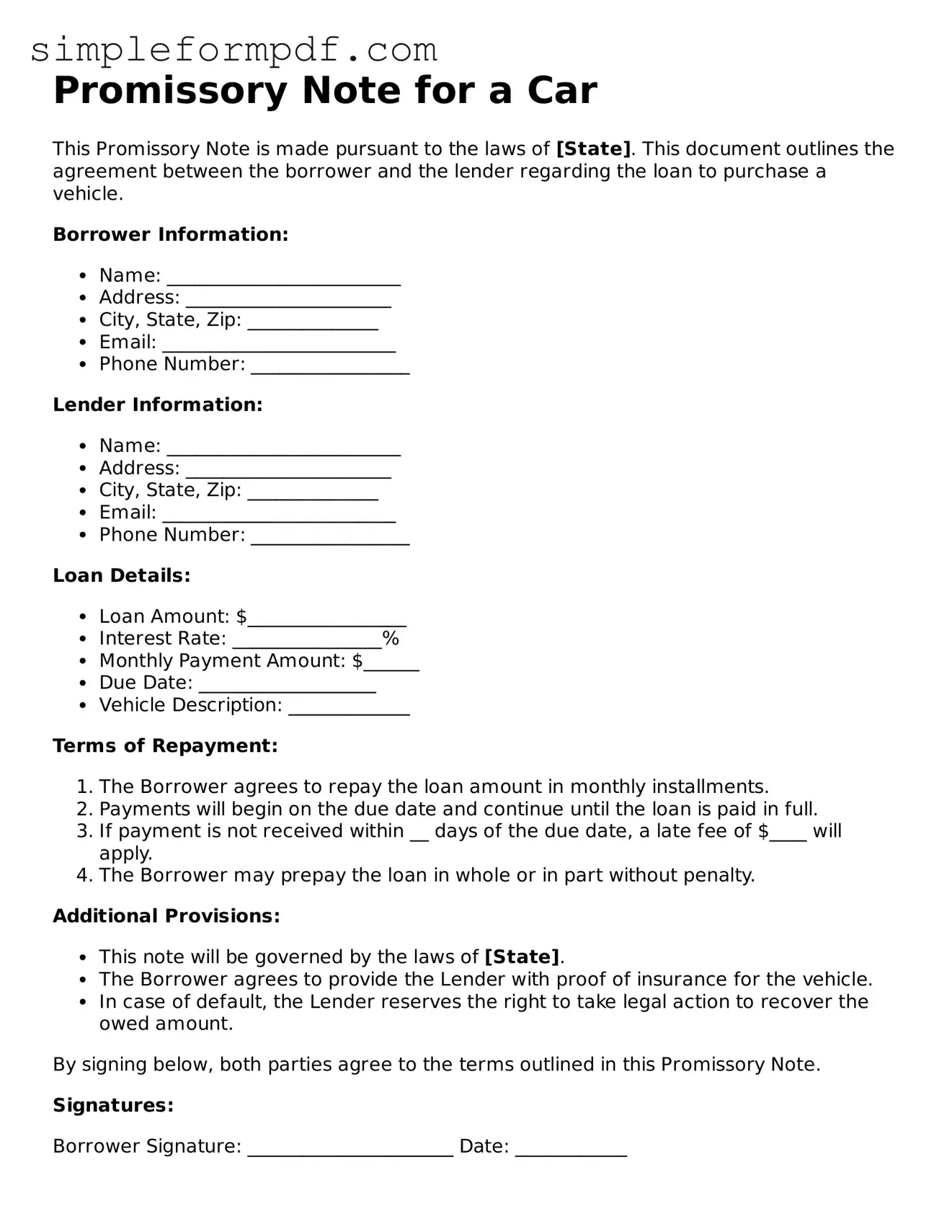

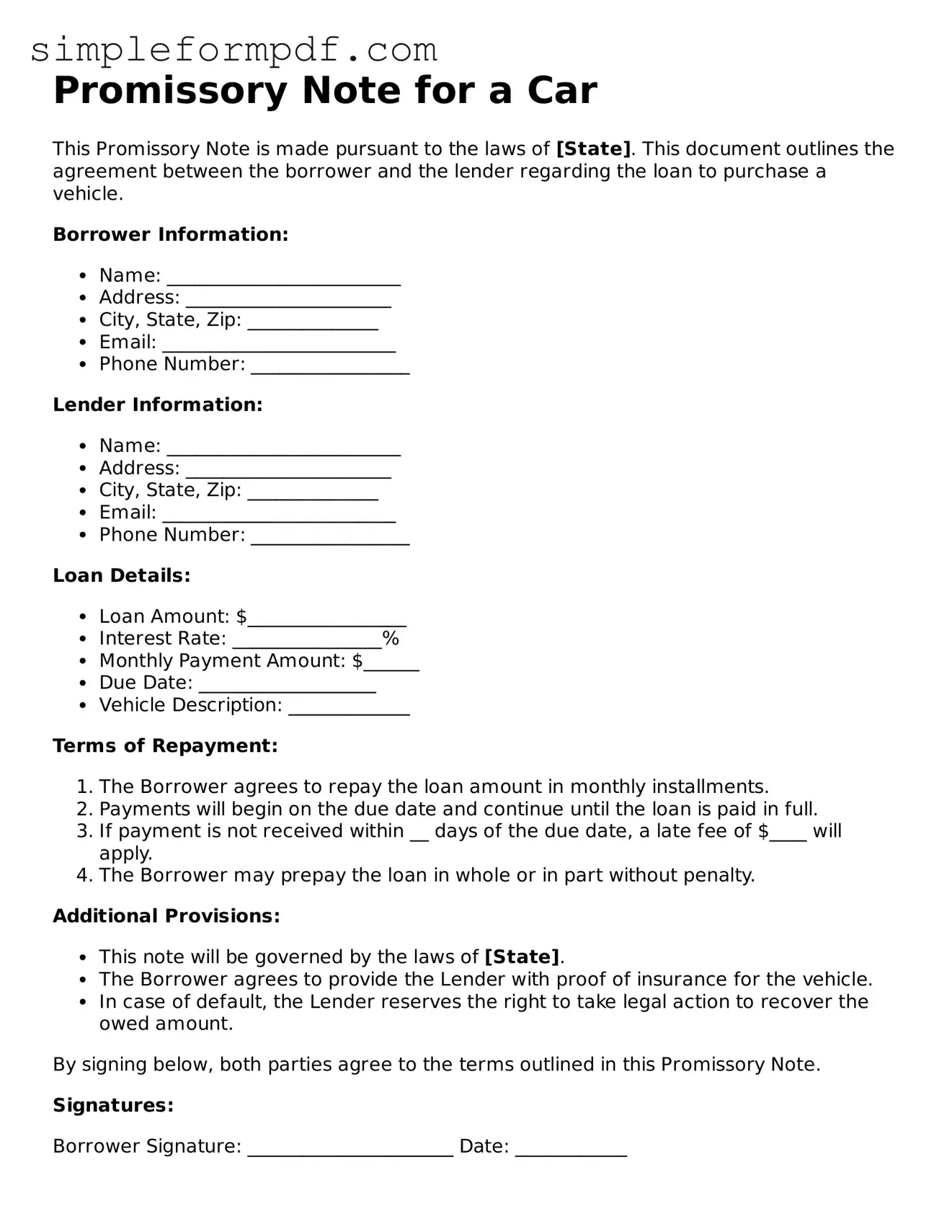

Fillable Promissory Note for a Car Template

A Promissory Note for a Car is a legal document in which one party agrees to pay a specified amount to another party, typically in exchange for a vehicle. This form outlines the terms of the loan, including payment schedules and interest rates. Ensure you complete the form accurately to protect your interests; click the button below to get started.

Launch Editor

Fillable Promissory Note for a Car Template

Launch Editor

Need instant form completion?

Finish Promissory Note for a Car online in just a few minutes.

Launch Editor

or

Download PDF