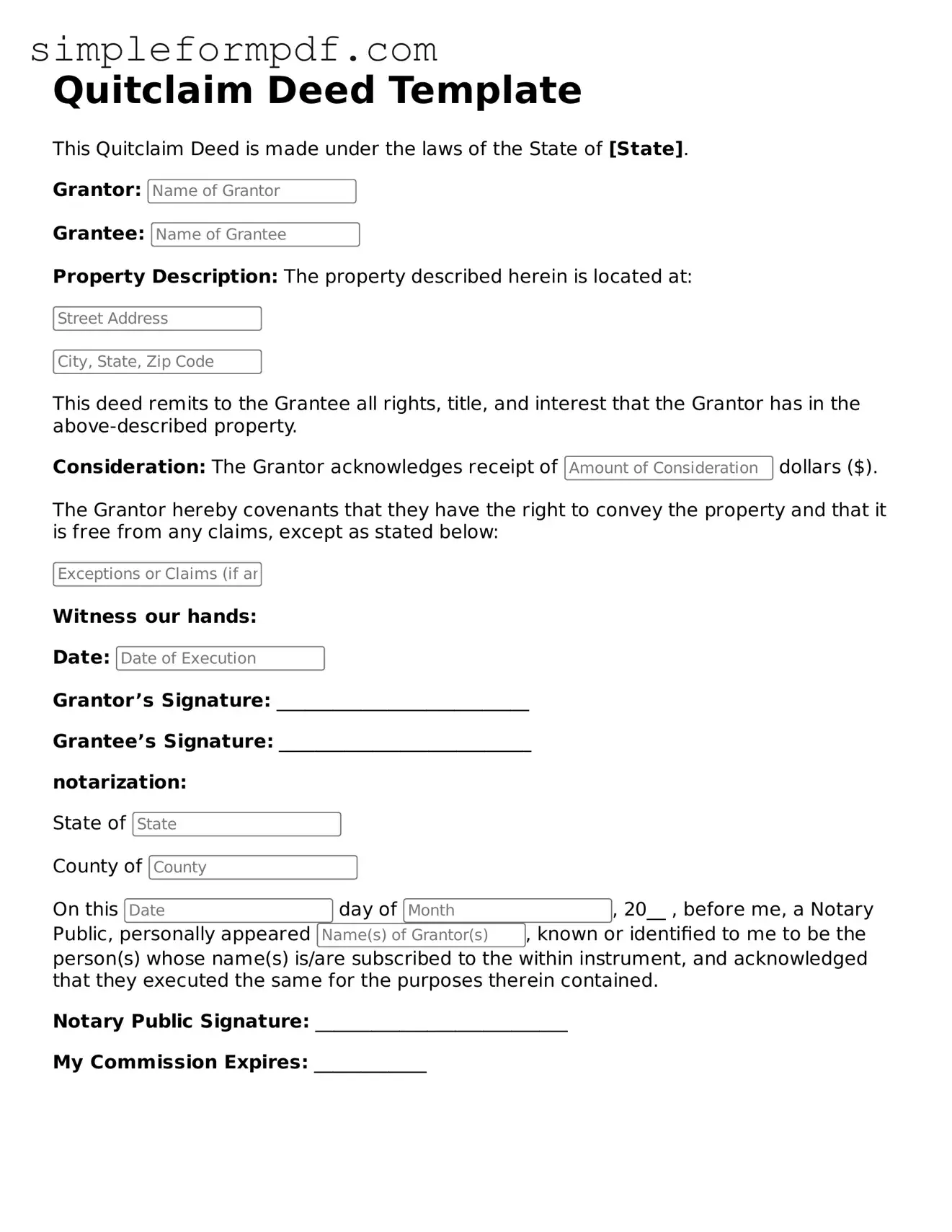

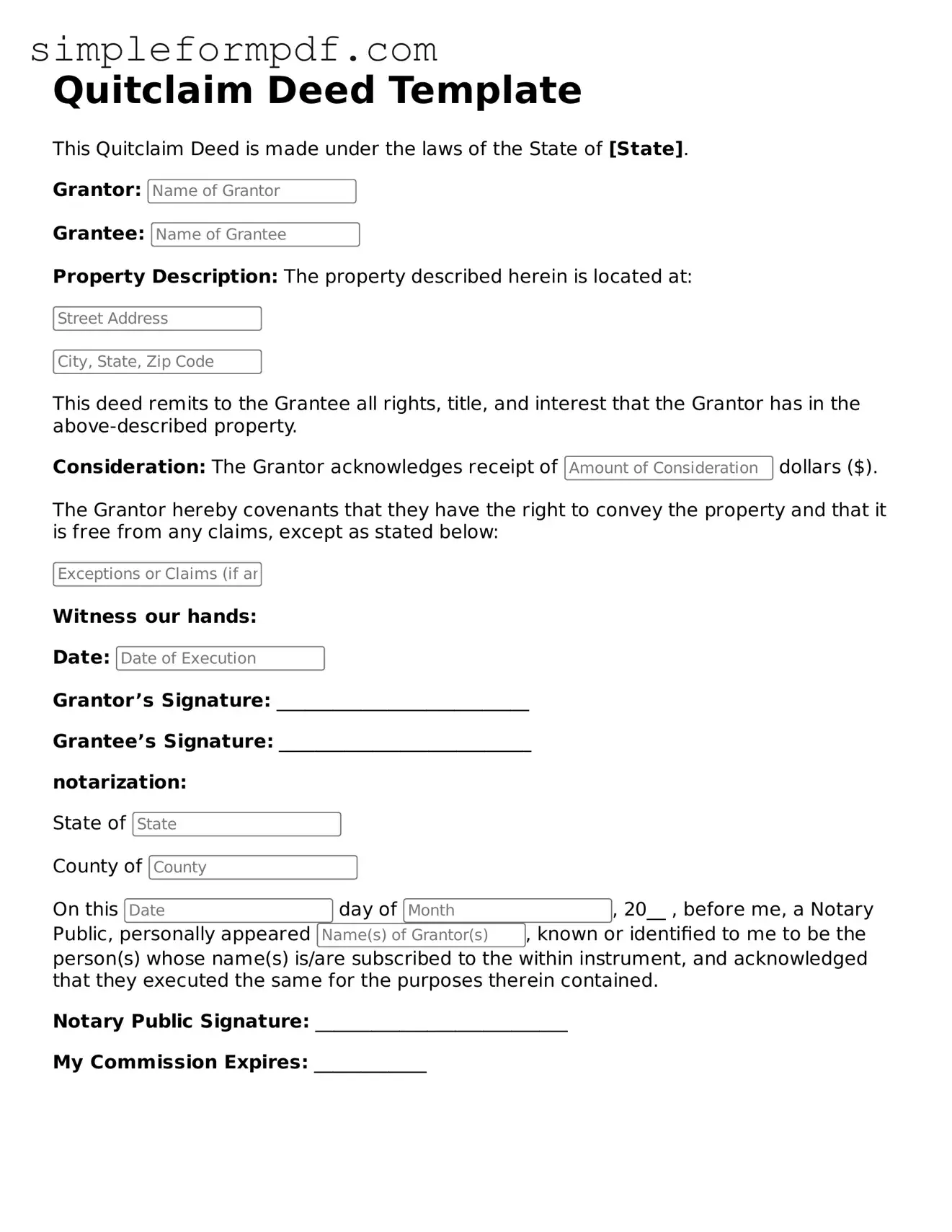

Fillable Quitclaim Deed Template

A Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another party without guaranteeing the quality of the title. This form is often used in situations such as divorce settlements or transferring property between family members. If you need to fill out a Quitclaim Deed, click the button below to get started.

Launch Editor

Fillable Quitclaim Deed Template

Launch Editor

Need instant form completion?

Finish Quitclaim Deed online in just a few minutes.

Launch Editor

or

Download PDF