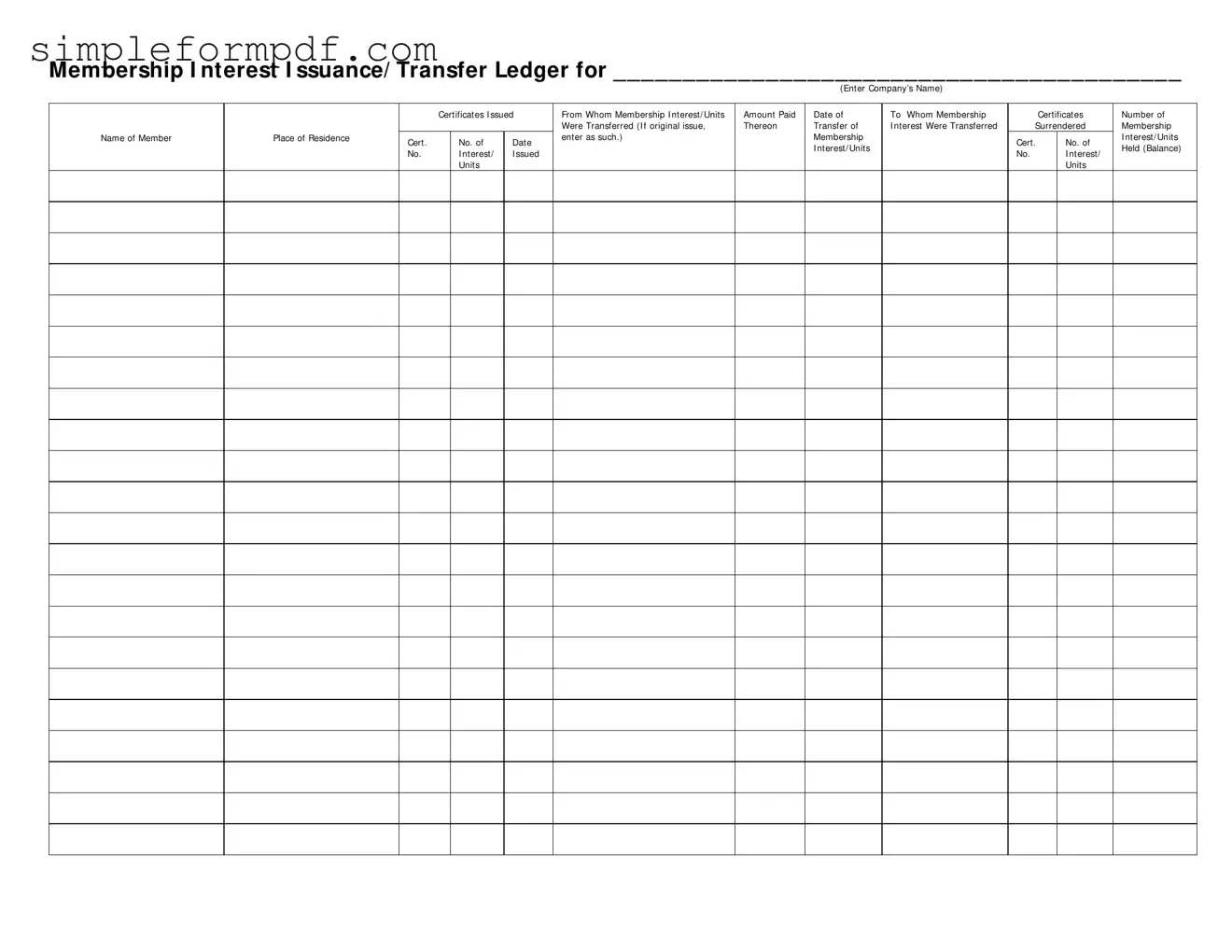

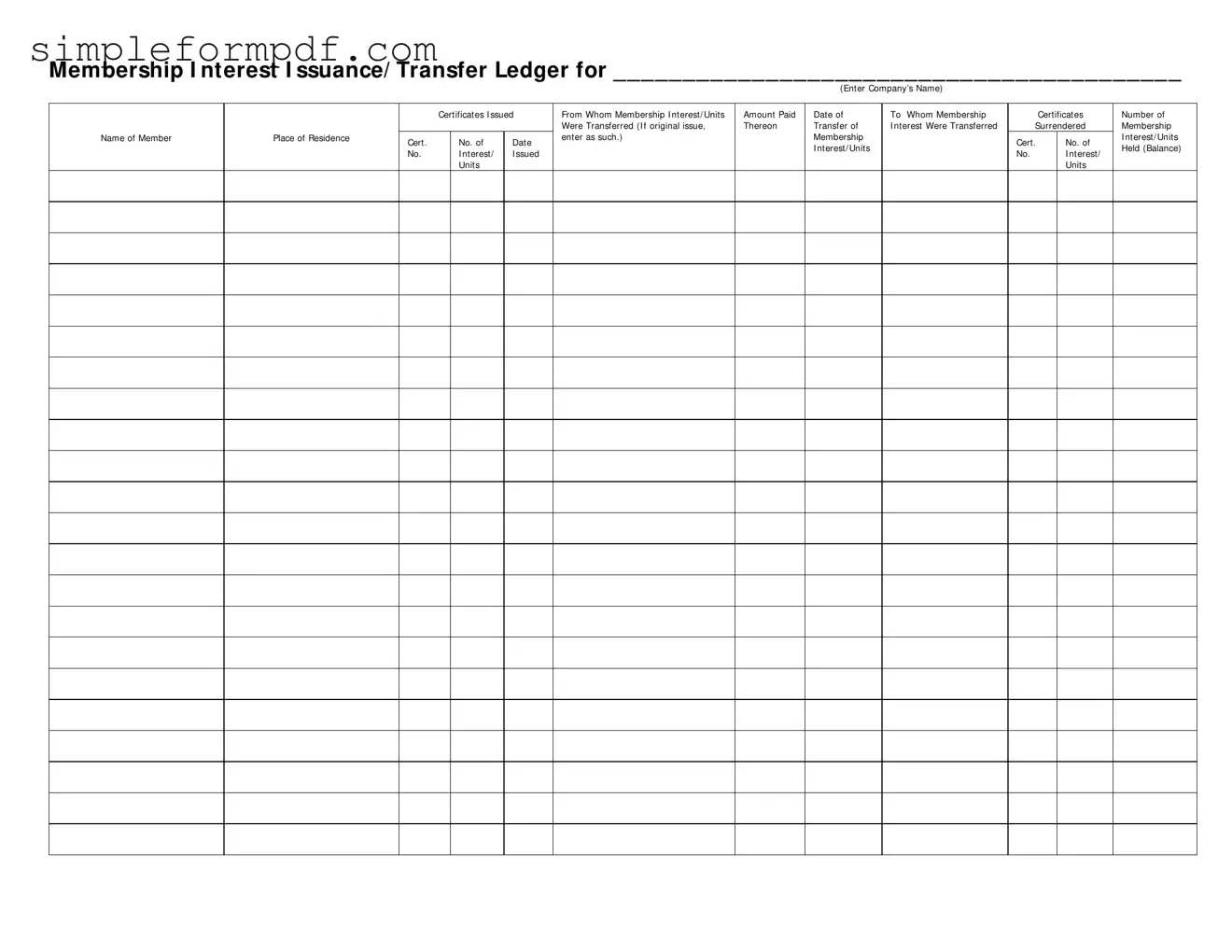

Membership Ledger PDF Form

The Membership Ledger form serves as a detailed record for tracking the issuance and transfer of membership interests within a company. This form captures essential information, including the names of members, the amount paid for interests, and the dates of transfers. For accurate record-keeping and transparency, it is vital to fill out this form correctly; please click the button below to get started.

Launch Editor

Membership Ledger PDF Form

Launch Editor

Need instant form completion?

Finish Membership Ledger online in just a few minutes.

Launch Editor

or

Download PDF