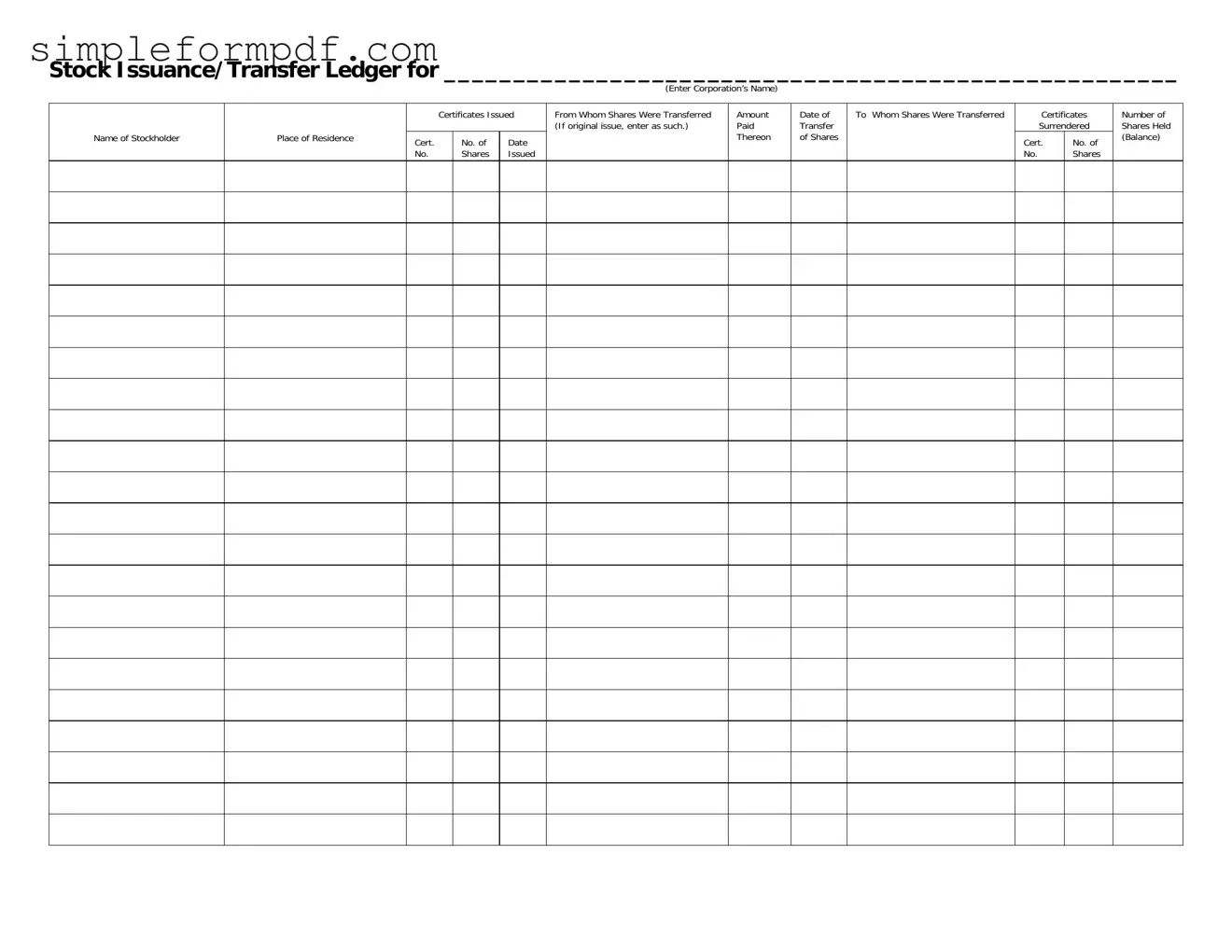

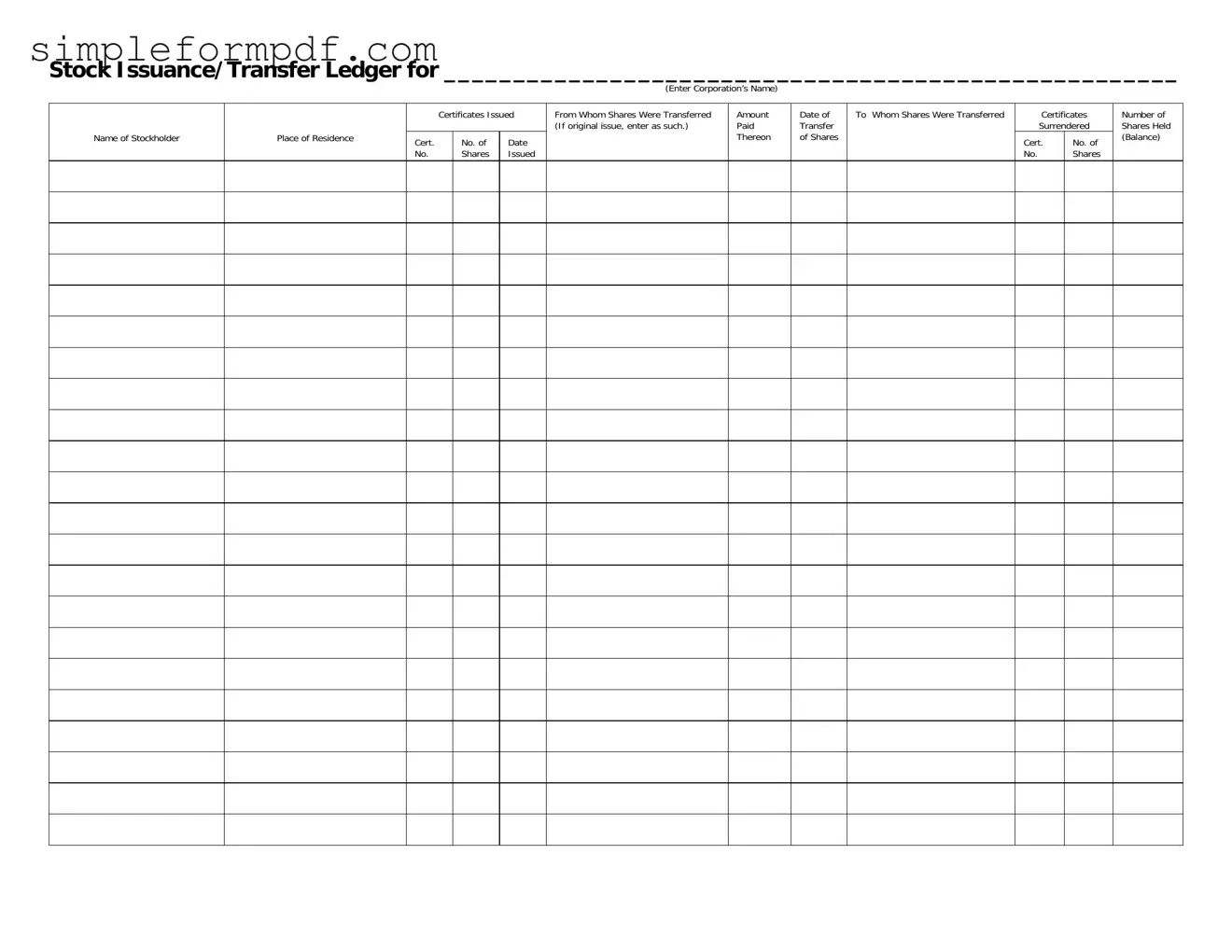

Stock Transfer Ledger PDF Form

The Stock Transfer Ledger form is an essential document used to track the issuance and transfer of stock shares within a corporation. It records vital information such as the stockholder's name, residence, certificates issued, and details about the transfer of shares. Ensuring this form is accurately filled out is crucial for maintaining clear ownership records.

To complete the Stock Transfer Ledger form, please click the button below.

Launch Editor

Stock Transfer Ledger PDF Form

Launch Editor

Need instant form completion?

Finish Stock Transfer Ledger online in just a few minutes.

Launch Editor

or

Download PDF