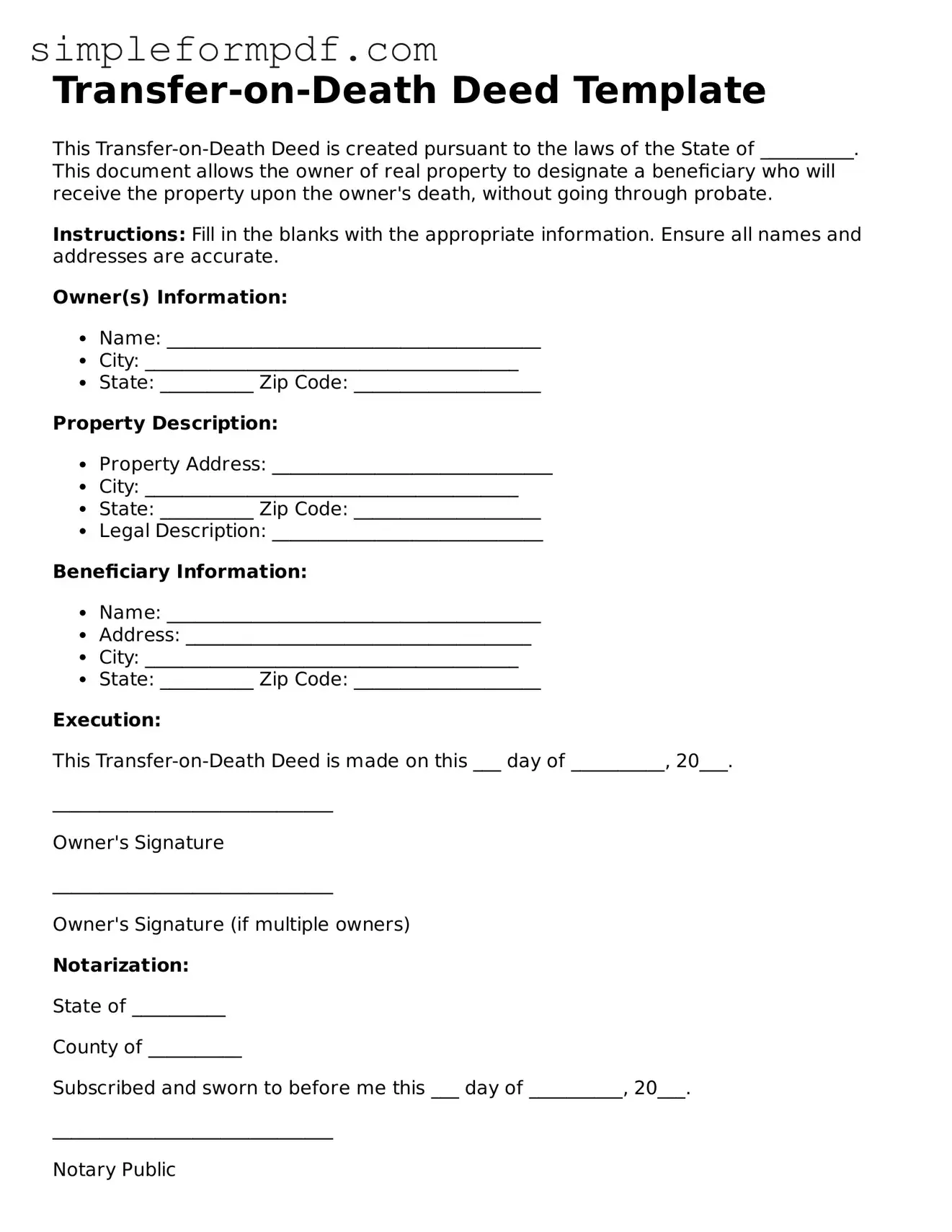

Fillable Transfer-on-Death Deed Template

A Transfer-on-Death Deed is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This simple yet effective tool ensures that your wishes are honored while providing a smooth transition of property ownership. To get started with your own Transfer-on-Death Deed, click the button below.

Launch Editor

Fillable Transfer-on-Death Deed Template

Launch Editor

Need instant form completion?

Finish Transfer-on-Death Deed online in just a few minutes.

Launch Editor

or

Download PDF