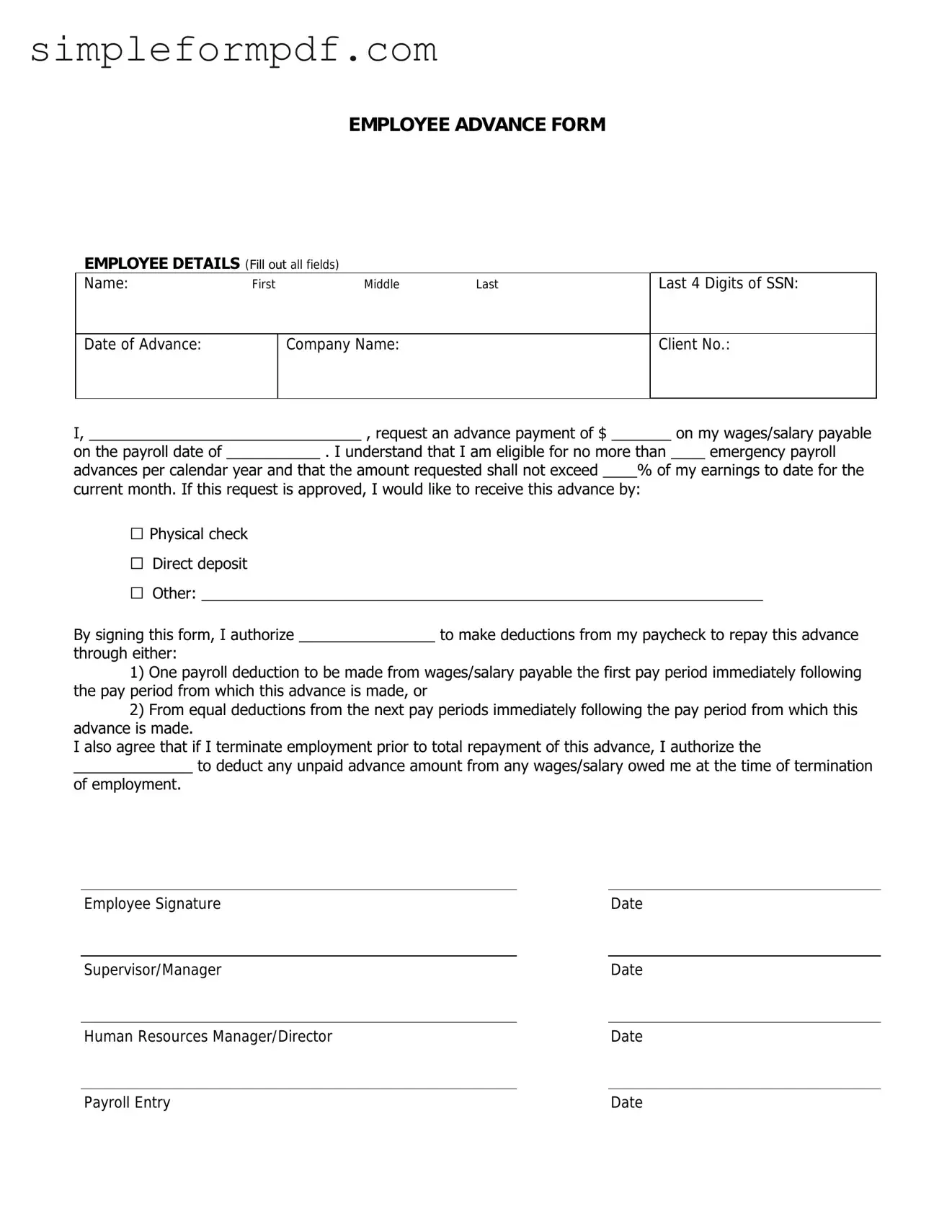

Employee Advance PDF Form

The Employee Advance form is a document used by employers to provide financial assistance to employees before their regular paycheck is issued. This form outlines the terms of the advance, including repayment details and eligibility criteria. If you need to request an advance, please fill out the form by clicking the button below.

Launch Editor

Employee Advance PDF Form

Launch Editor

Need instant form completion?

Finish Employee Advance online in just a few minutes.

Launch Editor

or

Download PDF