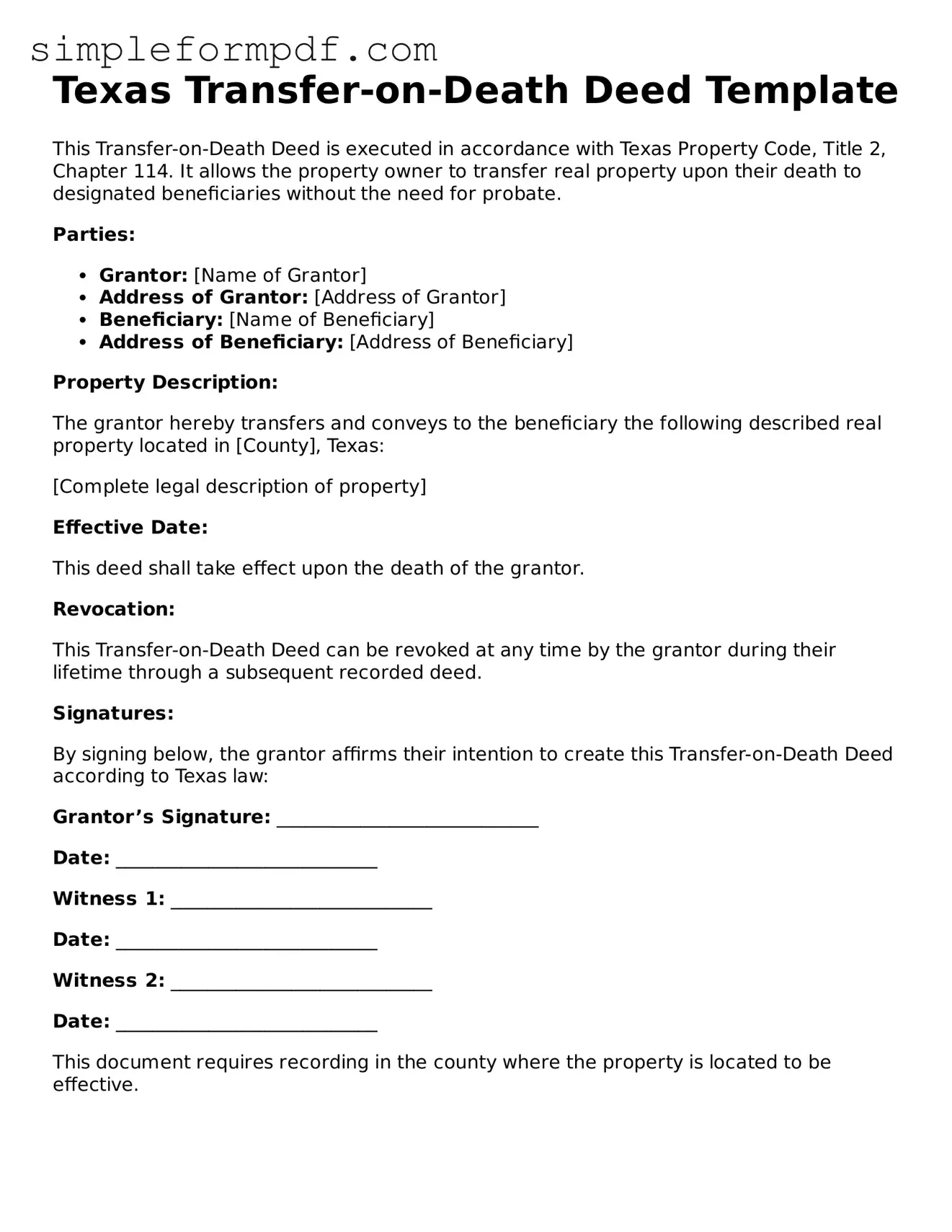

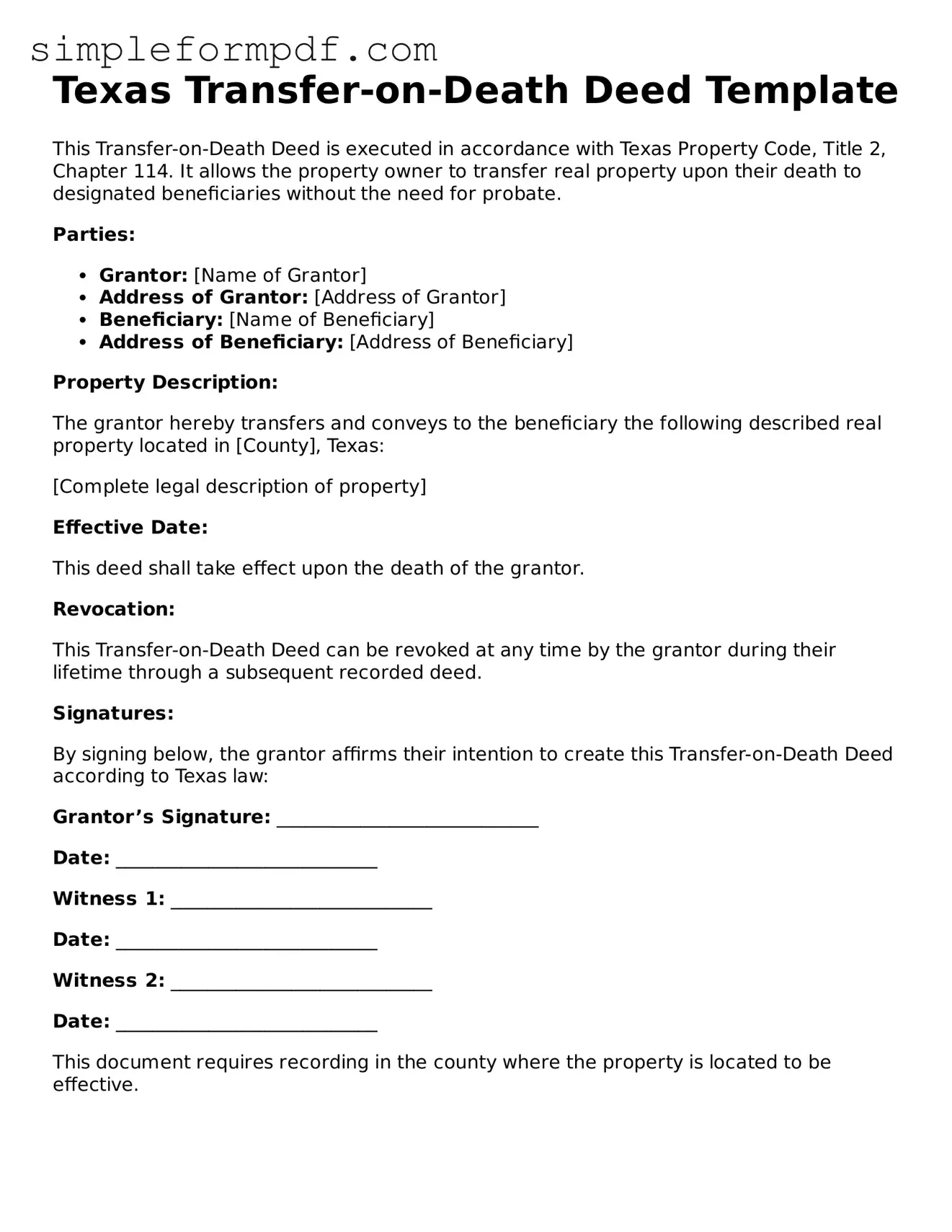

Free Transfer-on-Death Deed Form for the State of Texas

A Transfer-on-Death Deed is a legal document in Texas that allows property owners to transfer their real estate to beneficiaries upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property goes to the intended heirs without unnecessary delays or complications. For those looking to secure their property for future generations, filling out this form is a crucial step; click the button below to get started.

Launch Editor

Free Transfer-on-Death Deed Form for the State of Texas

Launch Editor

Need instant form completion?

Finish Transfer-on-Death Deed online in just a few minutes.

Launch Editor

or

Download PDF