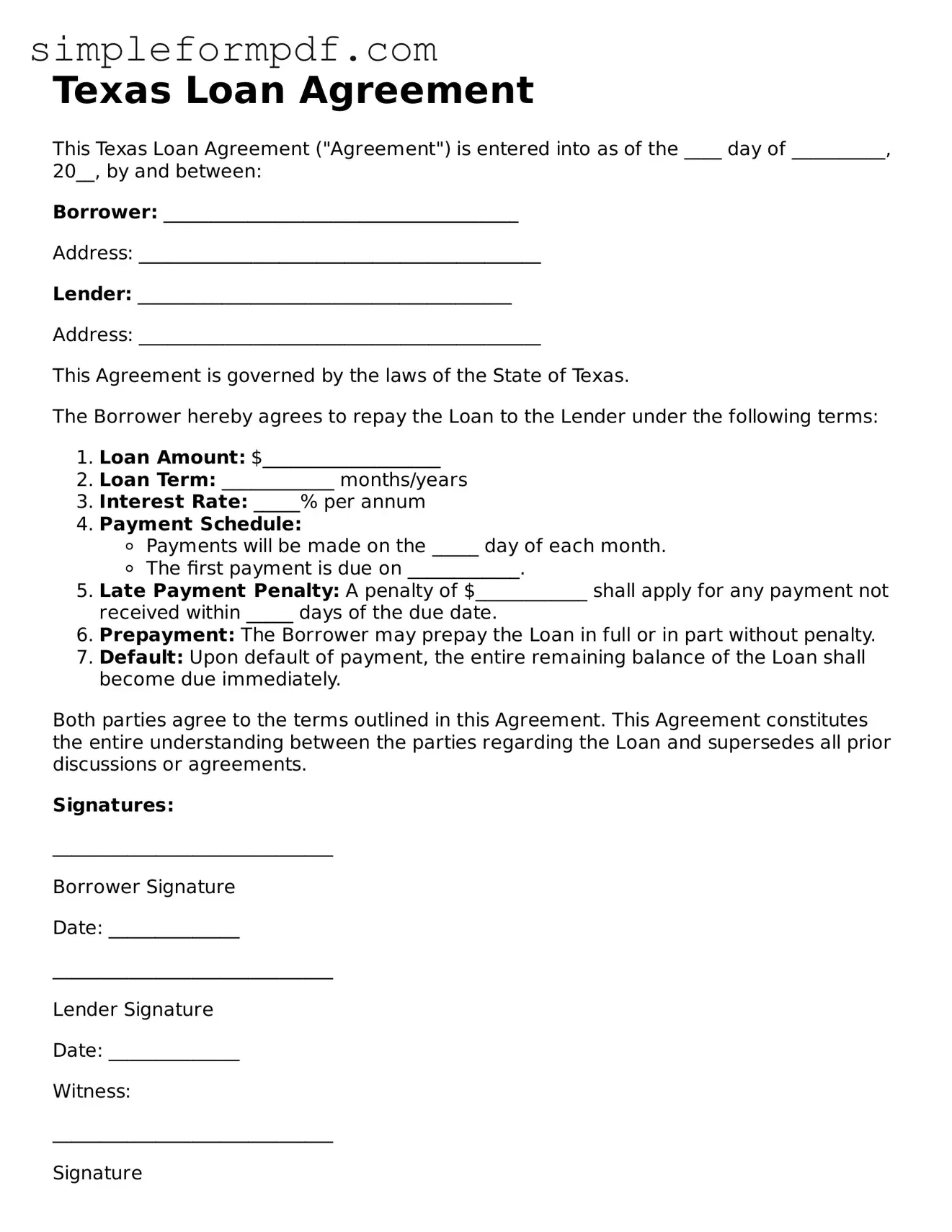

Free Loan Agreement Form for the State of Texas

The Texas Loan Agreement form is a legal document that outlines the terms and conditions between a lender and a borrower in the state of Texas. This form serves to protect both parties by clearly defining the loan amount, repayment schedule, and any applicable interest rates. Understanding the specifics of this agreement is crucial for ensuring a smooth lending process.

For those ready to proceed, fill out the form by clicking the button below.

Launch Editor

Free Loan Agreement Form for the State of Texas

Launch Editor

Need instant form completion?

Finish Loan Agreement online in just a few minutes.

Launch Editor

or

Download PDF