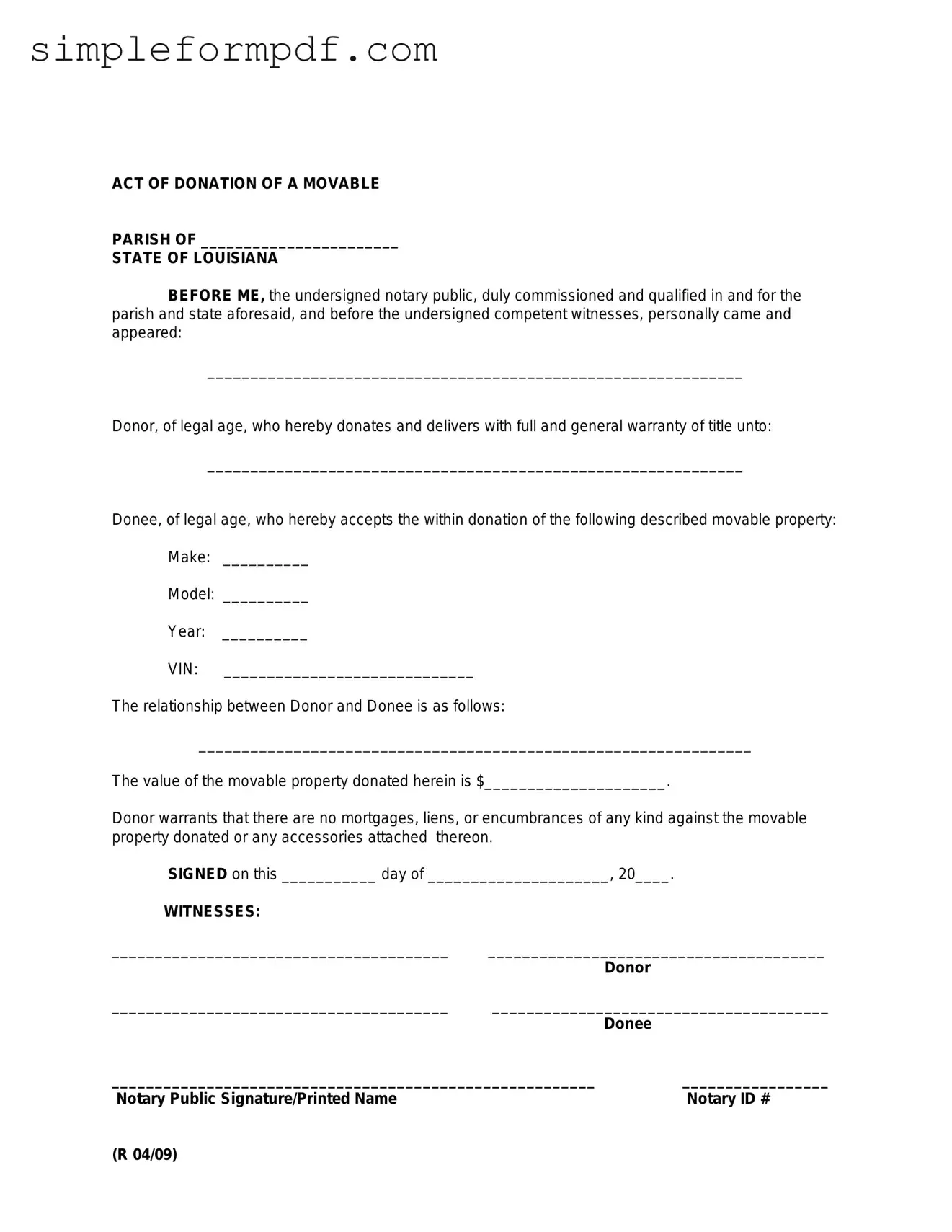

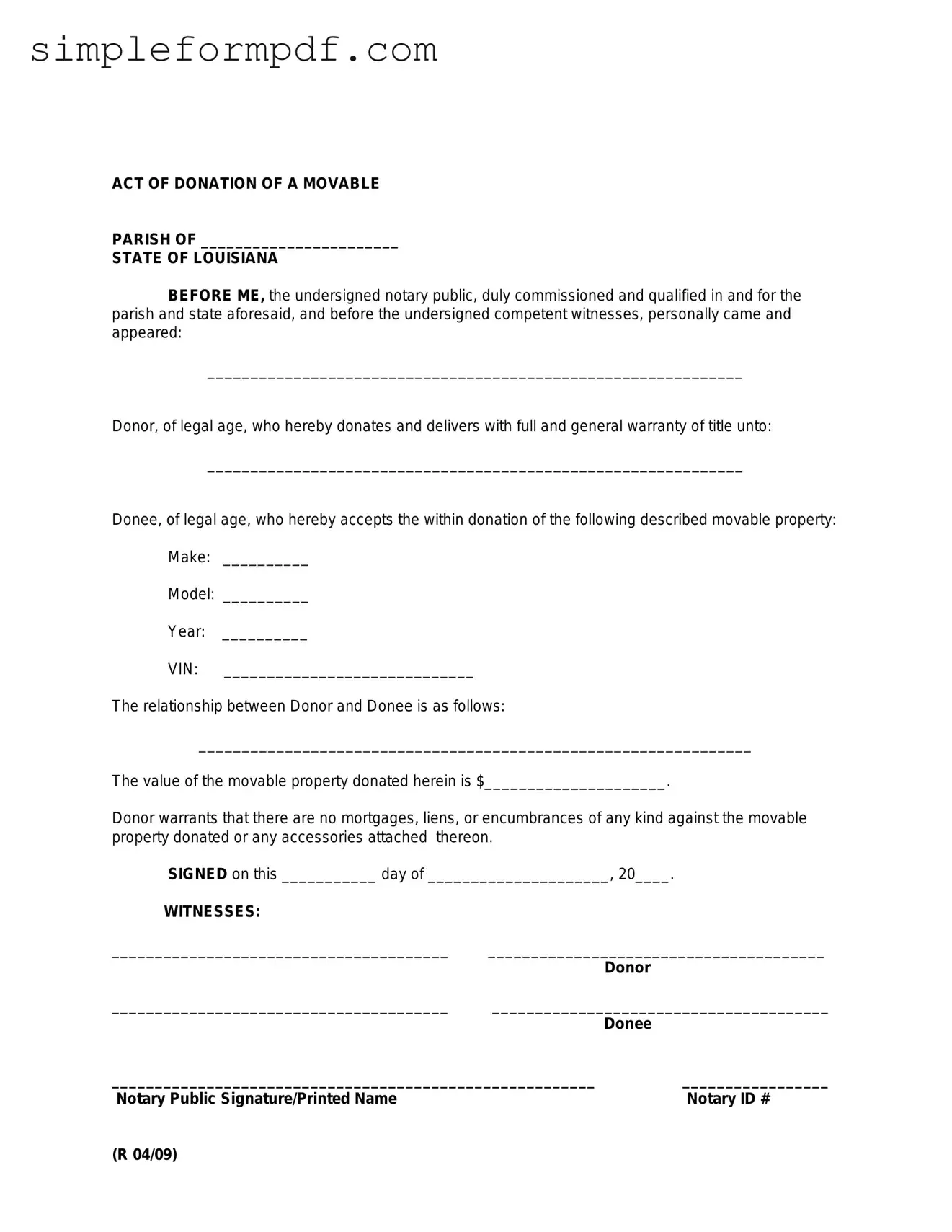

Louisiana act of donation PDF Form

The Louisiana act of donation form is a legal document used to transfer ownership of property or assets from one individual to another without any compensation. This form is essential for ensuring that the donation is recognized by the state and can help avoid potential disputes in the future. To learn more and fill out the form, click the button below.

Launch Editor

Louisiana act of donation PDF Form

Launch Editor

Need instant form completion?

Finish Louisiana act of donation online in just a few minutes.

Launch Editor

or

Download PDF