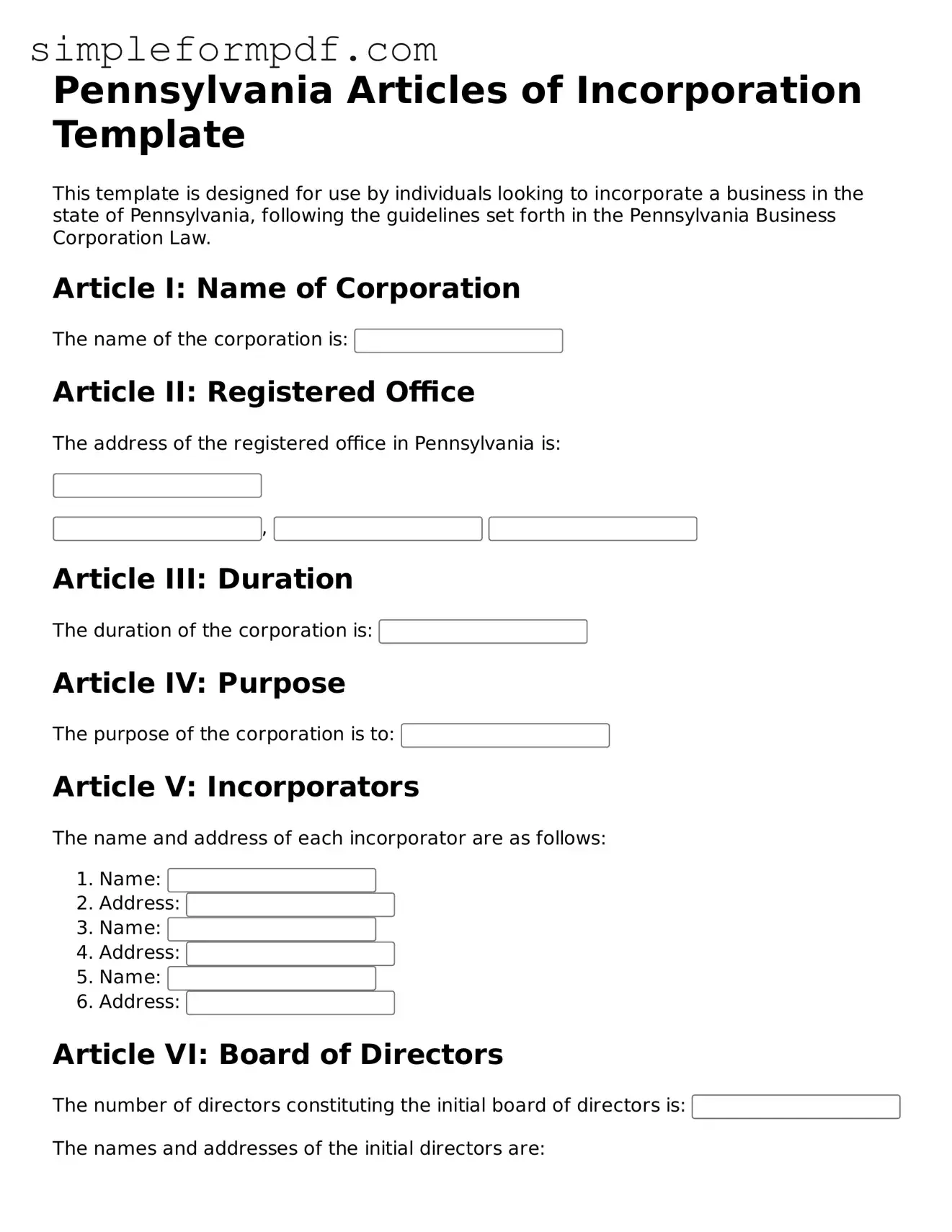

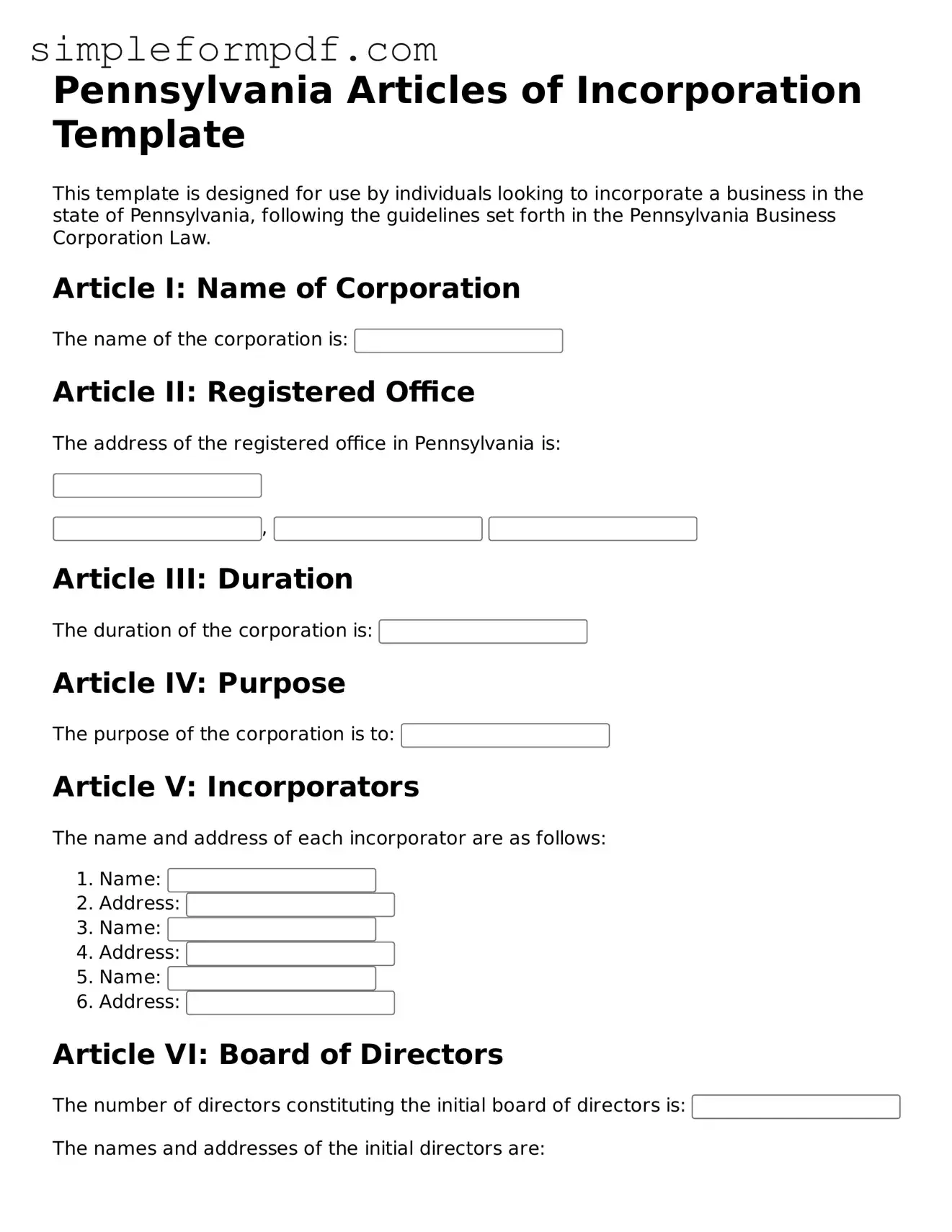

Free Articles of Incorporation Form for the State of Pennsylvania

The Pennsylvania Articles of Incorporation form serves as a crucial document for individuals seeking to establish a corporation in the state. This form outlines essential details about the corporation, including its name, purpose, and structure. To take the first step in forming your corporation, consider filling out the form by clicking the button below.

Launch Editor

Free Articles of Incorporation Form for the State of Pennsylvania

Launch Editor

Need instant form completion?

Finish Articles of Incorporation online in just a few minutes.

Launch Editor

or

Download PDF