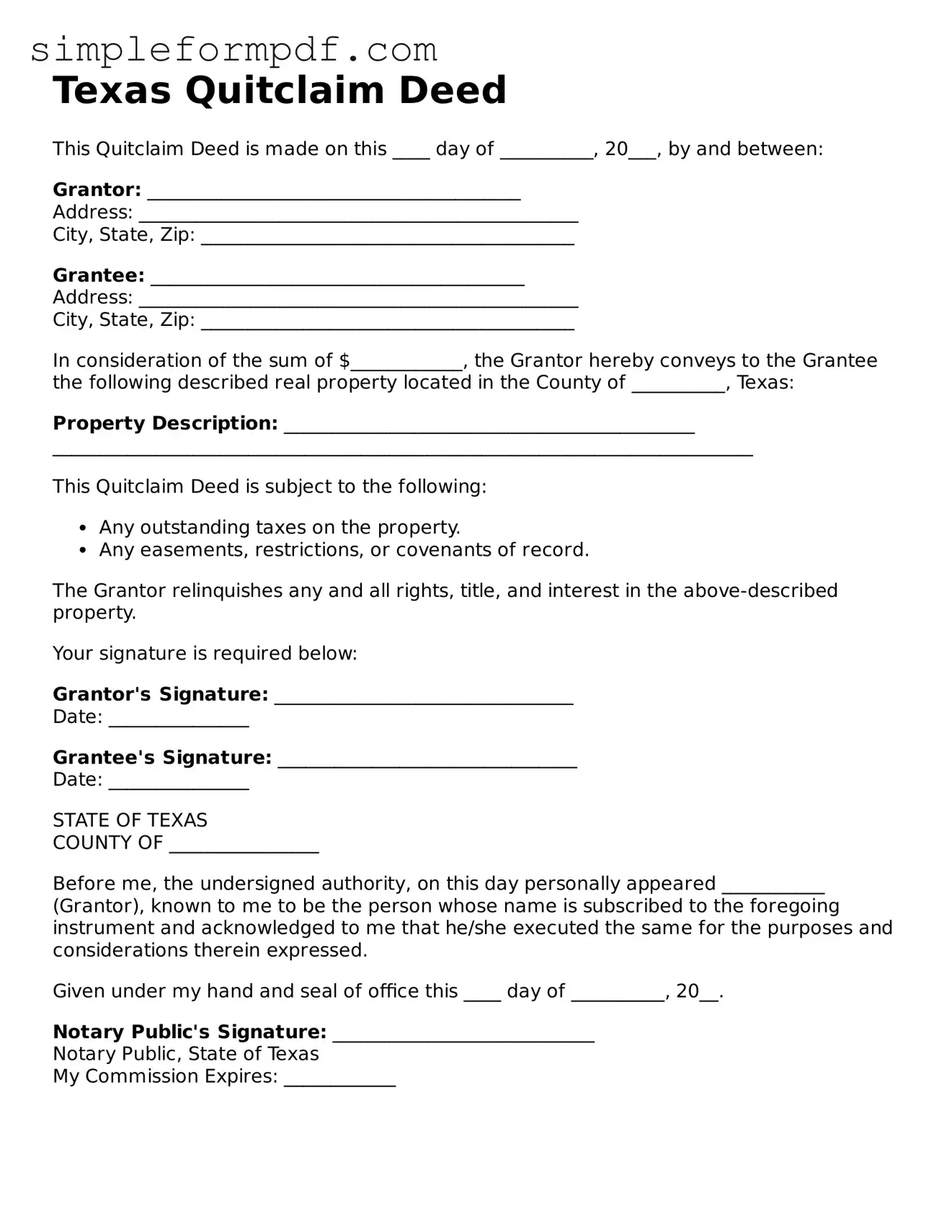

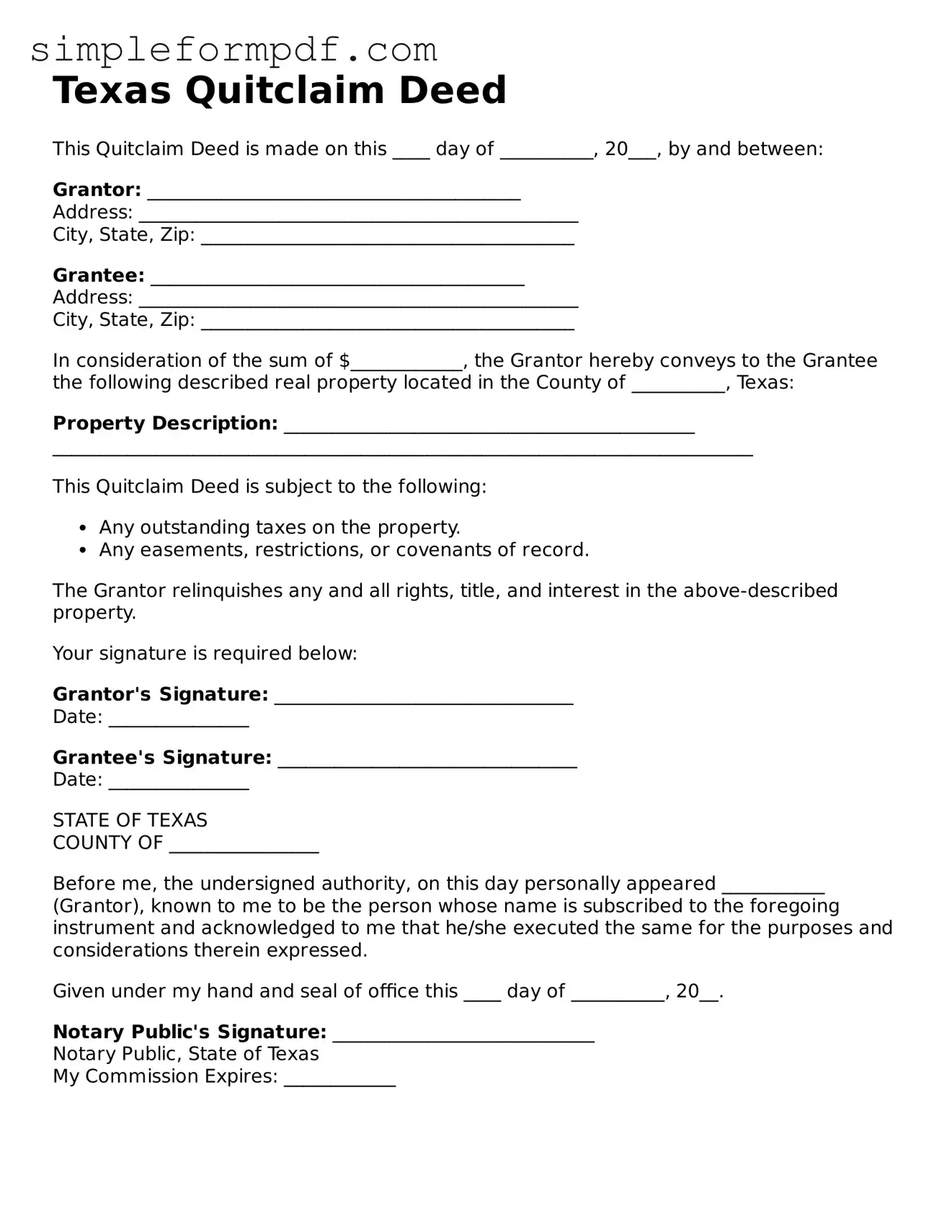

Free Quitclaim Deed Form for the State of Texas

A Texas Quitclaim Deed is a legal document that allows a property owner to transfer their interest in real estate to another party without making any warranties about the title. This form is often used in situations such as family transfers or when a property owner wishes to relinquish their rights. To ensure a smooth transfer, consider filling out the form by clicking the button below.

Launch Editor

Free Quitclaim Deed Form for the State of Texas

Launch Editor

Need instant form completion?

Finish Quitclaim Deed online in just a few minutes.

Launch Editor

or

Download PDF