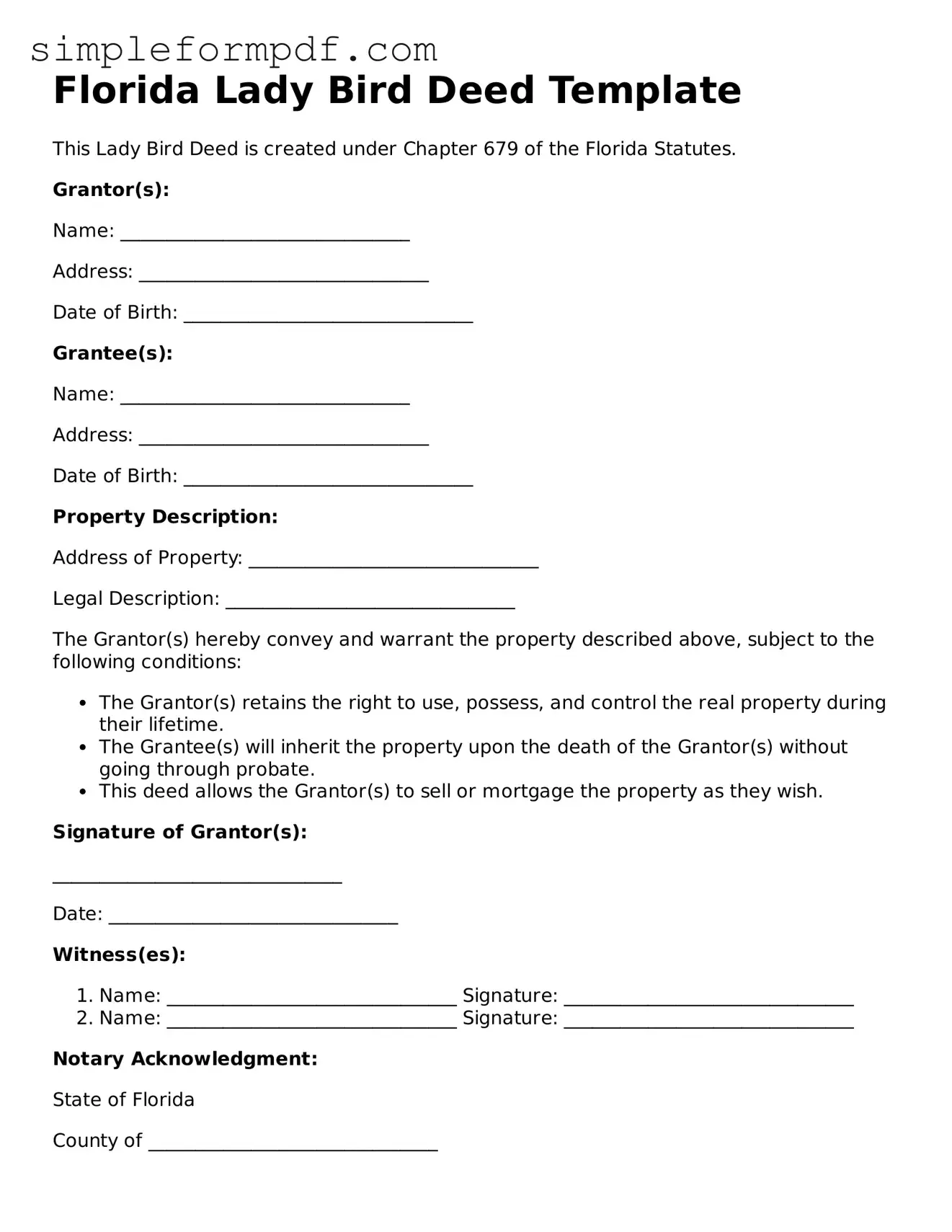

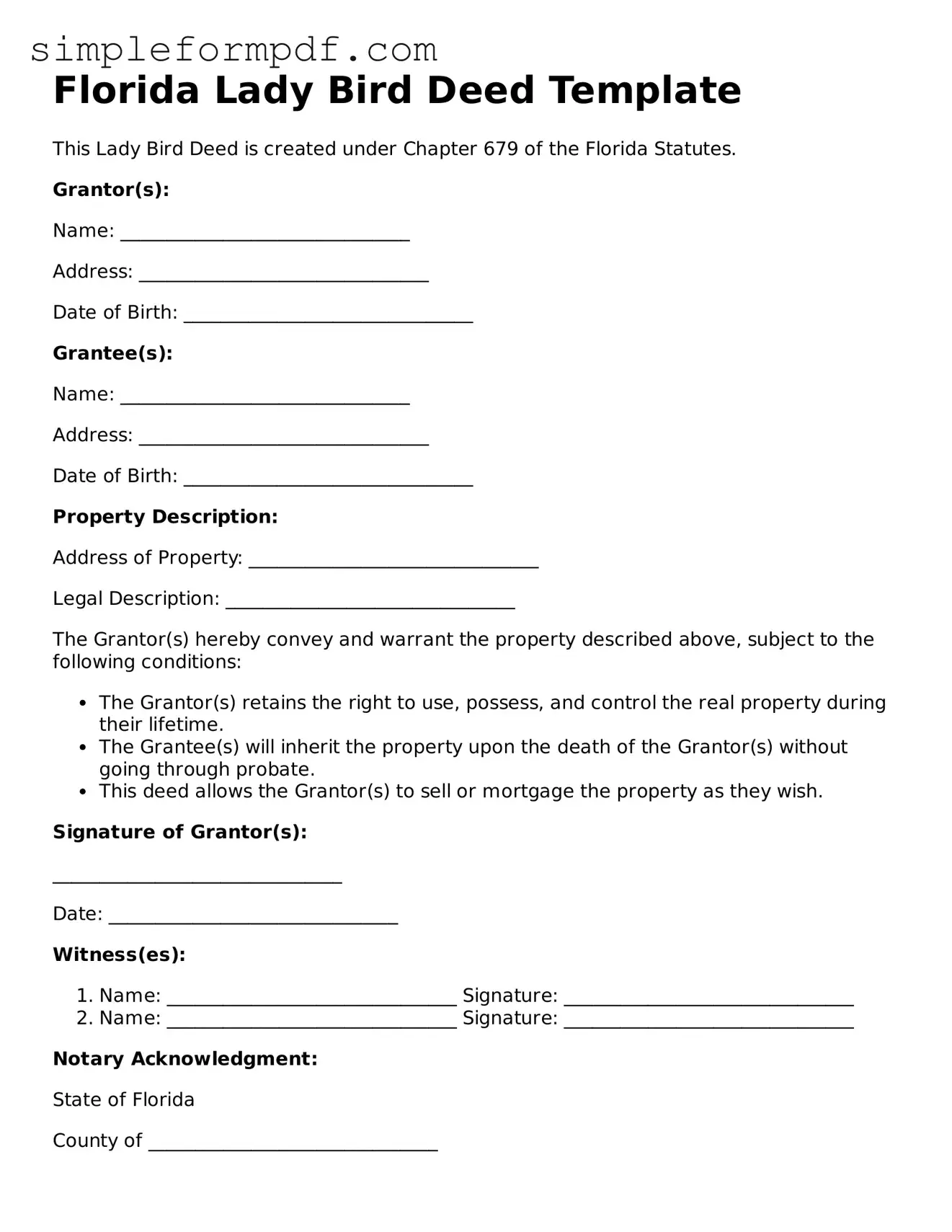

Free Lady Bird Deed Form for the State of Florida

The Florida Lady Bird Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique type of deed helps avoid probate and provides flexibility in estate planning. If you're considering this option, fill out the form by clicking the button below.

Launch Editor

Free Lady Bird Deed Form for the State of Florida

Launch Editor

Need instant form completion?

Finish Lady Bird Deed online in just a few minutes.

Launch Editor

or

Download PDF