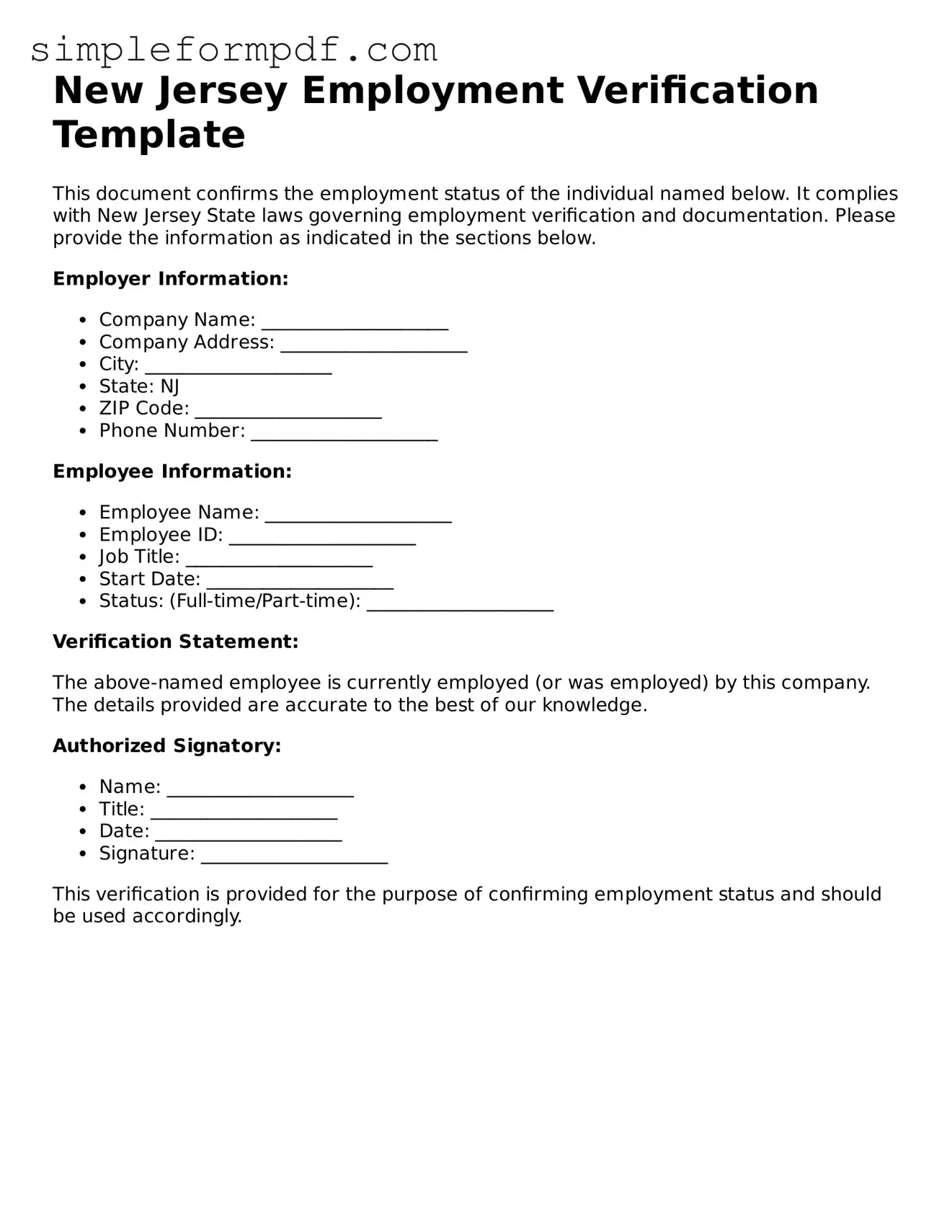

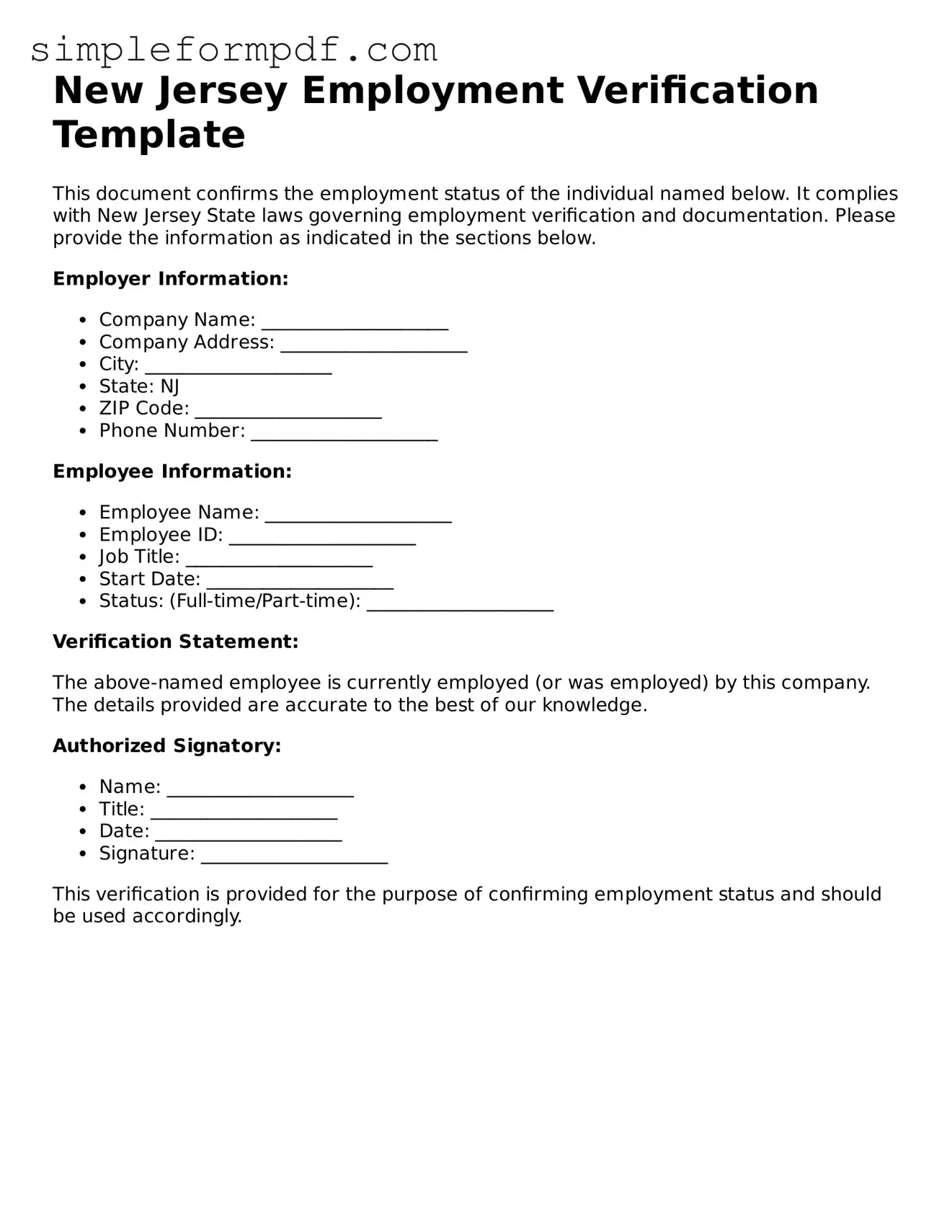

Free Employment Verification Form for the State of New Jersey

The New Jersey Employment Verification form is a crucial document used to confirm an individual's employment status and income. This form is often required by various entities, including lenders and government agencies, to ensure accurate assessment of an applicant's financial situation. To complete your verification process, please fill out the form by clicking the button below.

Launch Editor

Free Employment Verification Form for the State of New Jersey

Launch Editor

Need instant form completion?

Finish Employment Verification online in just a few minutes.

Launch Editor

or

Download PDF