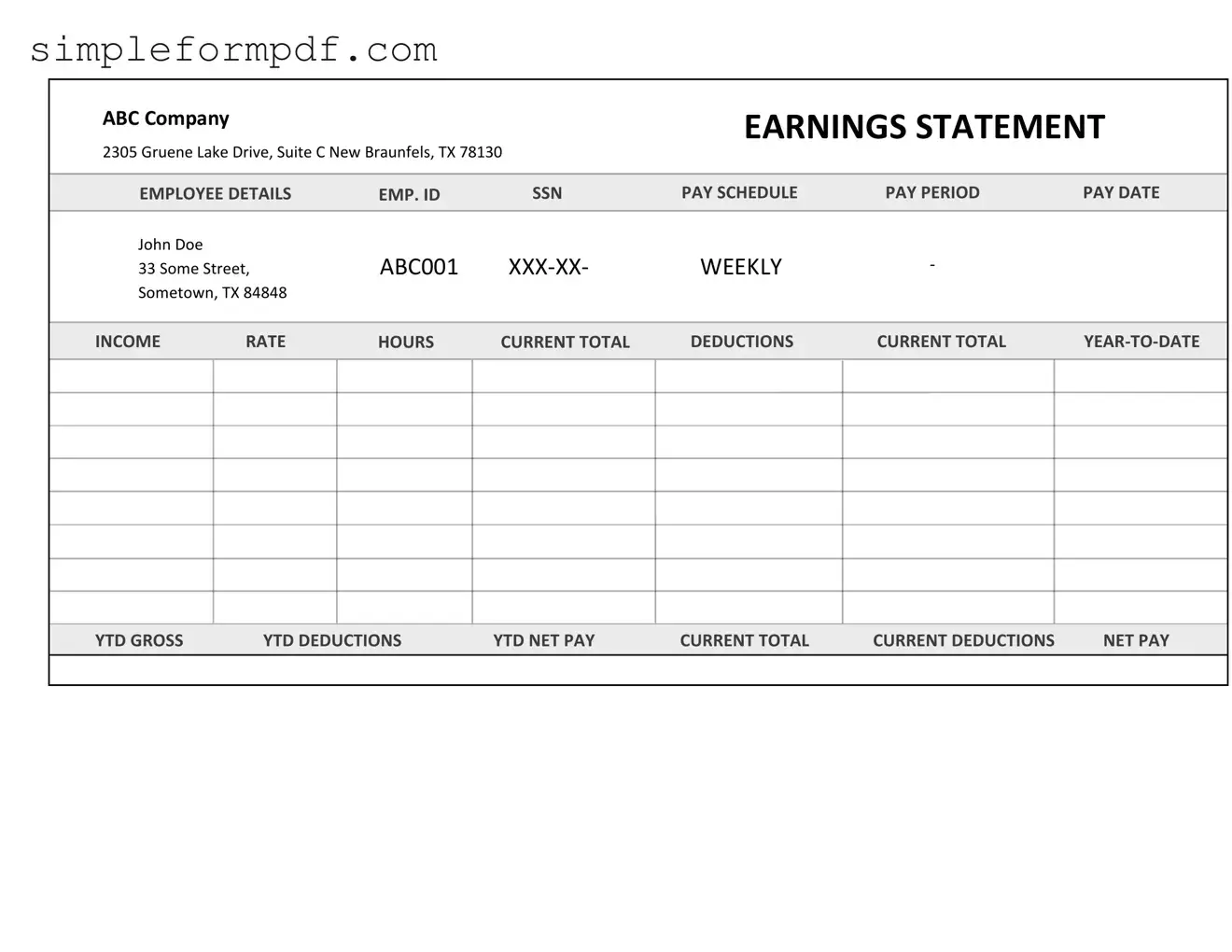

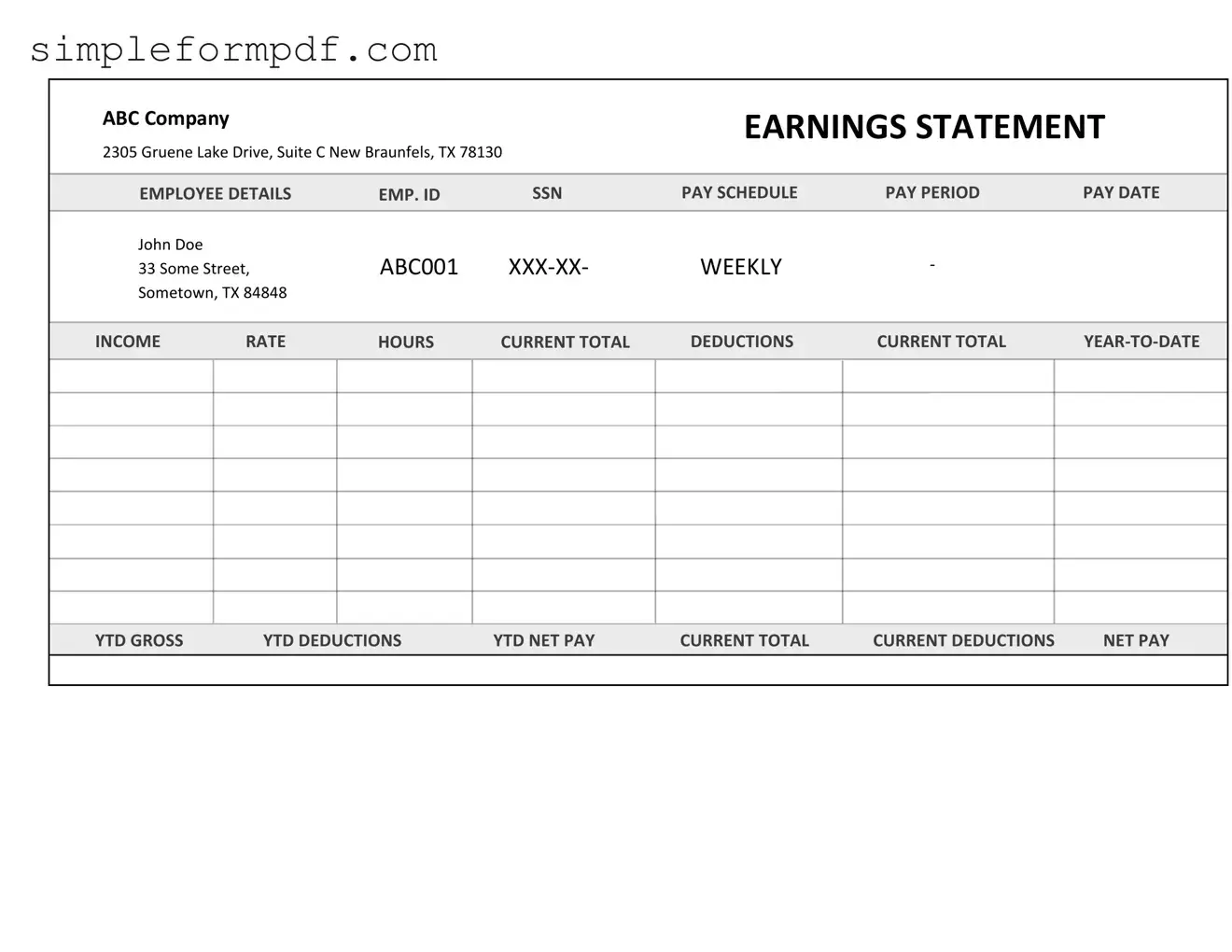

Independent Contractor Pay Stub PDF Form

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for individuals who provide services on a contract basis. This form serves as an essential tool for both contractors and clients, ensuring clarity and transparency in financial transactions. Understanding how to properly fill out this form is crucial for maintaining accurate records and complying with tax obligations.

To get started on your Independent Contractor Pay Stub, please click the button below.

Launch Editor

Independent Contractor Pay Stub PDF Form

Launch Editor

Need instant form completion?

Finish Independent Contractor Pay Stub online in just a few minutes.

Launch Editor

or

Download PDF