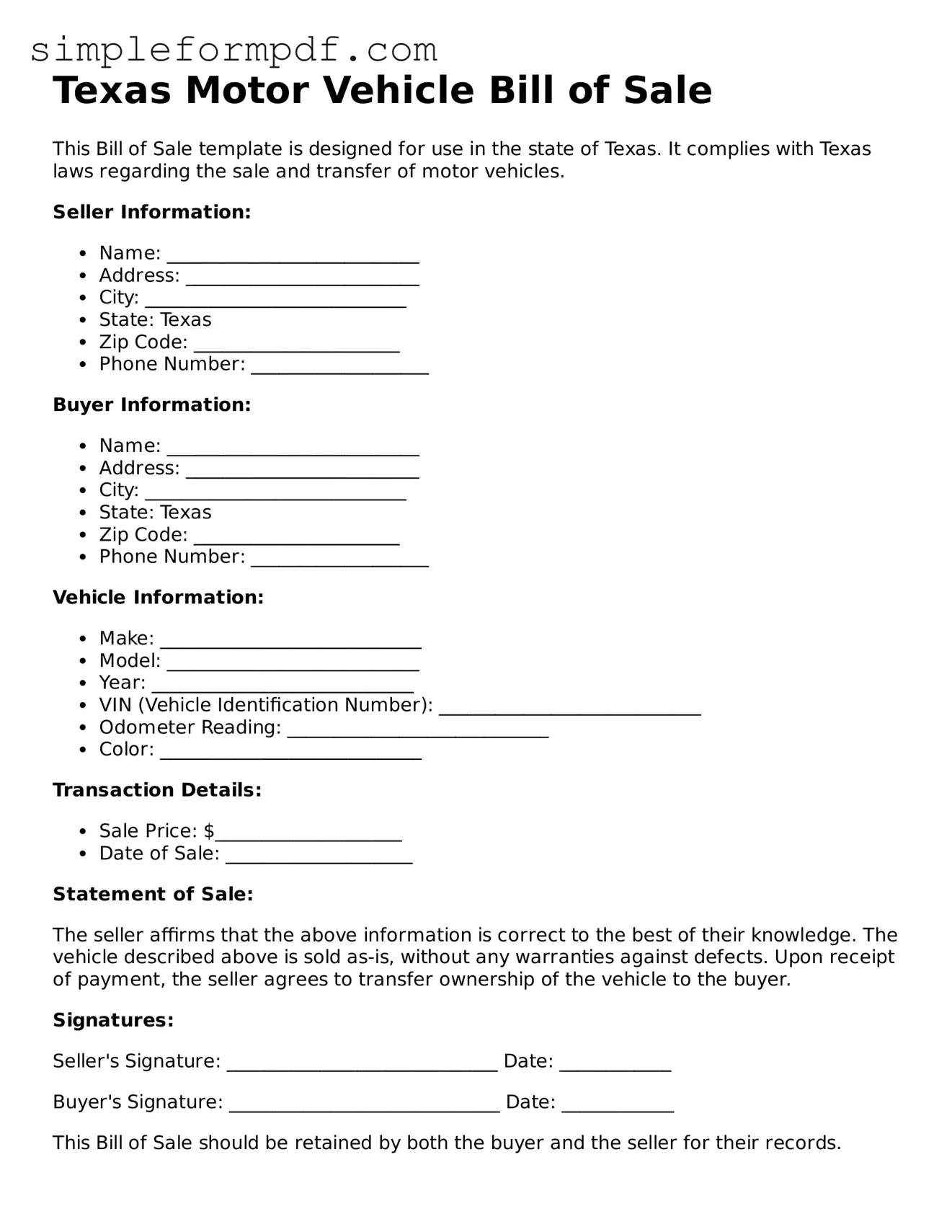

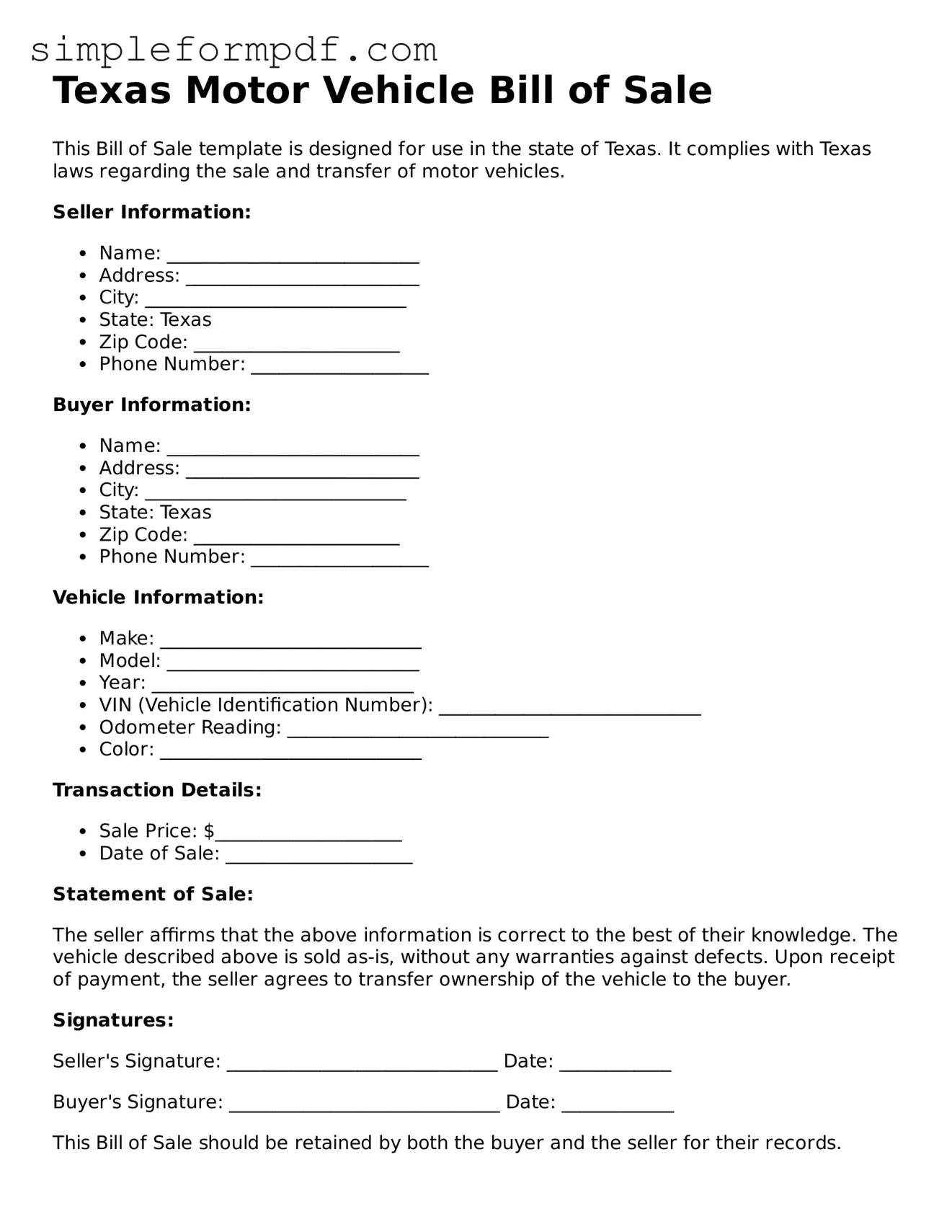

Free Motor Vehicle Bill of Sale Form for the State of Texas

The Texas Motor Vehicle Bill of Sale form serves as a crucial document in the transfer of ownership for vehicles in Texas. This form not only provides proof of the transaction but also outlines essential details about the vehicle and the parties involved. Understanding its importance can streamline the buying and selling process, ensuring a smooth transition of ownership.

Ready to fill out the form? Click the button below to get started!

Launch Editor

Free Motor Vehicle Bill of Sale Form for the State of Texas

Launch Editor

Need instant form completion?

Finish Motor Vehicle Bill of Sale online in just a few minutes.

Launch Editor

or

Download PDF