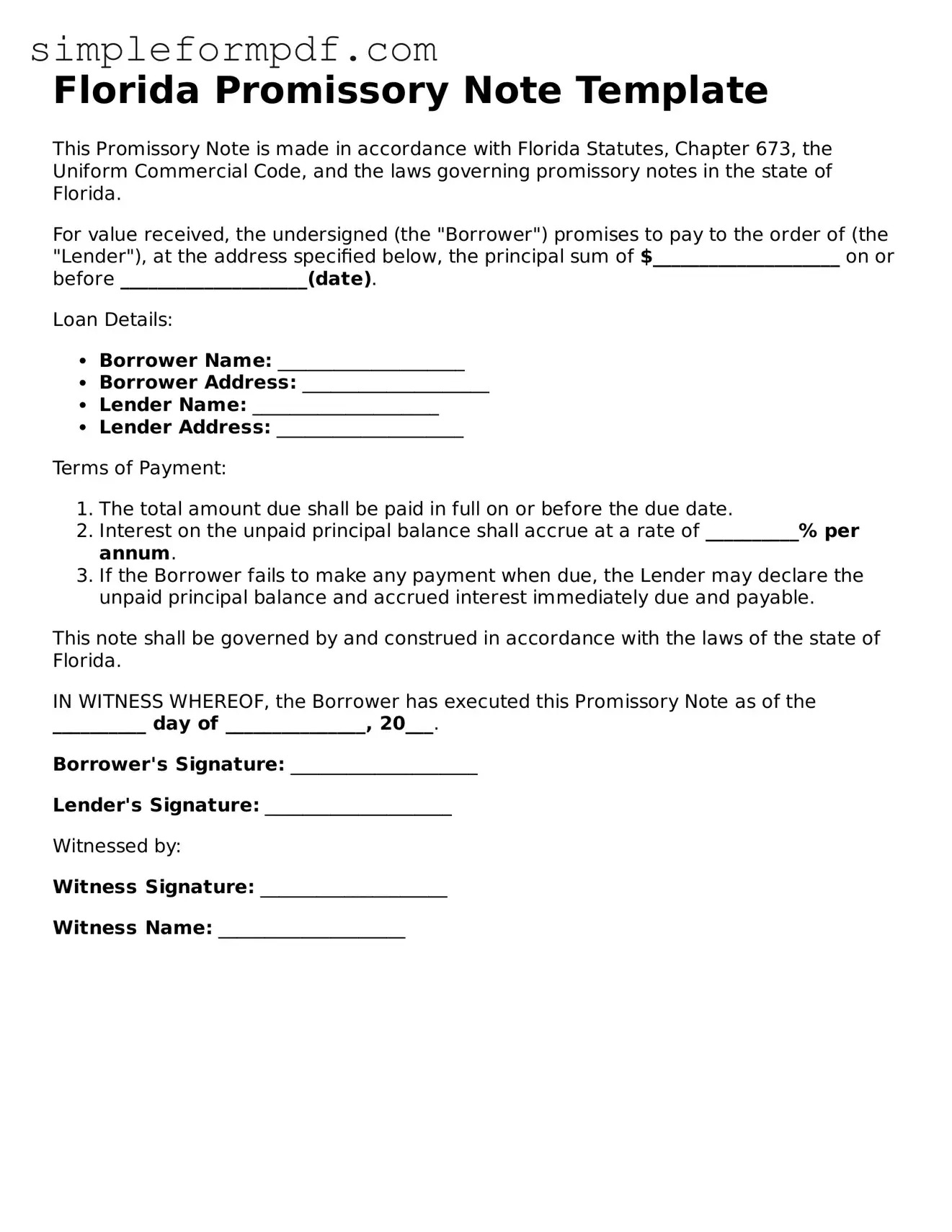

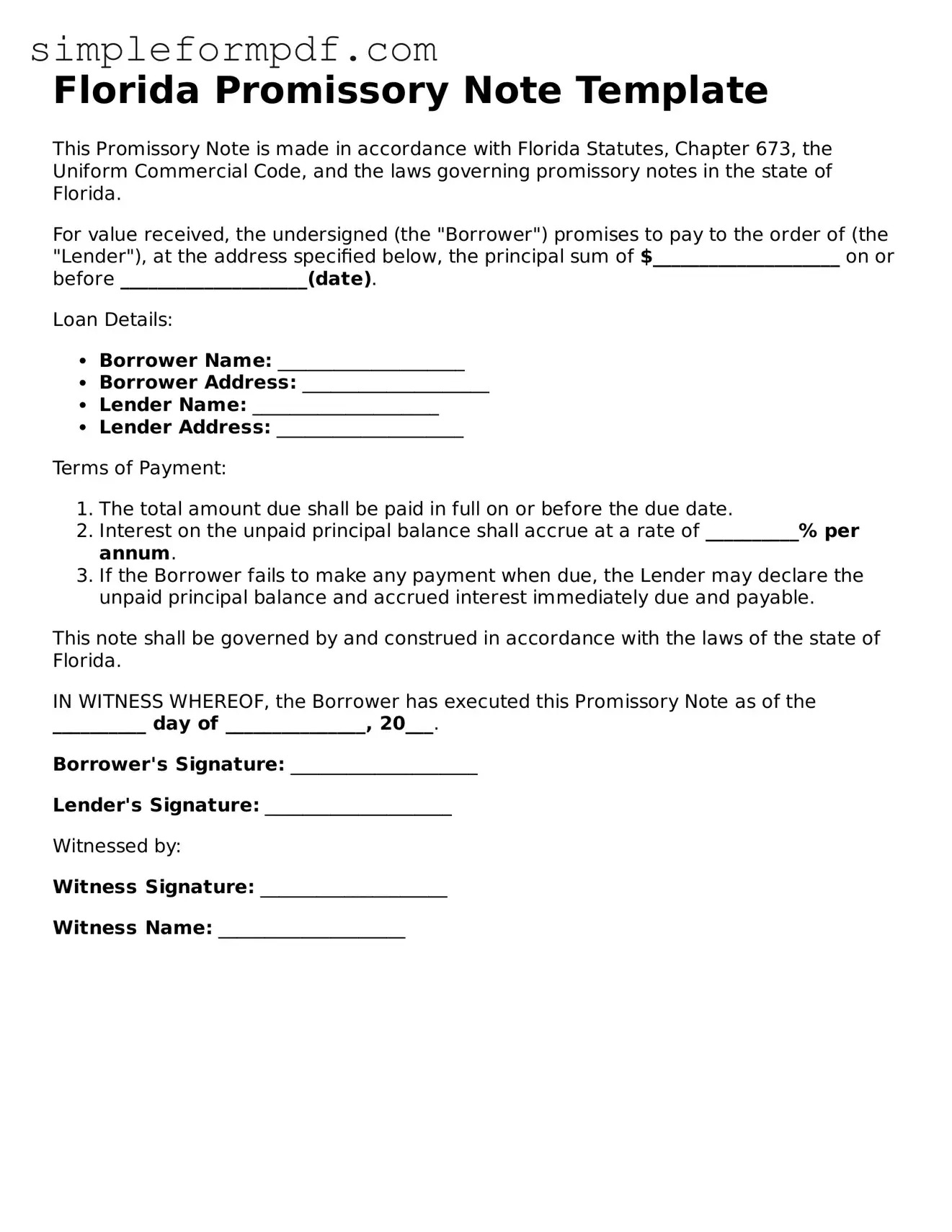

Free Promissory Note Form for the State of Florida

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool in financial transactions, ensuring both parties understand their obligations. If you're ready to formalize a loan agreement, fill out the form by clicking the button below.

Launch Editor

Free Promissory Note Form for the State of Florida

Launch Editor

Need instant form completion?

Finish Promissory Note online in just a few minutes.

Launch Editor

or

Download PDF