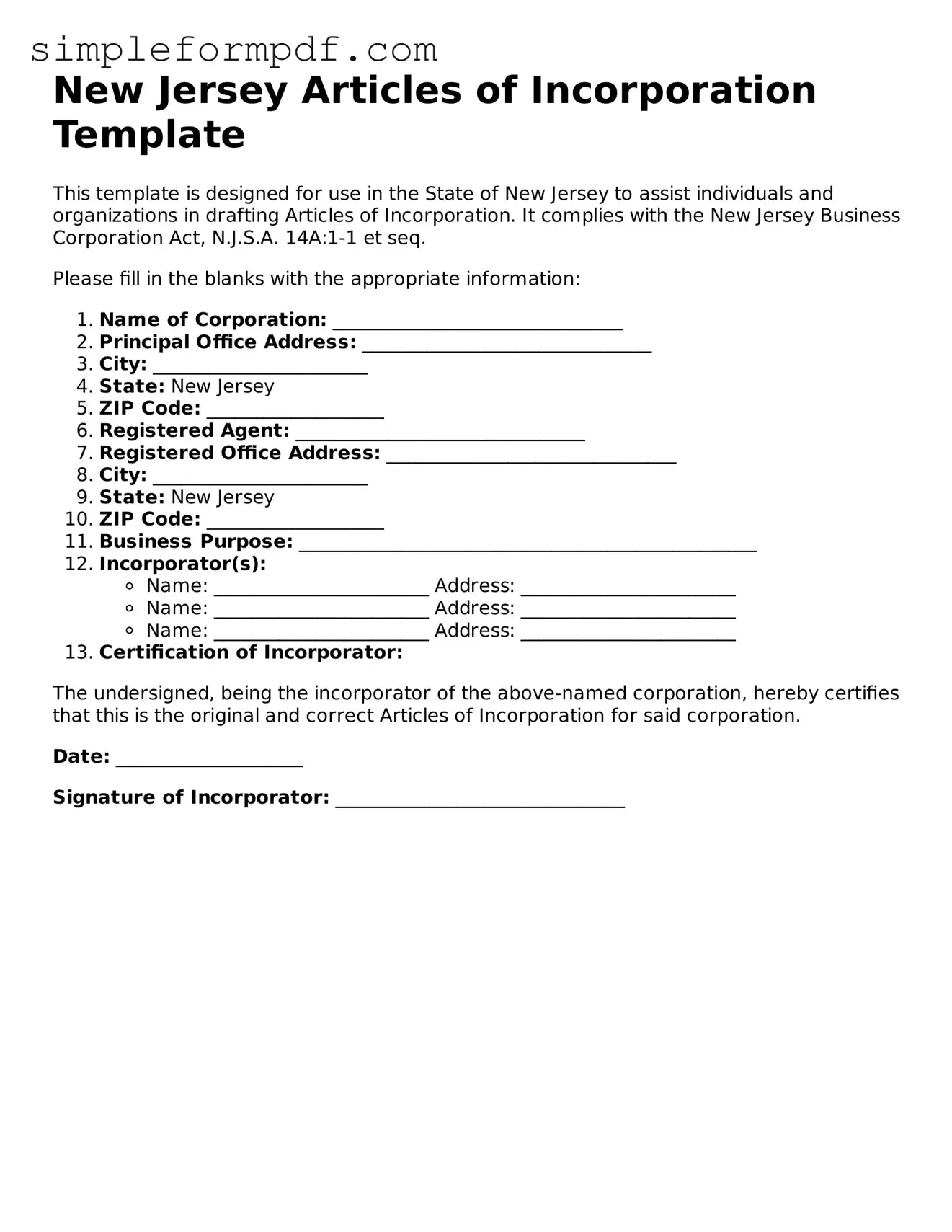

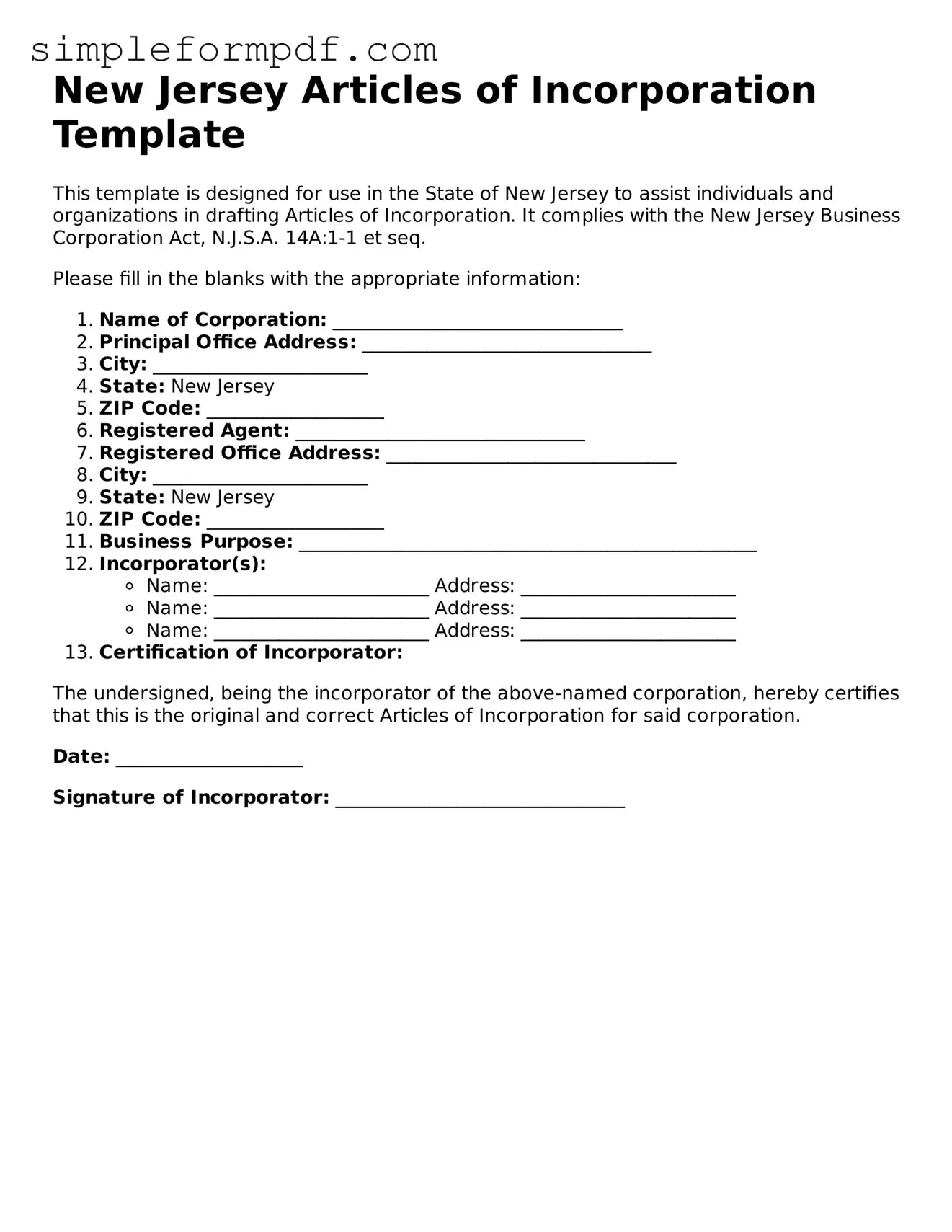

Free Articles of Incorporation Form for the State of New Jersey

The New Jersey Articles of Incorporation form is a crucial document that establishes a corporation in the state of New Jersey. This form outlines essential details about the business, including its name, purpose, and structure. Completing this form is the first step toward legally forming your corporation, so take action by filling it out today.

Click the button below to get started!

Launch Editor

Free Articles of Incorporation Form for the State of New Jersey

Launch Editor

Need instant form completion?

Finish Articles of Incorporation online in just a few minutes.

Launch Editor

or

Download PDF