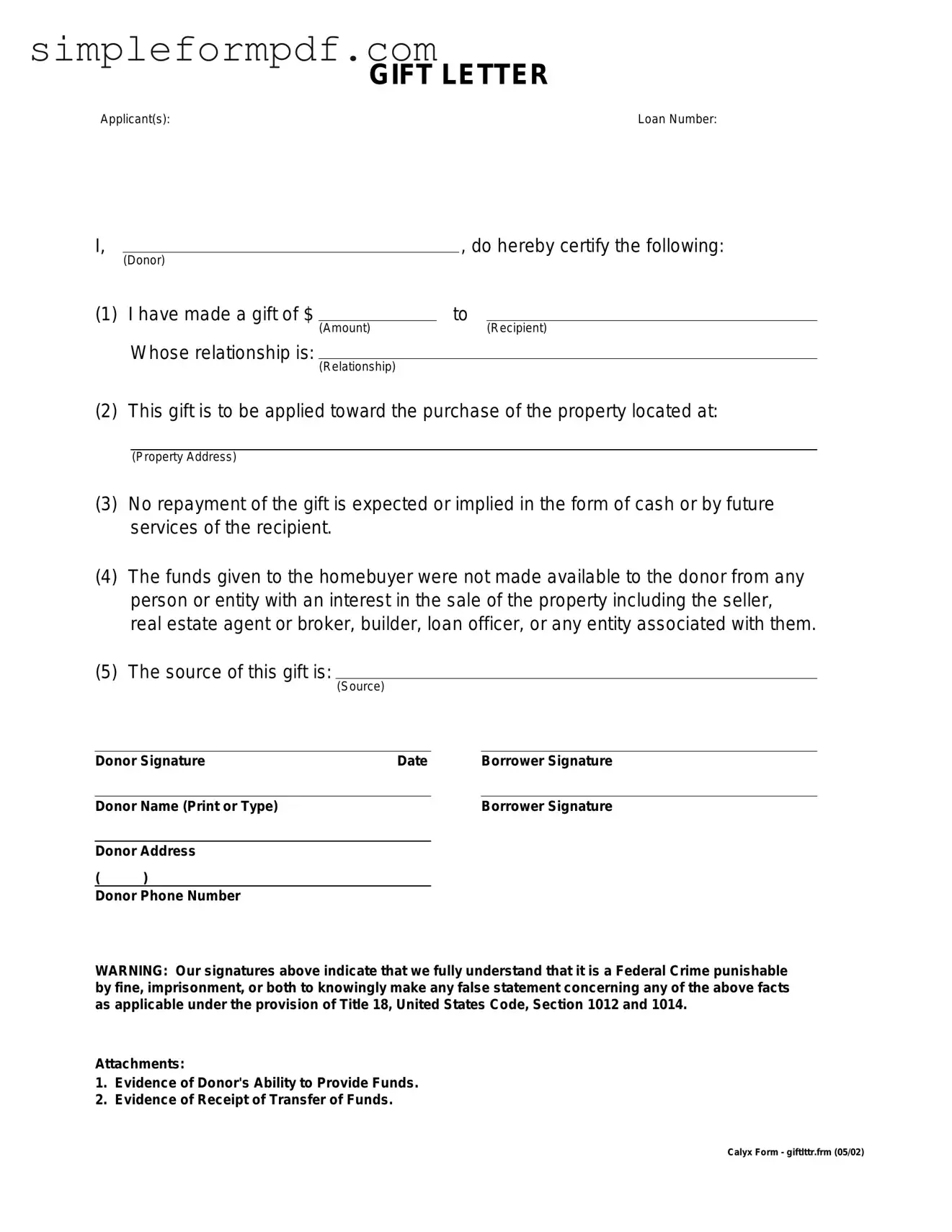

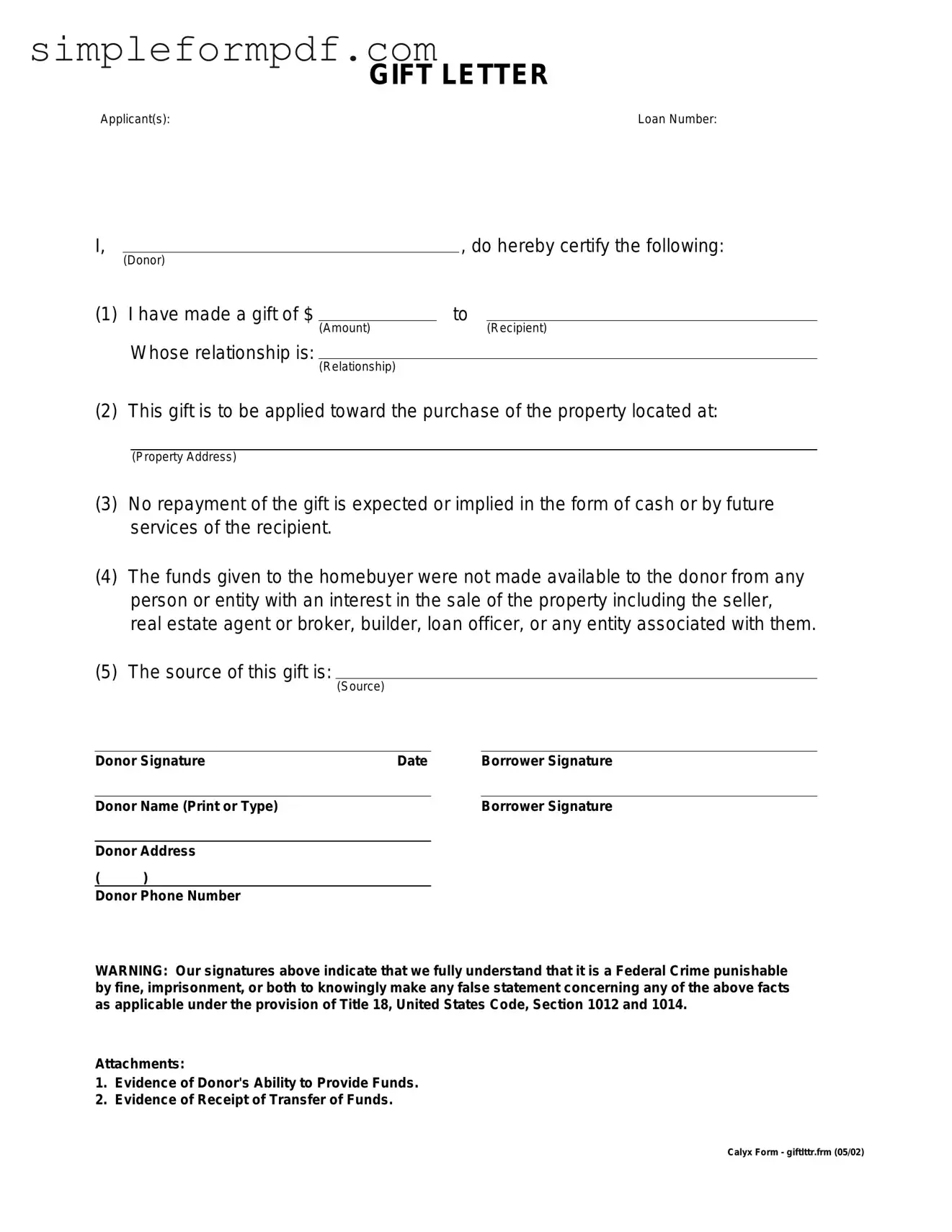

Gift Letter PDF Form

A Gift Letter form is a document used to confirm that a financial gift has been given, often for purposes such as purchasing a home. This form helps clarify the nature of the funds, ensuring that they are not a loan and that the recipient is not obligated to repay the giver. Understanding how to fill out this form is essential for a smooth transaction, so take the next step by clicking the button below.

Launch Editor

Gift Letter PDF Form

Launch Editor

Need instant form completion?

Finish Gift Letter online in just a few minutes.

Launch Editor

or

Download PDF