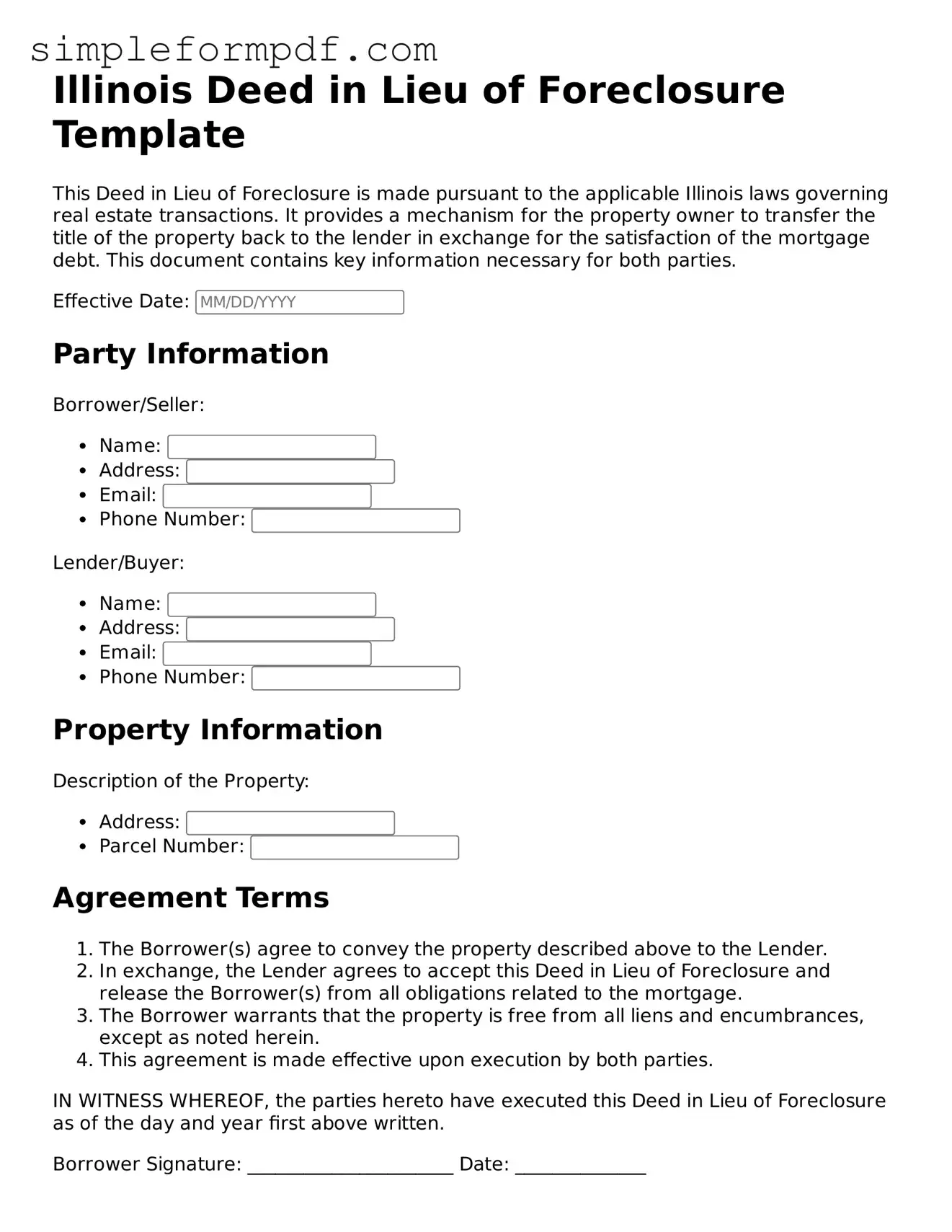

Free Deed in Lieu of Foreclosure Form for the State of Illinois

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender in order to avoid the lengthy and costly foreclosure process. This option can provide a more amicable resolution for both parties, as it helps the homeowner escape financial distress while allowing the lender to recover their investment more efficiently. If you're considering this option, take the first step by filling out the form below.

Launch Editor

Free Deed in Lieu of Foreclosure Form for the State of Illinois

Launch Editor

Need instant form completion?

Finish Deed in Lieu of Foreclosure online in just a few minutes.

Launch Editor

or

Download PDF