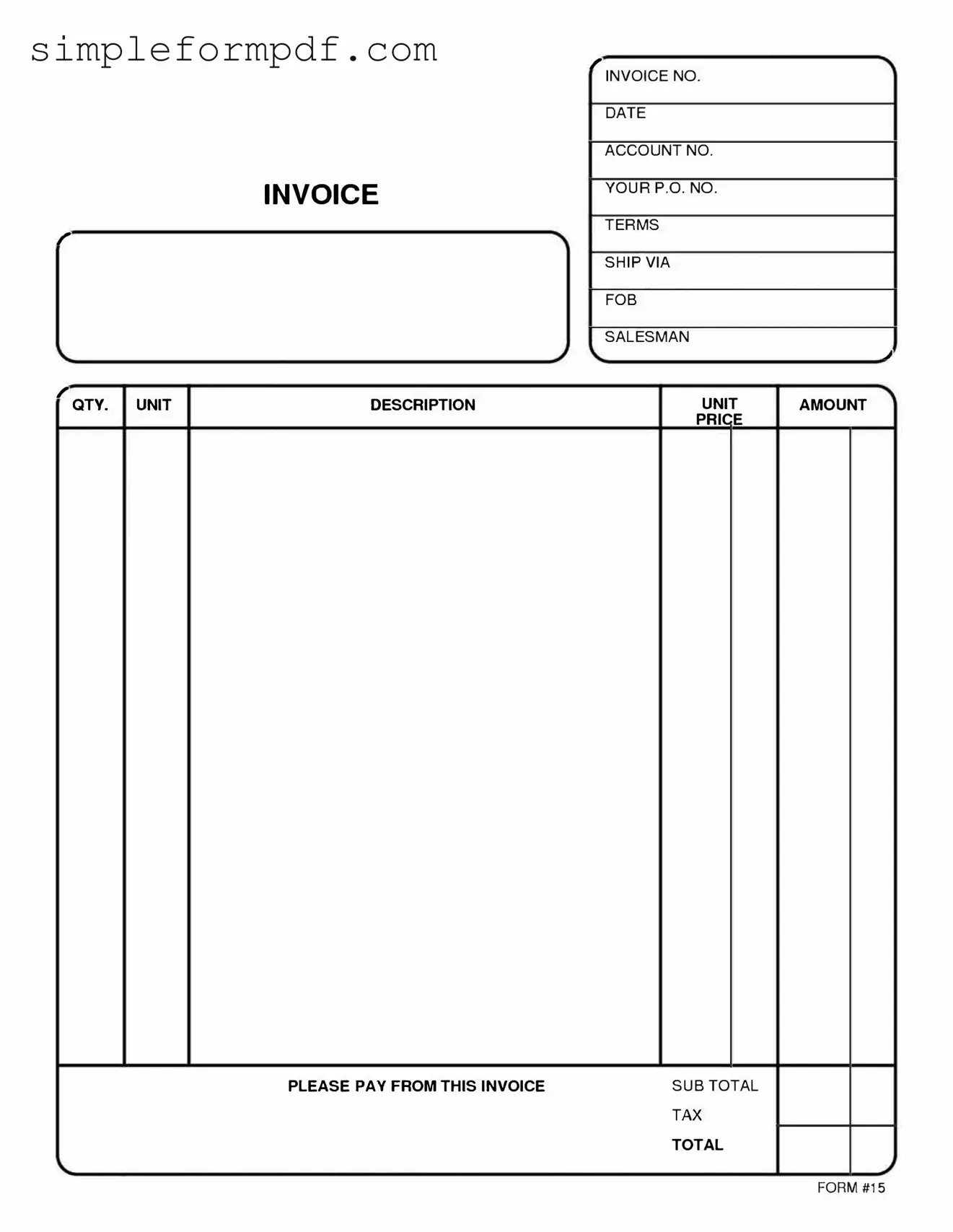

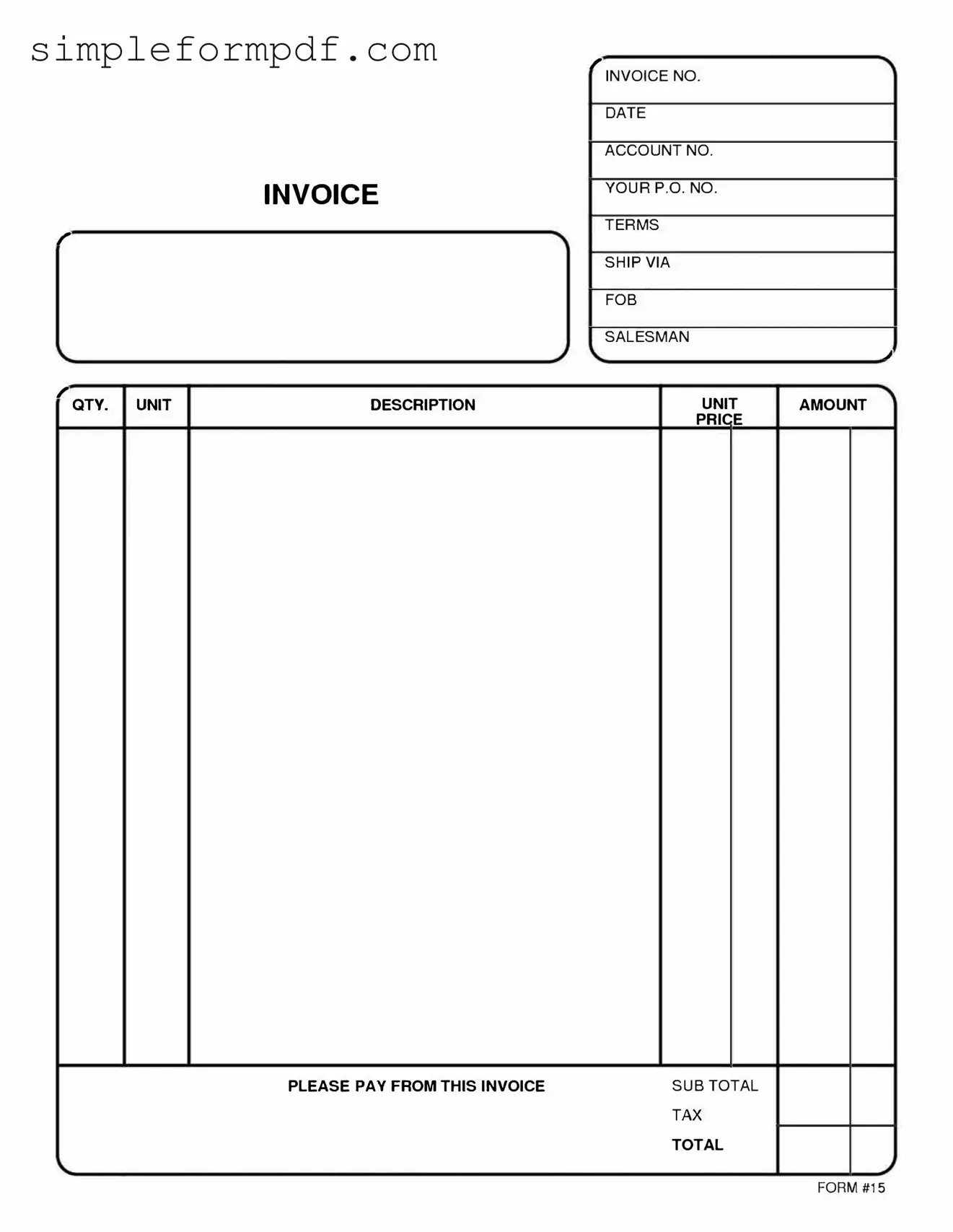

Free And Invoice Pdf PDF Form

The Free And Invoice PDF form is a document designed to help individuals and businesses create and manage invoices efficiently. This form simplifies the invoicing process, making it easier to track payments and maintain financial records. To get started, fill out the form by clicking the button below.

Launch Editor

Free And Invoice Pdf PDF Form

Launch Editor

Need instant form completion?

Finish Free And Invoice Pdf online in just a few minutes.

Launch Editor

or

Download PDF