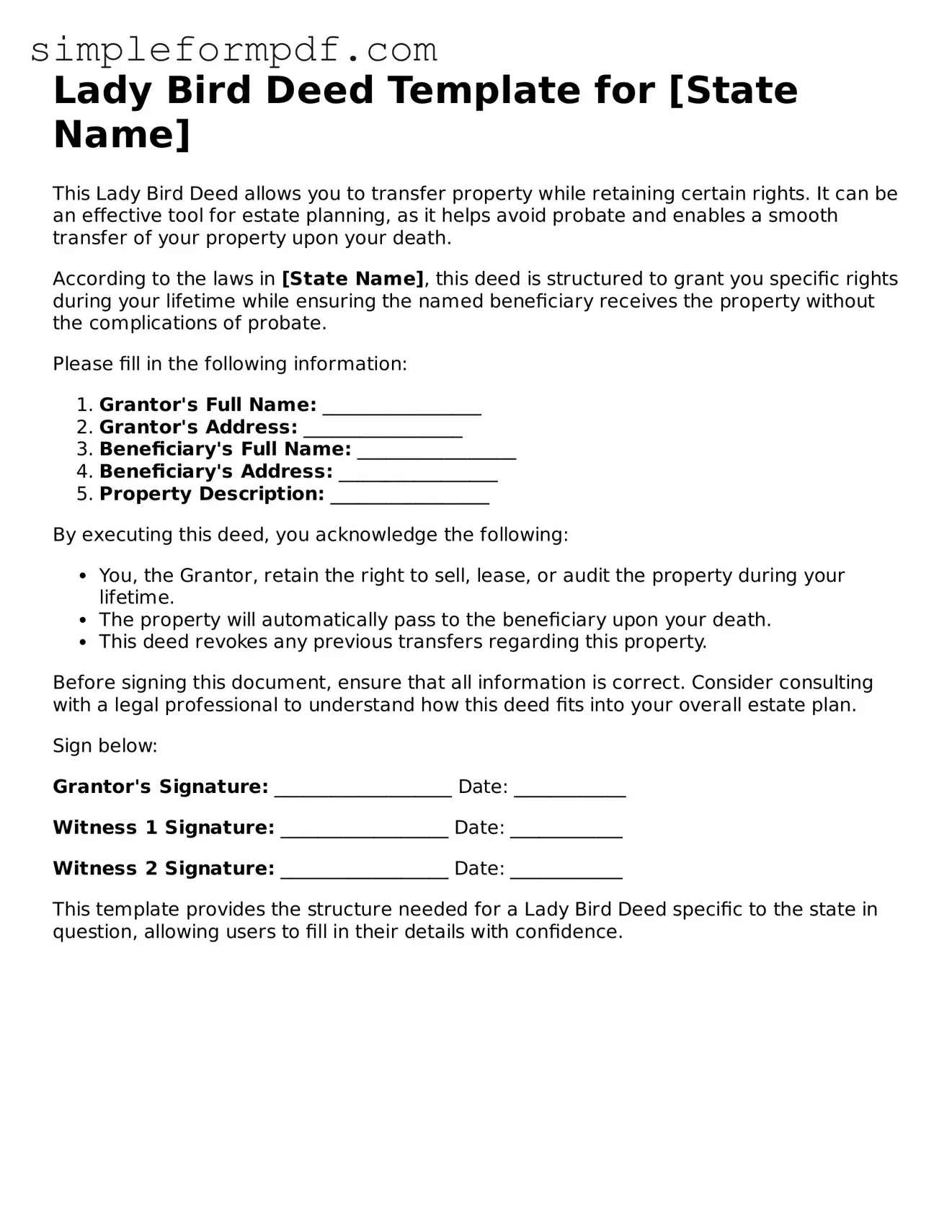

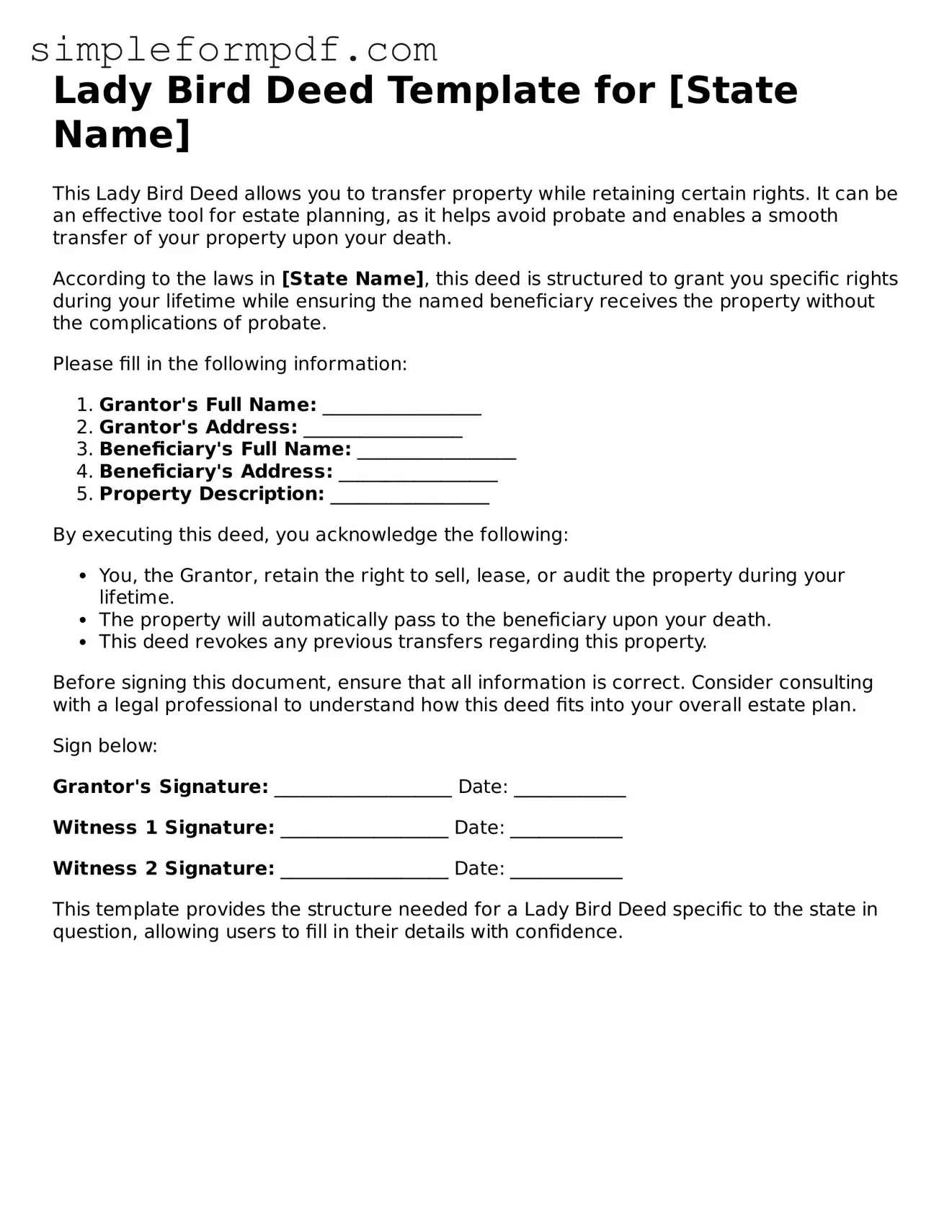

Fillable Lady Bird Deed Template

The Lady Bird Deed is a unique legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This deed provides a way to avoid probate, making the transfer of property smoother and more efficient. If you're considering this option, take the next step by filling out the form below.

Launch Editor

Fillable Lady Bird Deed Template

Launch Editor

Need instant form completion?

Finish Lady Bird Deed online in just a few minutes.

Launch Editor

or

Download PDF