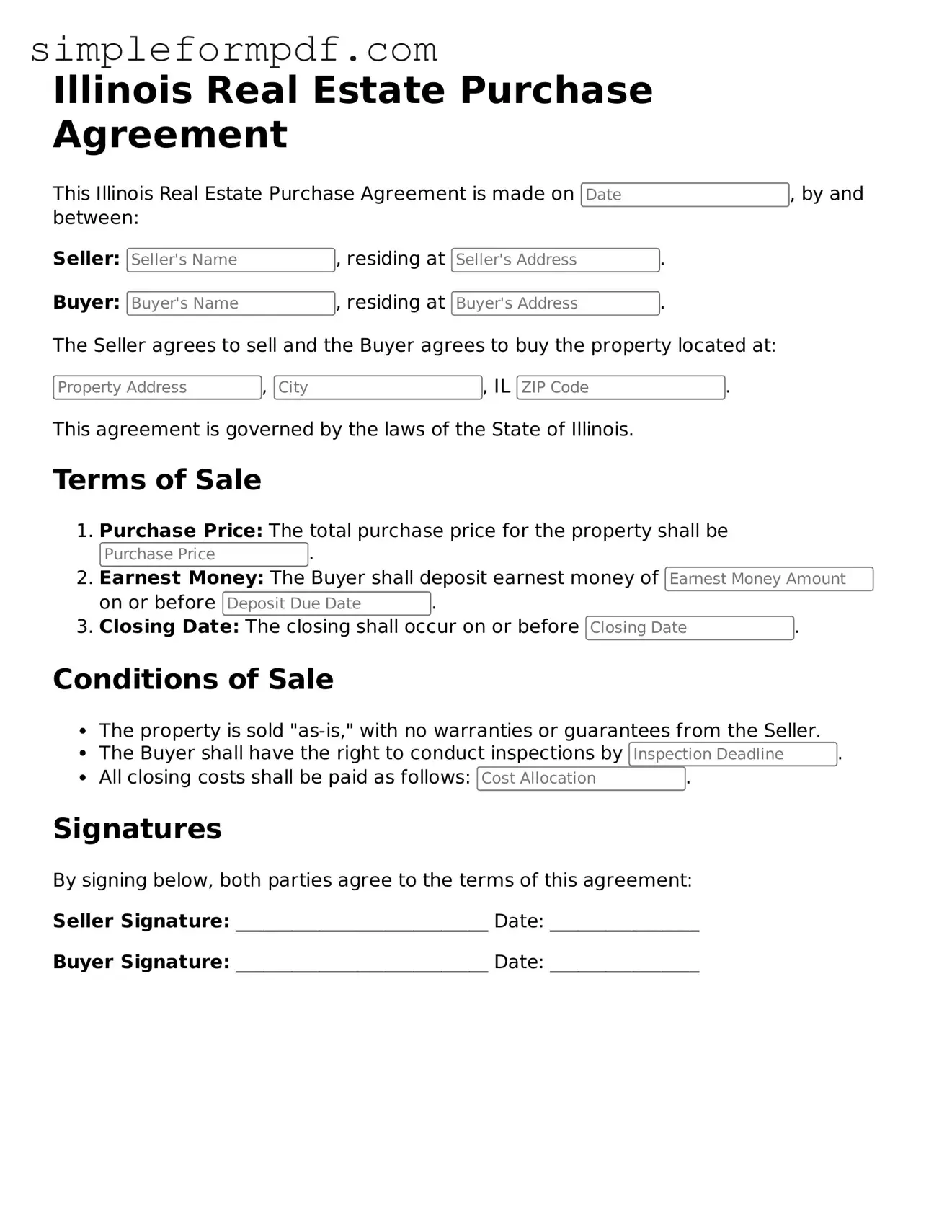

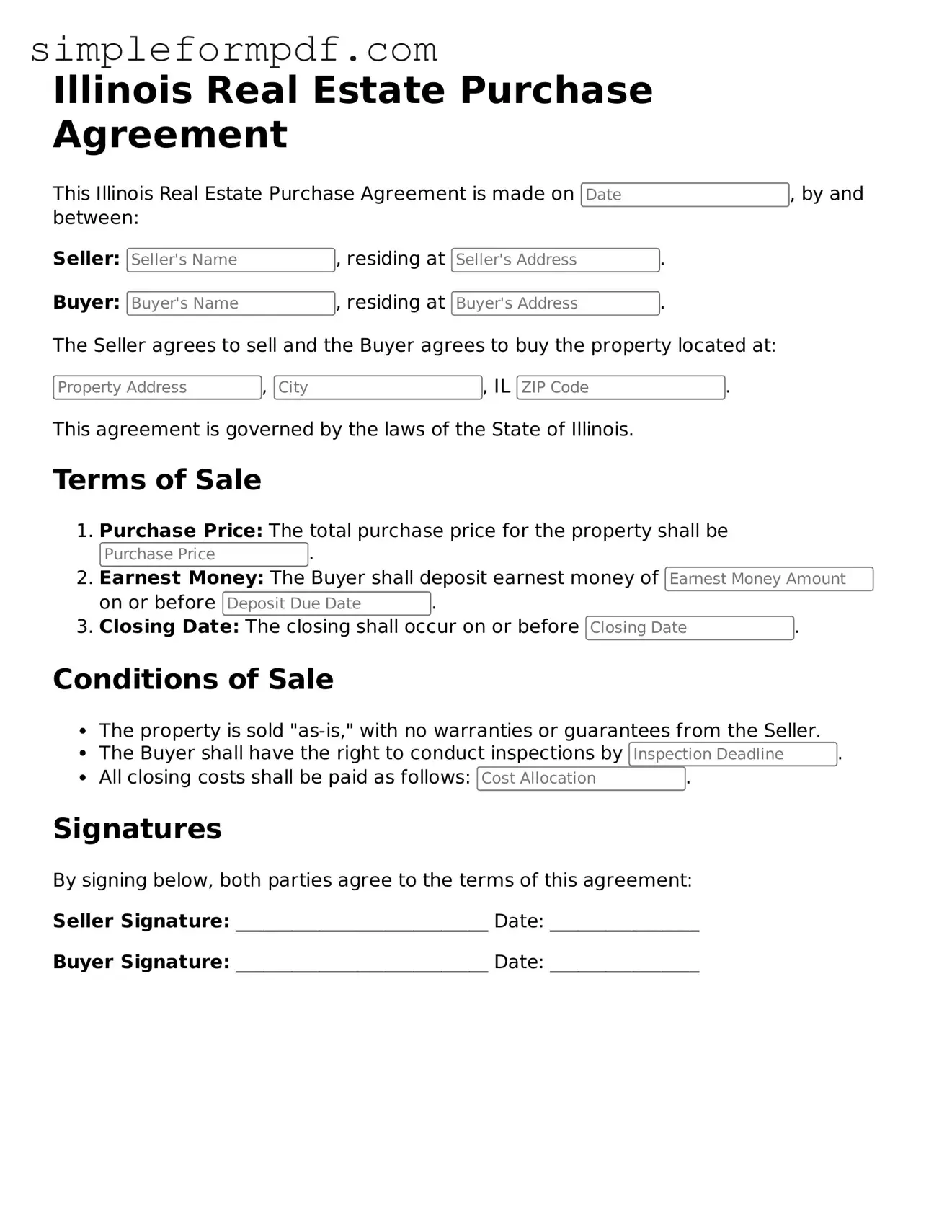

Free Real Estate Purchase Agreement Form for the State of Illinois

The Illinois Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a property sale between a buyer and a seller. This form serves as a crucial tool in facilitating real estate transactions, ensuring that both parties understand their rights and obligations. To get started on your property purchase, fill out the form by clicking the button below.

Launch Editor

Free Real Estate Purchase Agreement Form for the State of Illinois

Launch Editor

Need instant form completion?

Finish Real Estate Purchase Agreement online in just a few minutes.

Launch Editor

or

Download PDF