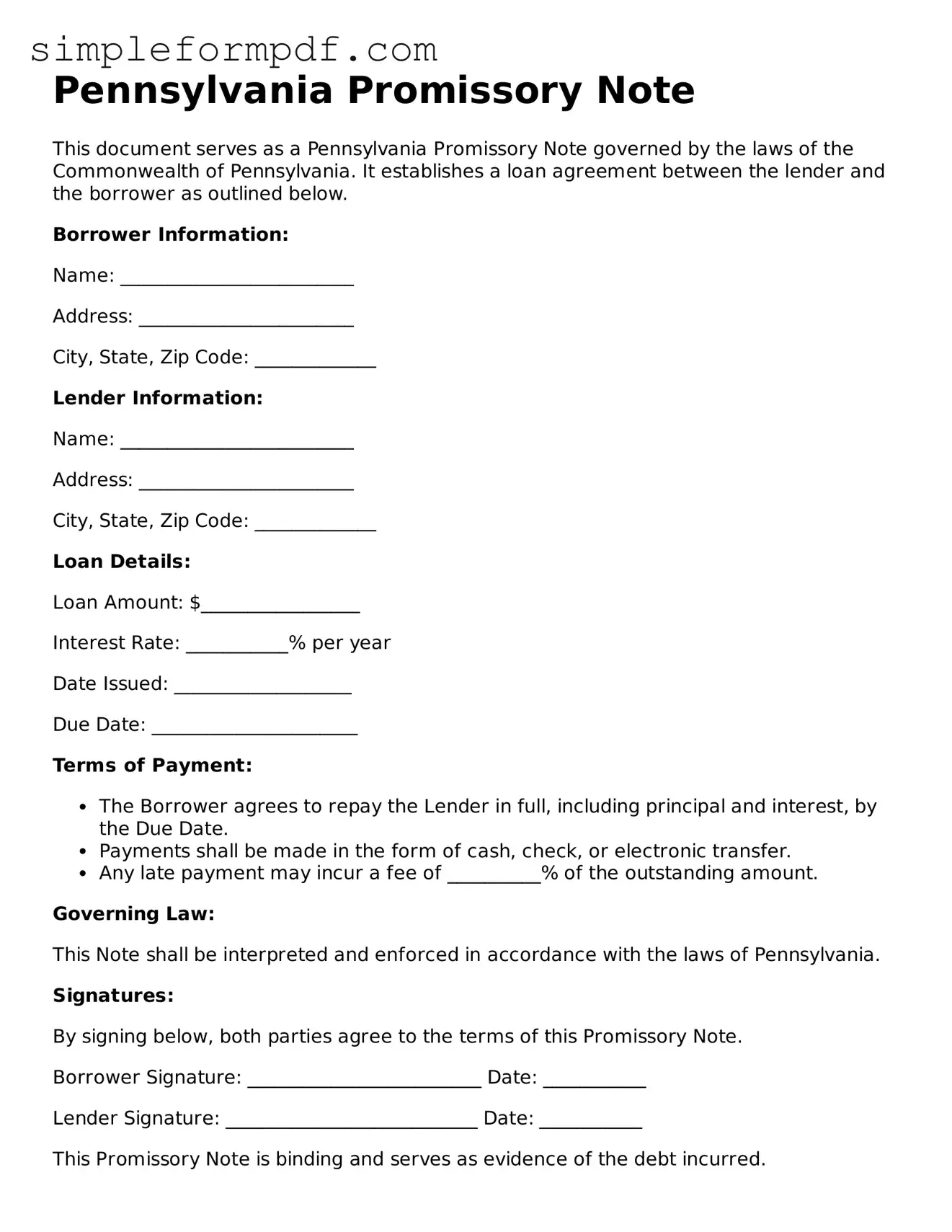

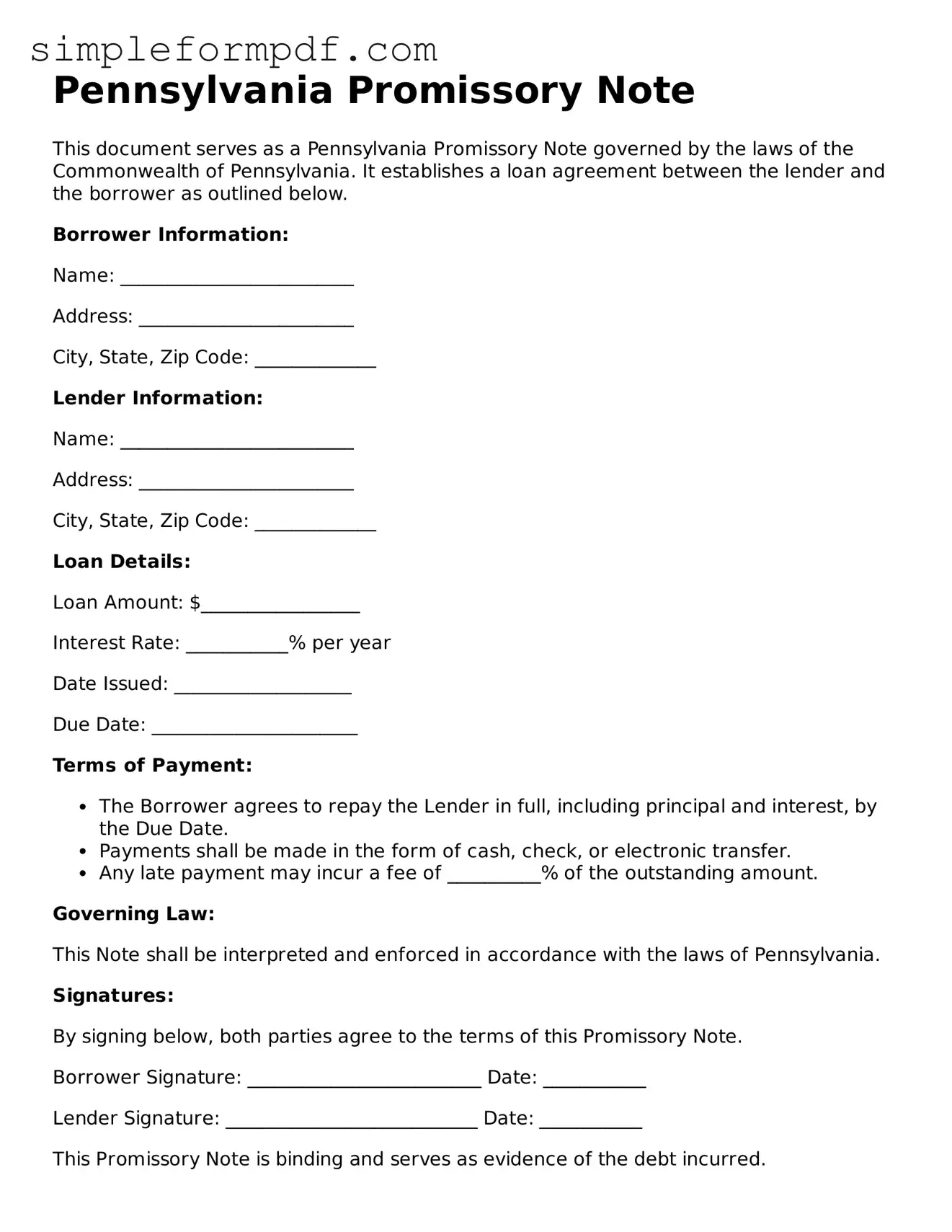

Free Promissory Note Form for the State of Pennsylvania

A Pennsylvania Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms. This form includes essential details such as the amount borrowed, interest rates, and repayment schedule. To get started on your financial agreement, fill out the form by clicking the button below.

Launch Editor

Free Promissory Note Form for the State of Pennsylvania

Launch Editor

Need instant form completion?

Finish Promissory Note online in just a few minutes.

Launch Editor

or

Download PDF