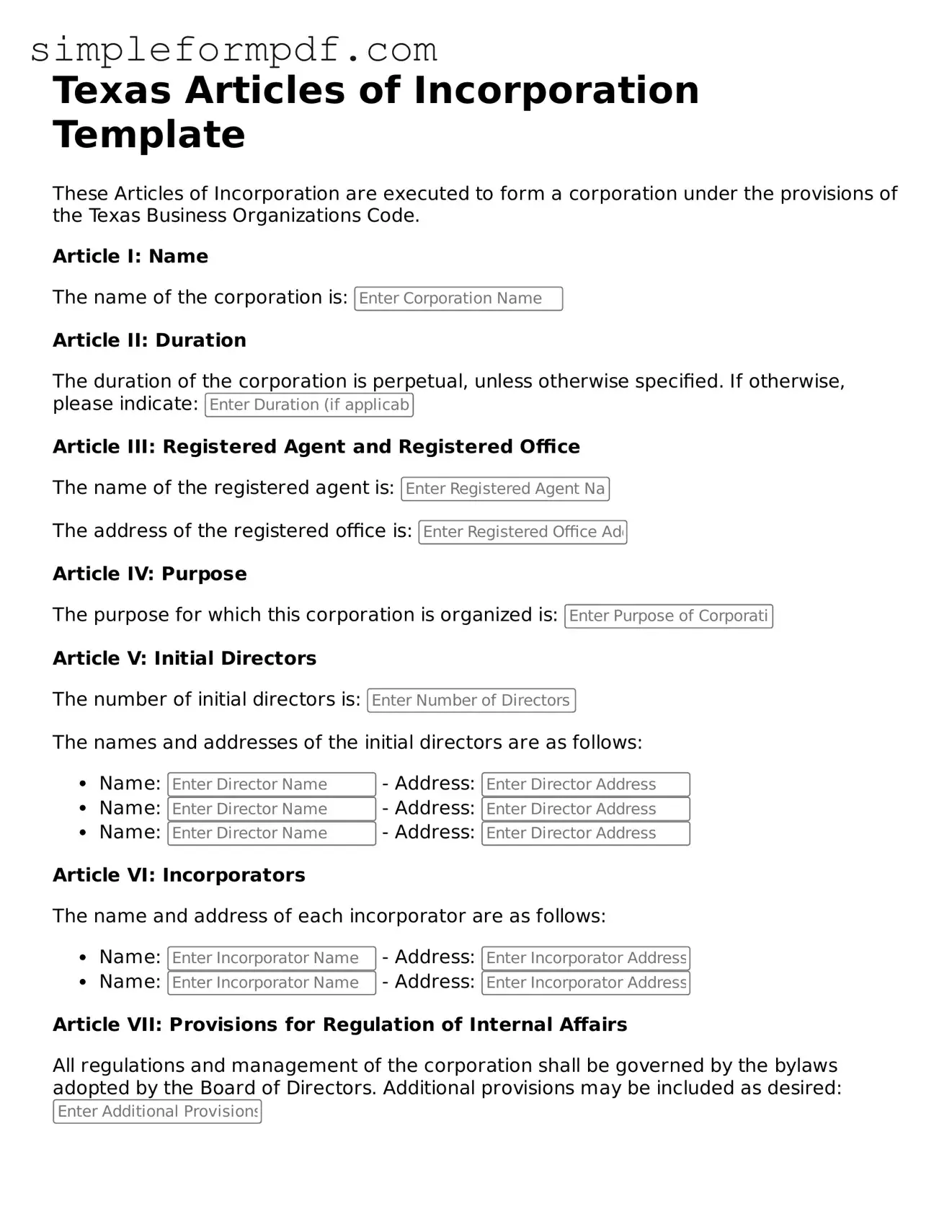

Free Articles of Incorporation Form for the State of Texas

The Texas Articles of Incorporation form is a legal document required to establish a corporation in the state of Texas. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing this form is a crucial step in the incorporation process, ensuring compliance with state regulations.

To proceed with your incorporation, please fill out the form by clicking the button below.

Launch Editor

Free Articles of Incorporation Form for the State of Texas

Launch Editor

Need instant form completion?

Finish Articles of Incorporation online in just a few minutes.

Launch Editor

or

Download PDF