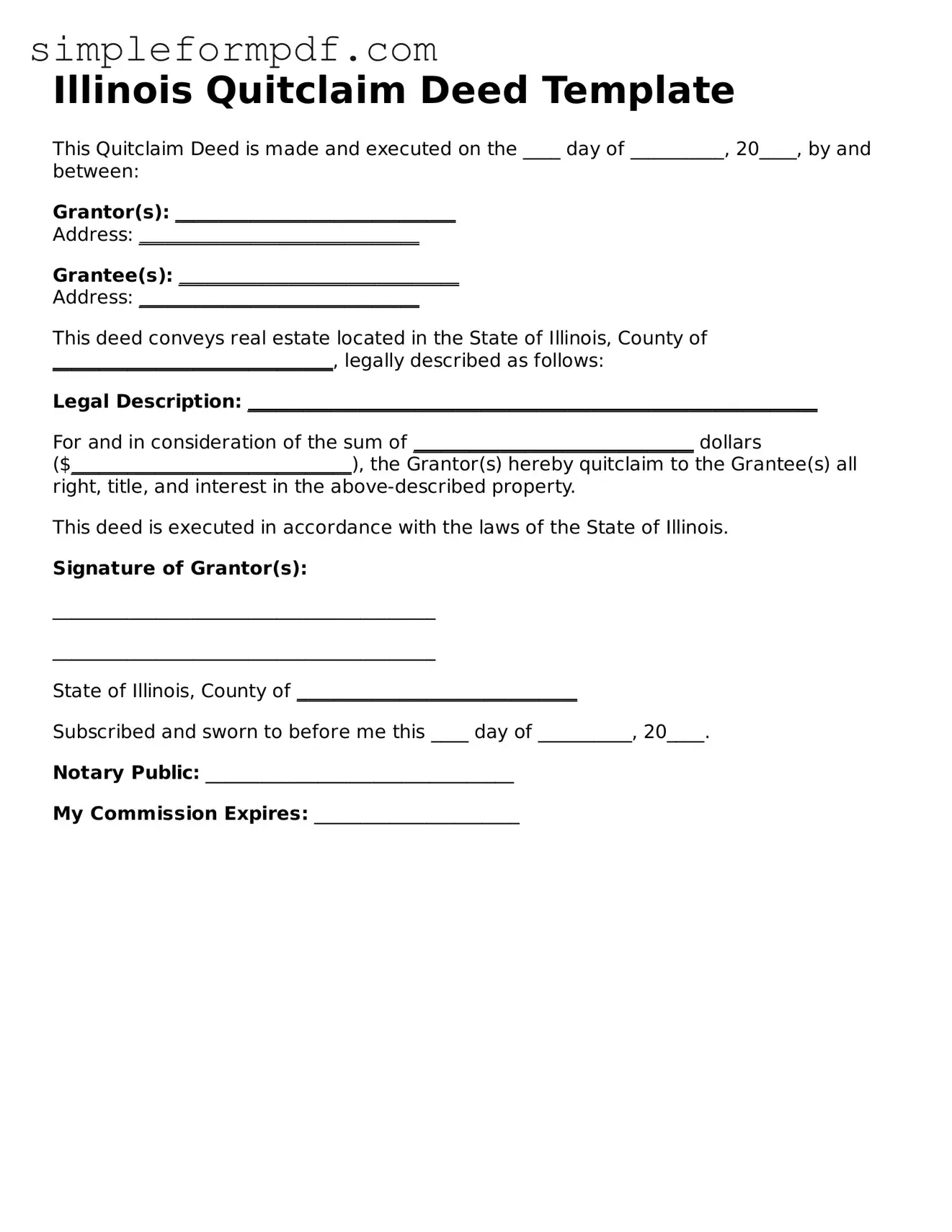

Free Quitclaim Deed Form for the State of Illinois

A Quitclaim Deed is a legal document used in Illinois to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. This type of deed is often utilized in situations such as transferring property between family members or clearing up title issues. Understanding how to properly fill out this form is essential for ensuring a smooth transfer of ownership.

Ready to fill out the Illinois Quitclaim Deed form? Click the button below to get started!

Launch Editor

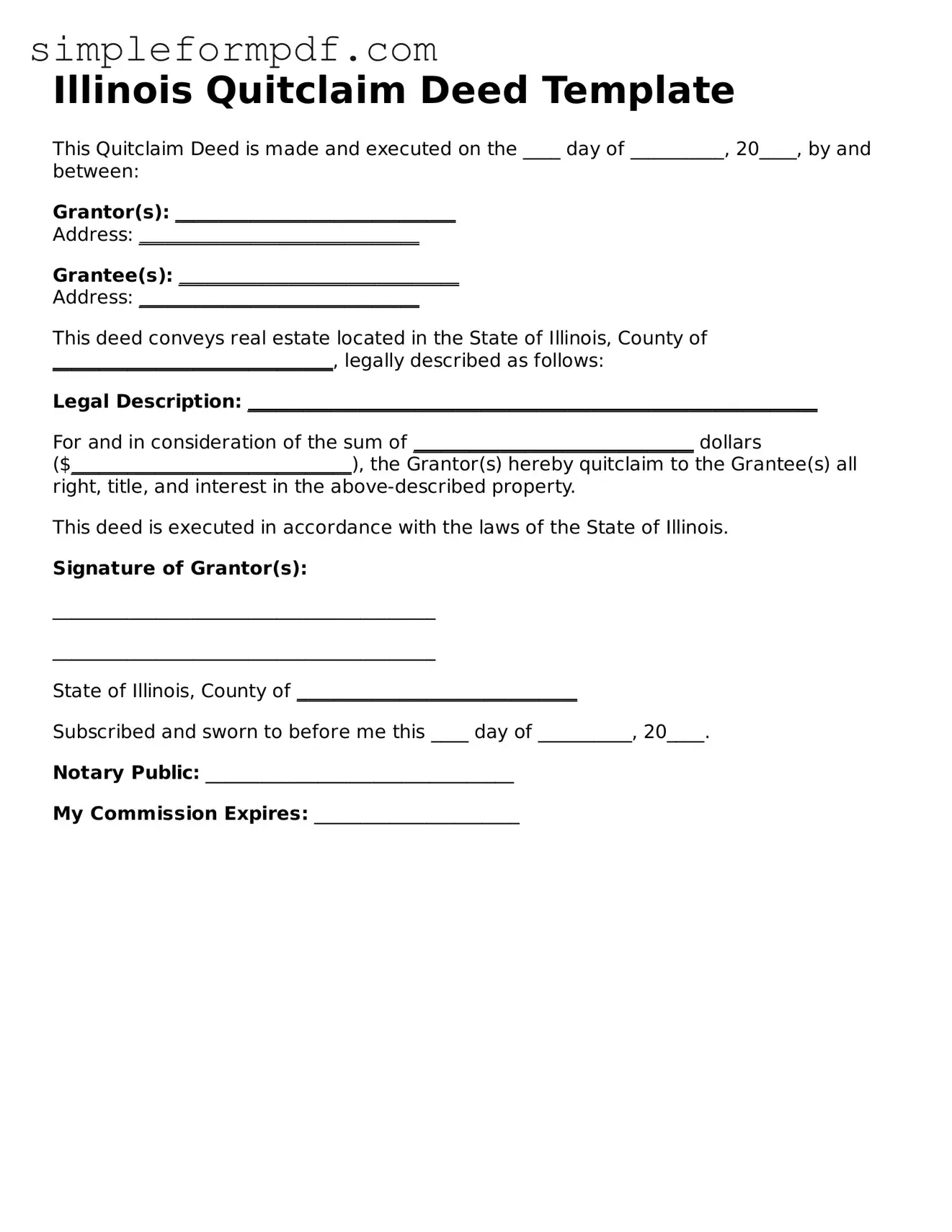

Free Quitclaim Deed Form for the State of Illinois

Launch Editor

Need instant form completion?

Finish Quitclaim Deed online in just a few minutes.

Launch Editor

or

Download PDF