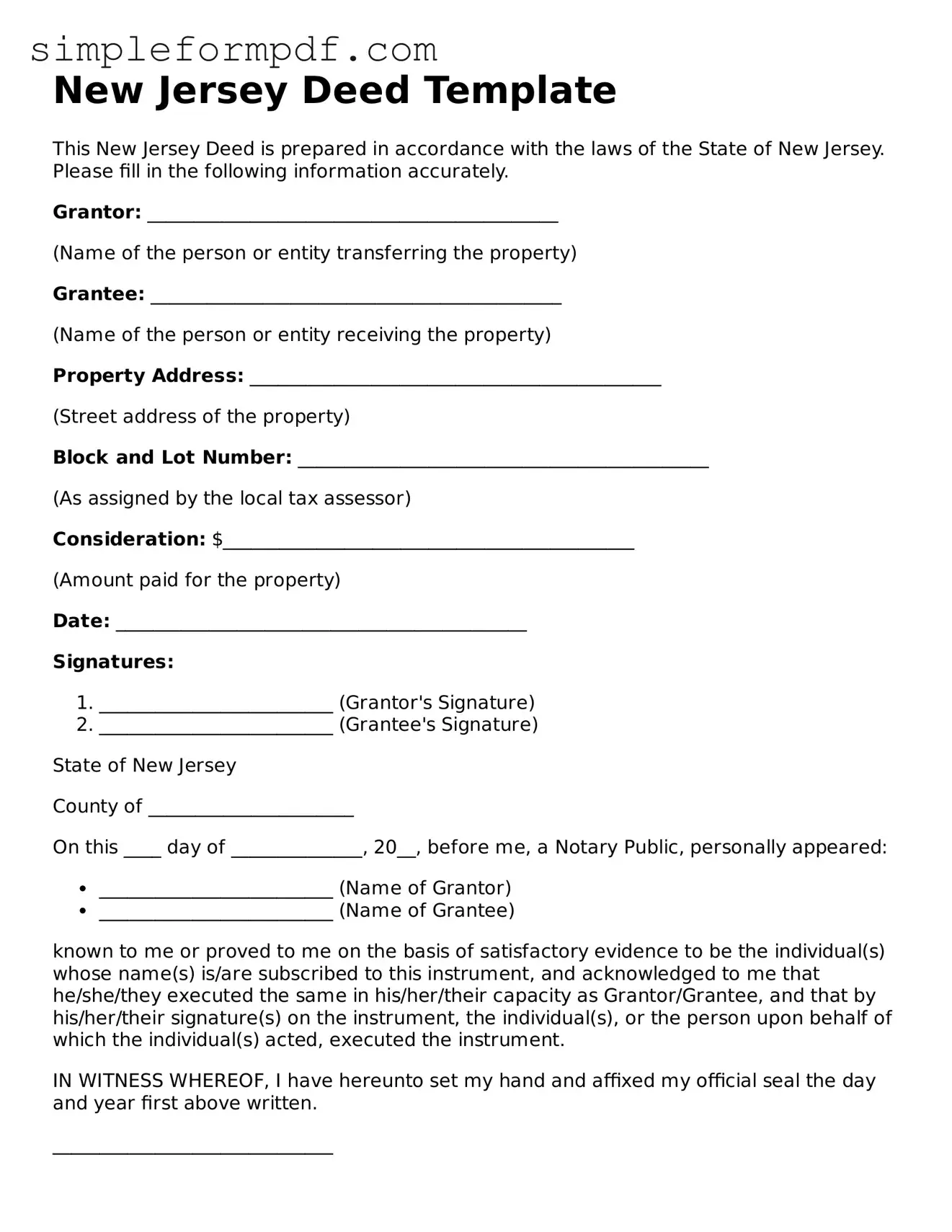

Free Deed Form for the State of New Jersey

A New Jersey Deed form is a legal document used to transfer ownership of real property from one party to another. This form ensures that the transfer is recorded properly, providing a clear record of ownership. To begin the process of transferring property, consider filling out the form by clicking the button below.

Launch Editor

Free Deed Form for the State of New Jersey

Launch Editor

Need instant form completion?

Finish Deed online in just a few minutes.

Launch Editor

or

Download PDF