Payroll Check PDF Form

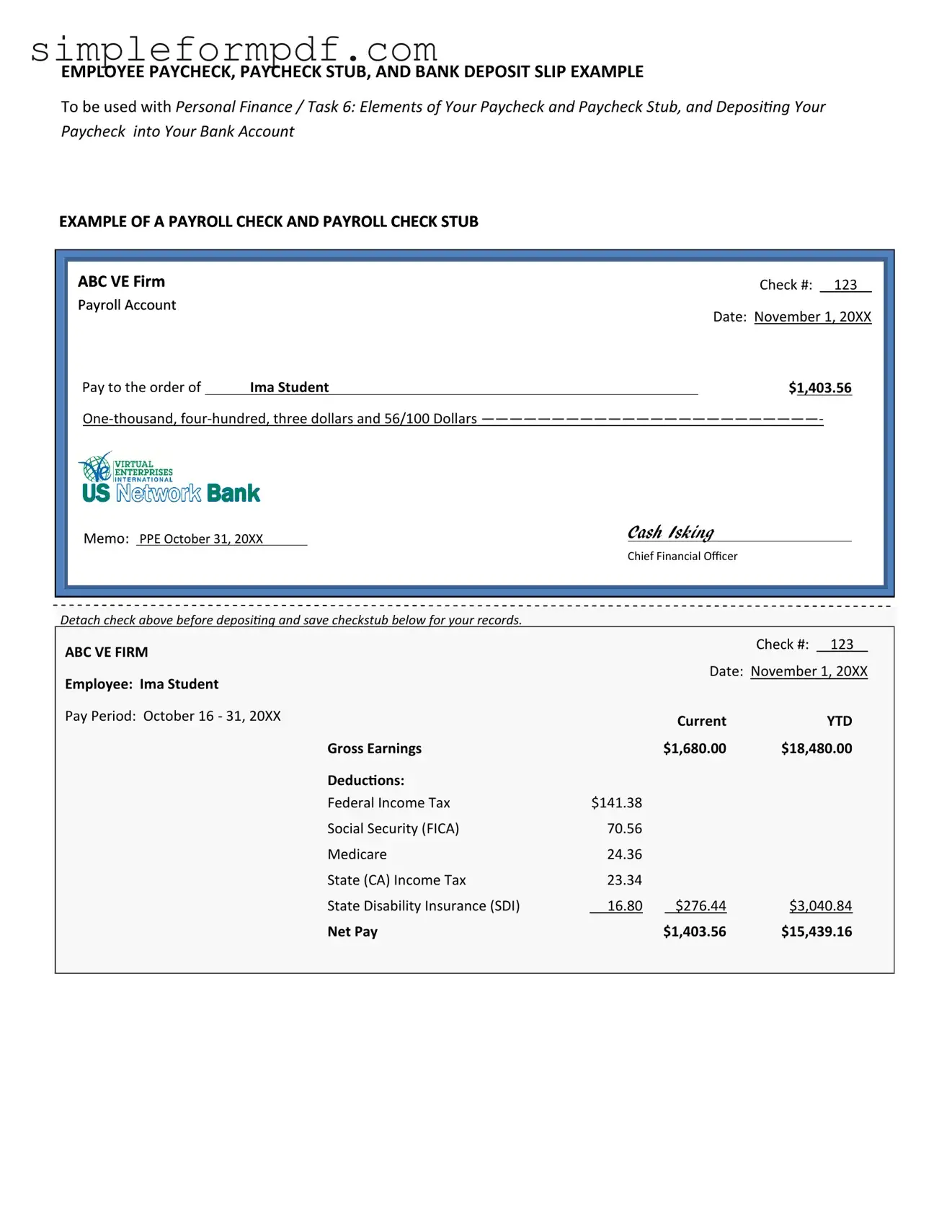

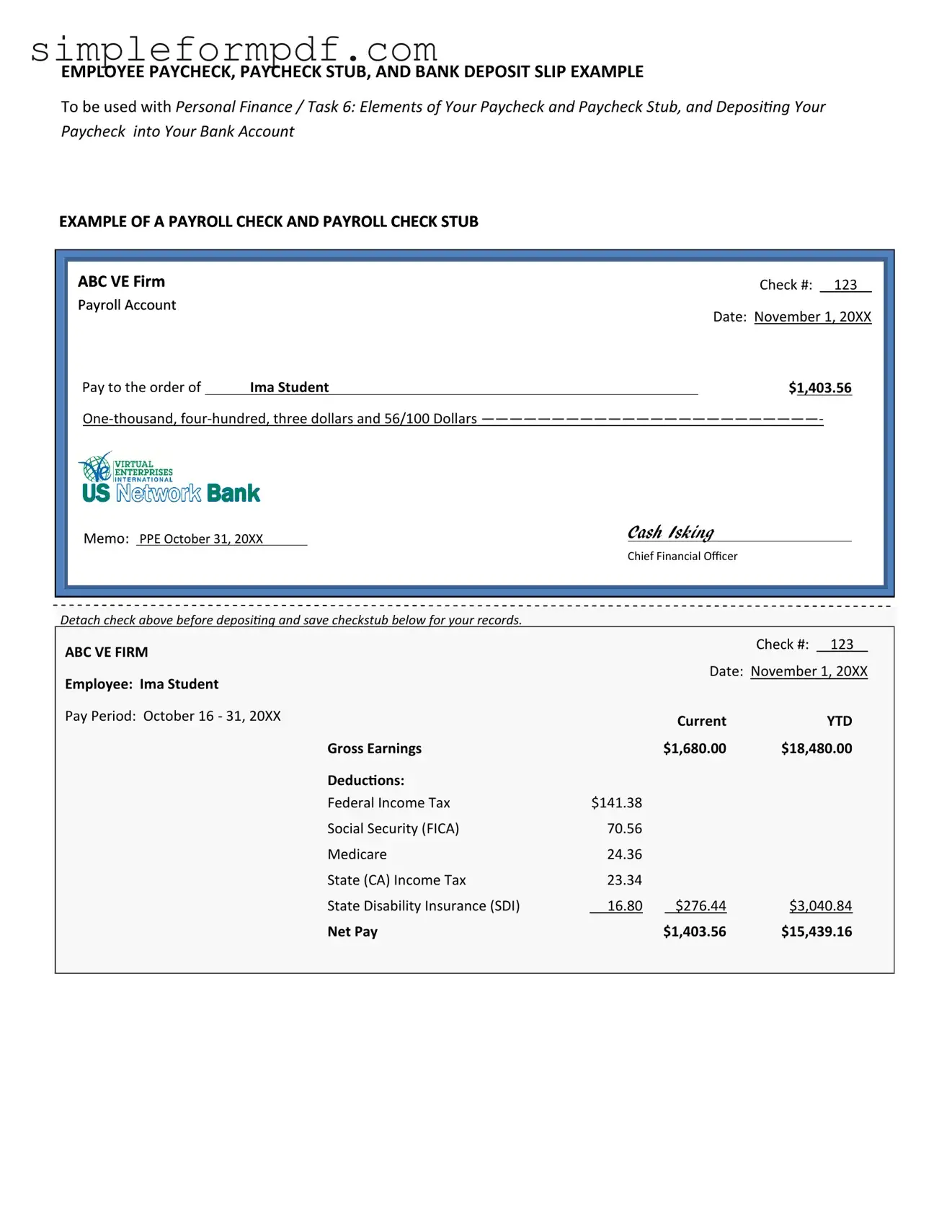

The Payroll Check form is a crucial document used by employers to disburse wages to their employees. This form outlines the details of the payment, including the amount earned and any deductions applied. Understanding how to properly fill out this form is essential for ensuring accurate and timely compensation.

Ready to get started? Fill out the form by clicking the button below.

Launch Editor

Payroll Check PDF Form

Launch Editor

Need instant form completion?

Finish Payroll Check online in just a few minutes.

Launch Editor

or

Download PDF