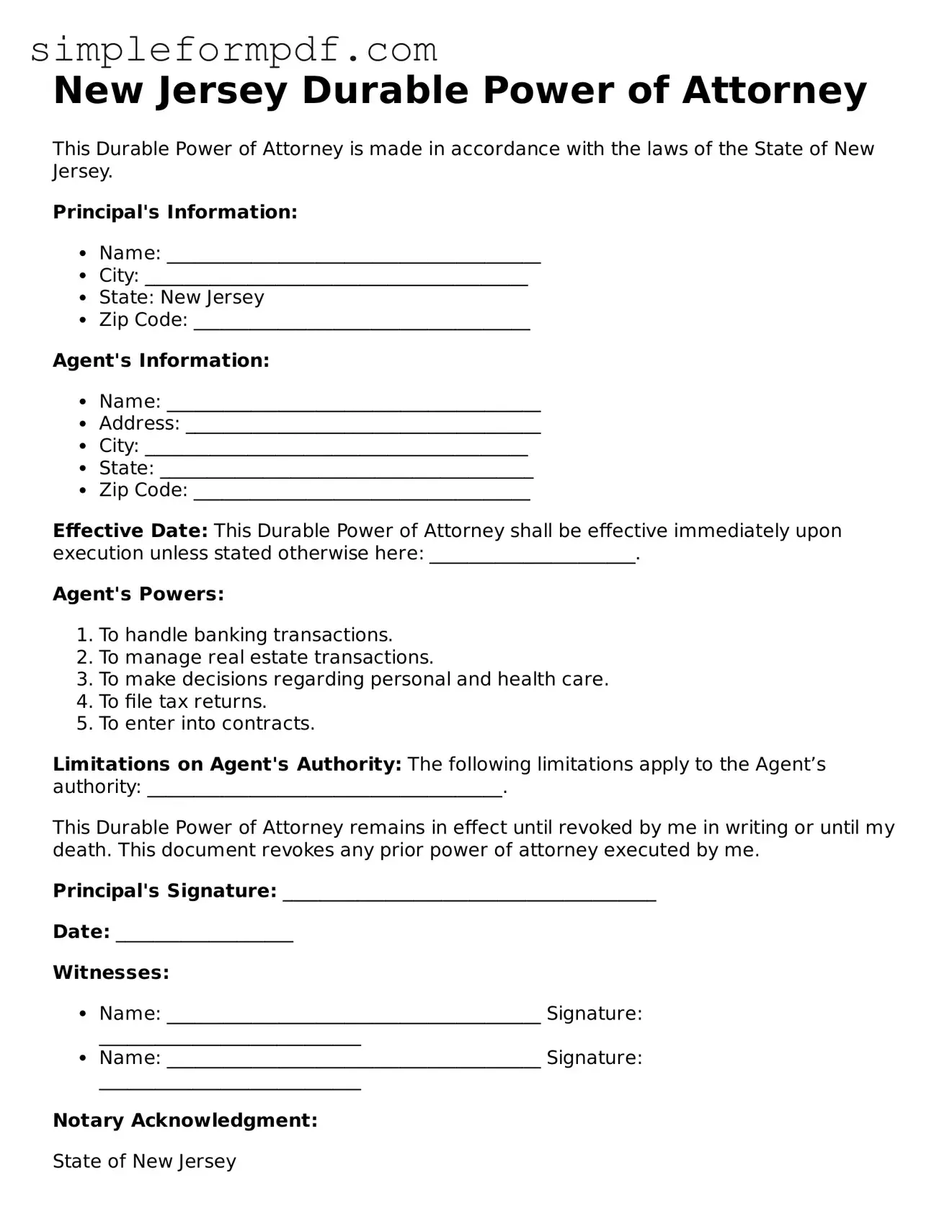

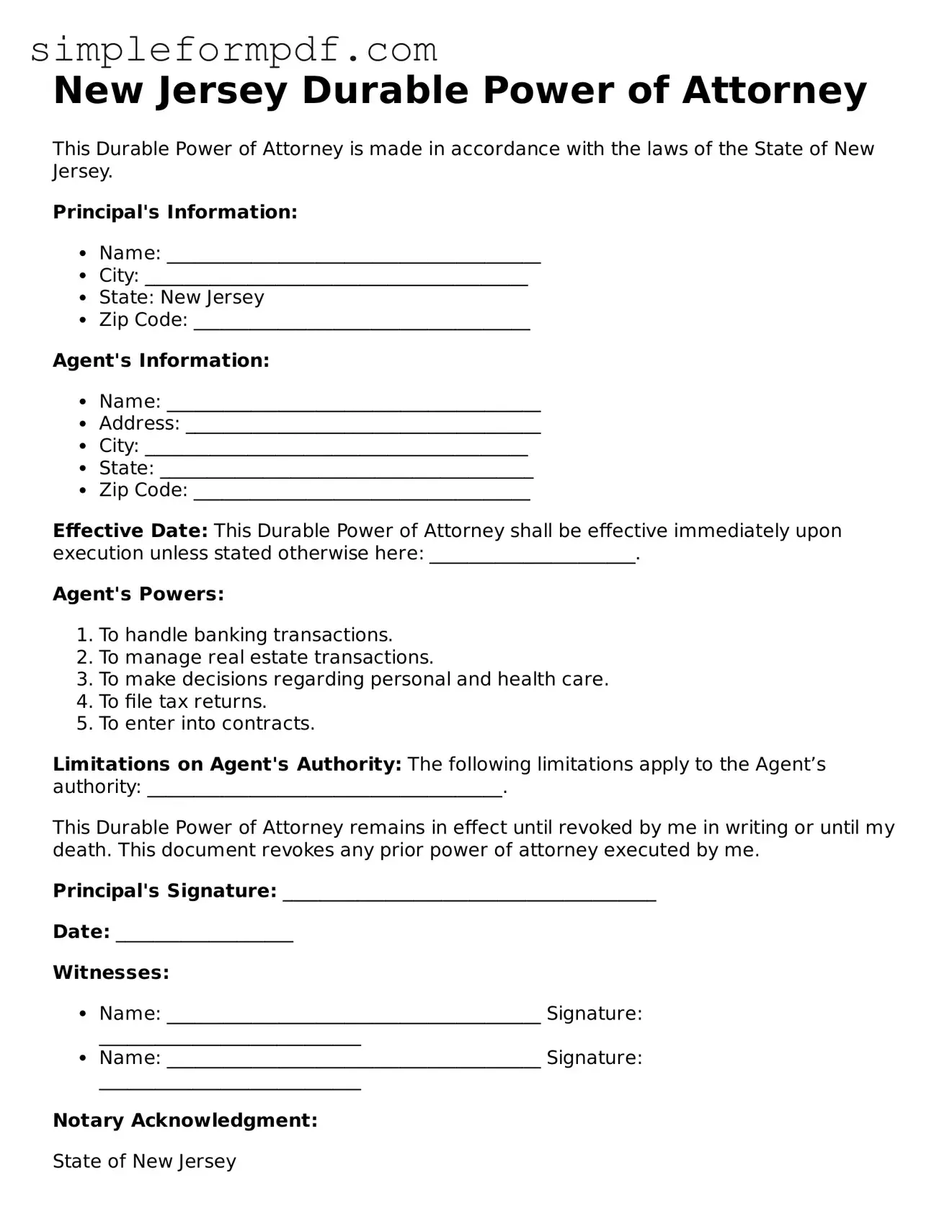

Free Durable Power of Attorney Form for the State of New Jersey

A New Jersey Durable Power of Attorney form is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so. This form ensures that your affairs are managed according to your wishes, even if you lose the capacity to communicate them. Understanding its importance can help you secure your future; consider filling out the form by clicking the button below.

Launch Editor

Free Durable Power of Attorney Form for the State of New Jersey

Launch Editor

Need instant form completion?

Finish Durable Power of Attorney online in just a few minutes.

Launch Editor

or

Download PDF