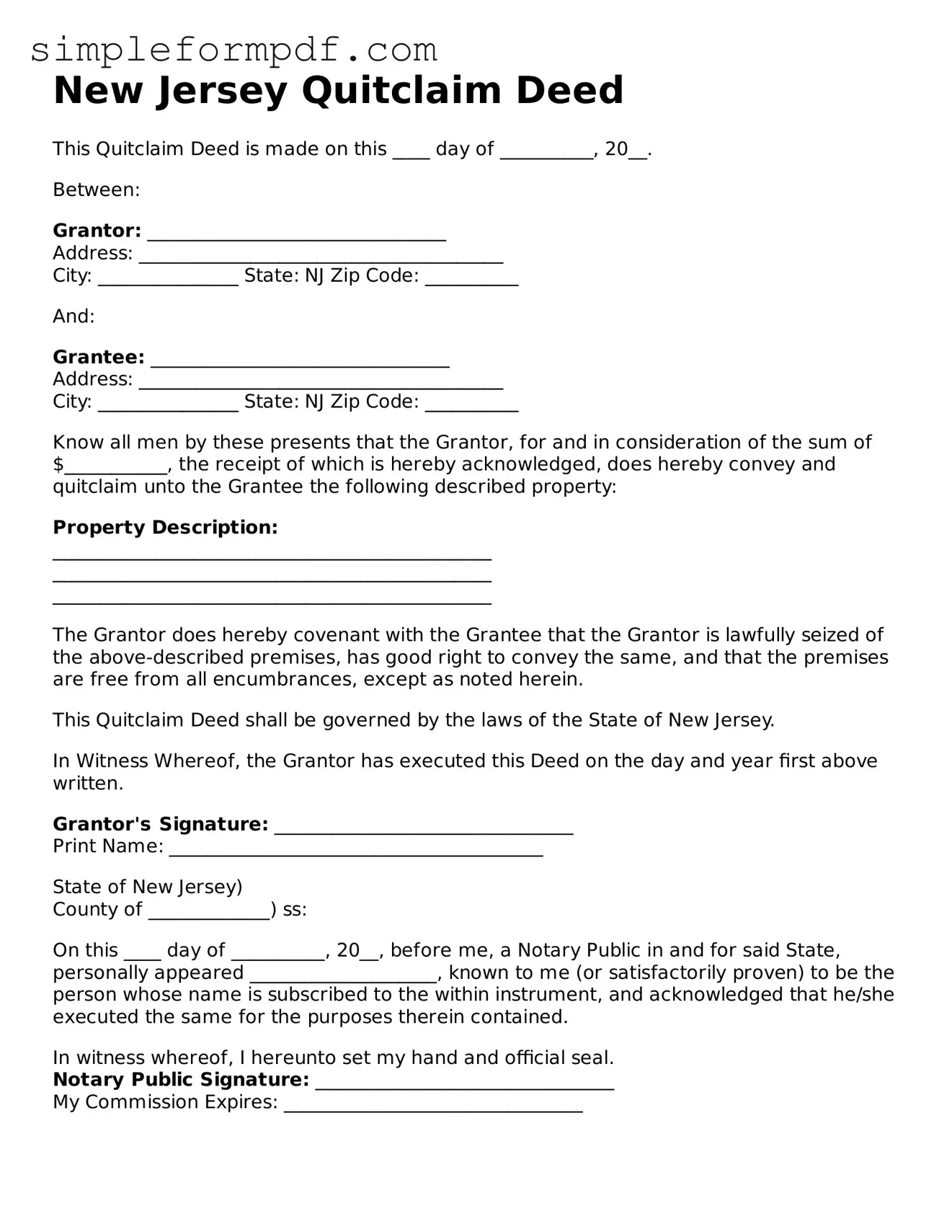

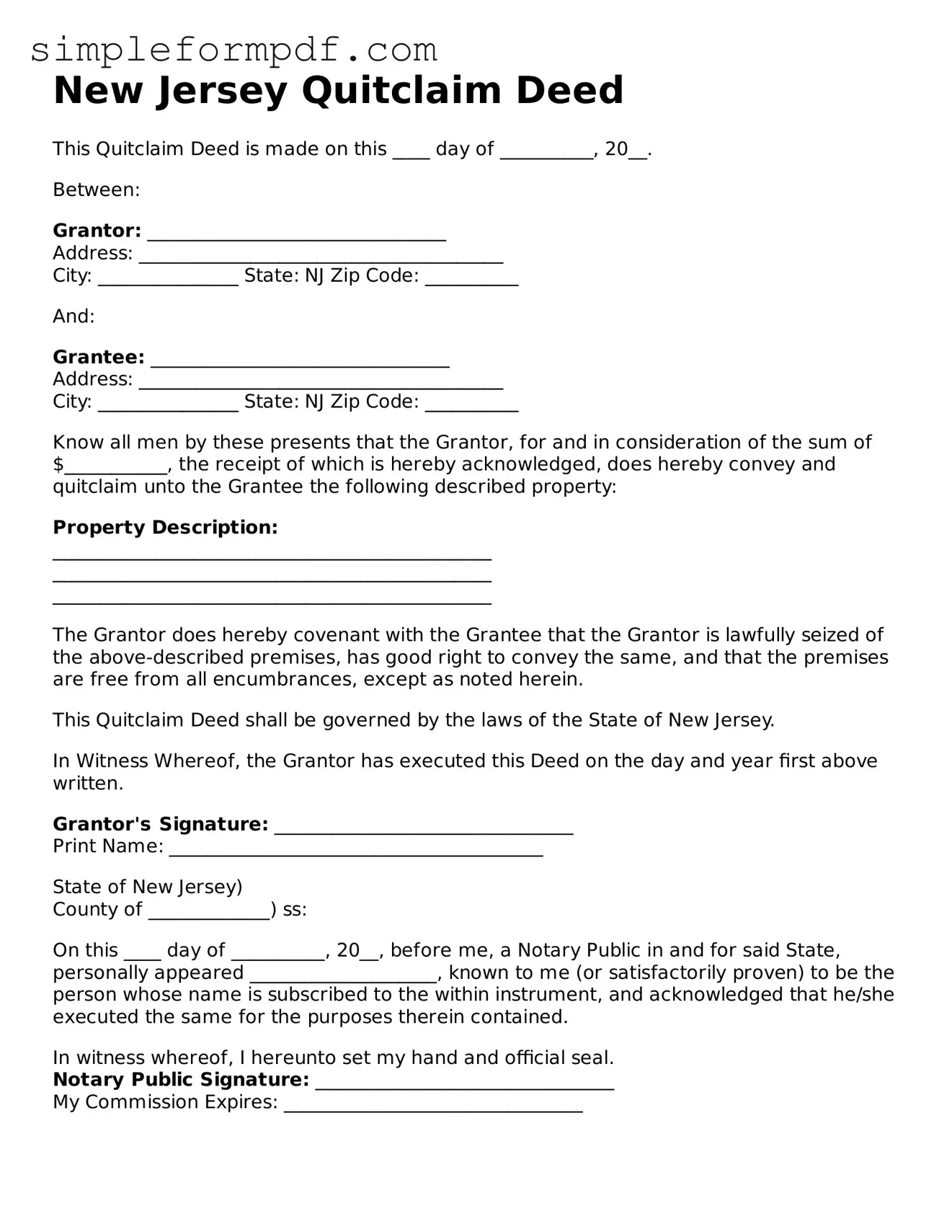

Free Quitclaim Deed Form for the State of New Jersey

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. This form is commonly used in New Jersey for various property transactions, including gifting property or clearing up title issues. To get started on your Quitclaim Deed, click the button below.

Launch Editor

Free Quitclaim Deed Form for the State of New Jersey

Launch Editor

Need instant form completion?

Finish Quitclaim Deed online in just a few minutes.

Launch Editor

or

Download PDF