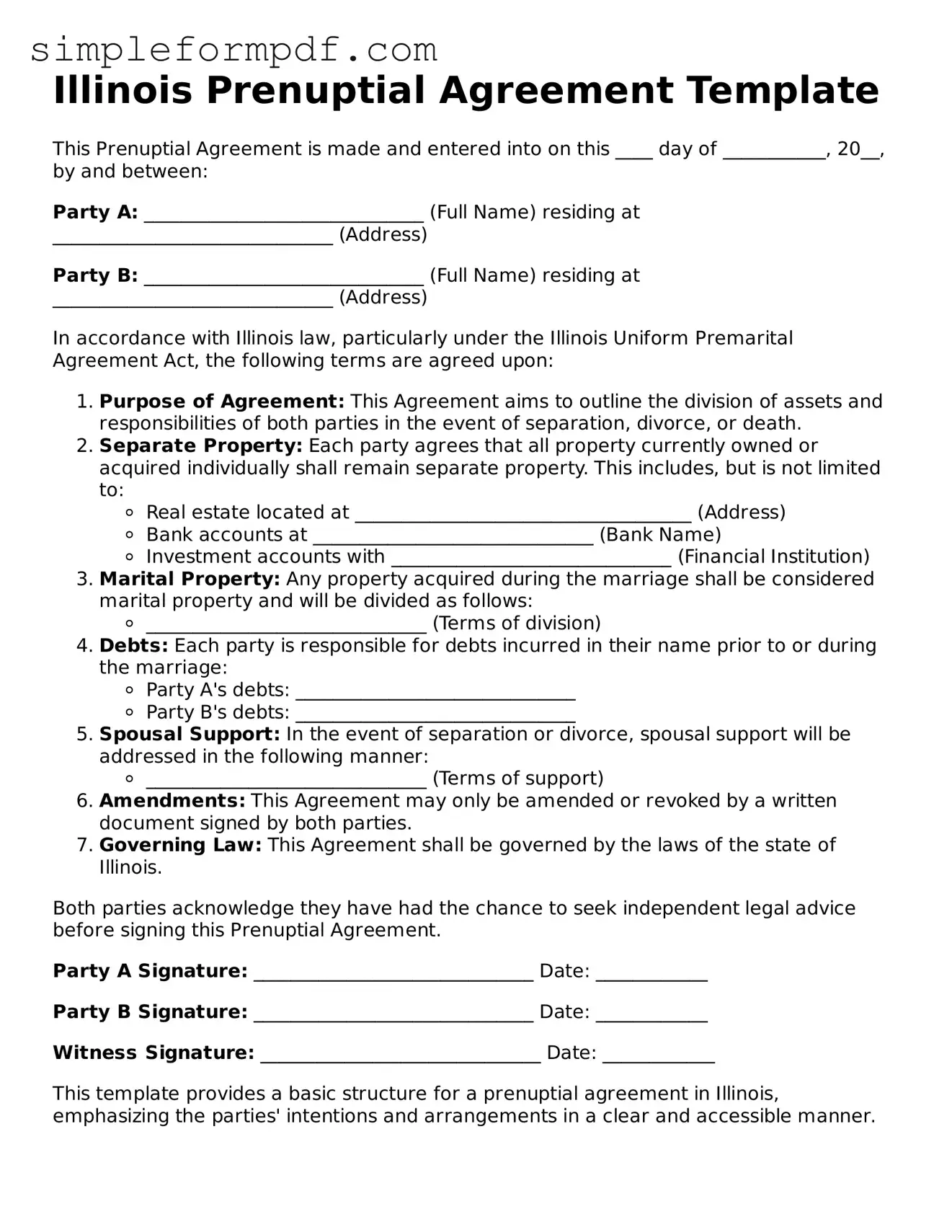

Illinois Prenuptial Agreement Template

This Prenuptial Agreement is made and entered into on this ____ day of ___________, 20__, by and between:

Party A: ______________________________ (Full Name) residing at ______________________________ (Address)

Party B: ______________________________ (Full Name) residing at ______________________________ (Address)

In accordance with Illinois law, particularly under the Illinois Uniform Premarital Agreement Act, the following terms are agreed upon:

- Purpose of Agreement: This Agreement aims to outline the division of assets and responsibilities of both parties in the event of separation, divorce, or death.

- Separate Property: Each party agrees that all property currently owned or acquired individually shall remain separate property. This includes, but is not limited to:

- Real estate located at ____________________________________ (Address)

- Bank accounts at ______________________________ (Bank Name)

- Investment accounts with ______________________________ (Financial Institution)

- Marital Property: Any property acquired during the marriage shall be considered marital property and will be divided as follows:

- ______________________________ (Terms of division)

- Debts: Each party is responsible for debts incurred in their name prior to or during the marriage:

- Party A's debts: ______________________________

- Party B's debts: ______________________________

- Spousal Support: In the event of separation or divorce, spousal support will be addressed in the following manner:

- ______________________________ (Terms of support)

- Amendments: This Agreement may only be amended or revoked by a written document signed by both parties.

- Governing Law: This Agreement shall be governed by the laws of the state of Illinois.

Both parties acknowledge they have had the chance to seek independent legal advice before signing this Prenuptial Agreement.

Party A Signature: ______________________________ Date: ____________

Party B Signature: ______________________________ Date: ____________

Witness Signature: ______________________________ Date: ____________

This template provides a basic structure for a prenuptial agreement in Illinois, emphasizing the parties' intentions and arrangements in a clear and accessible manner.