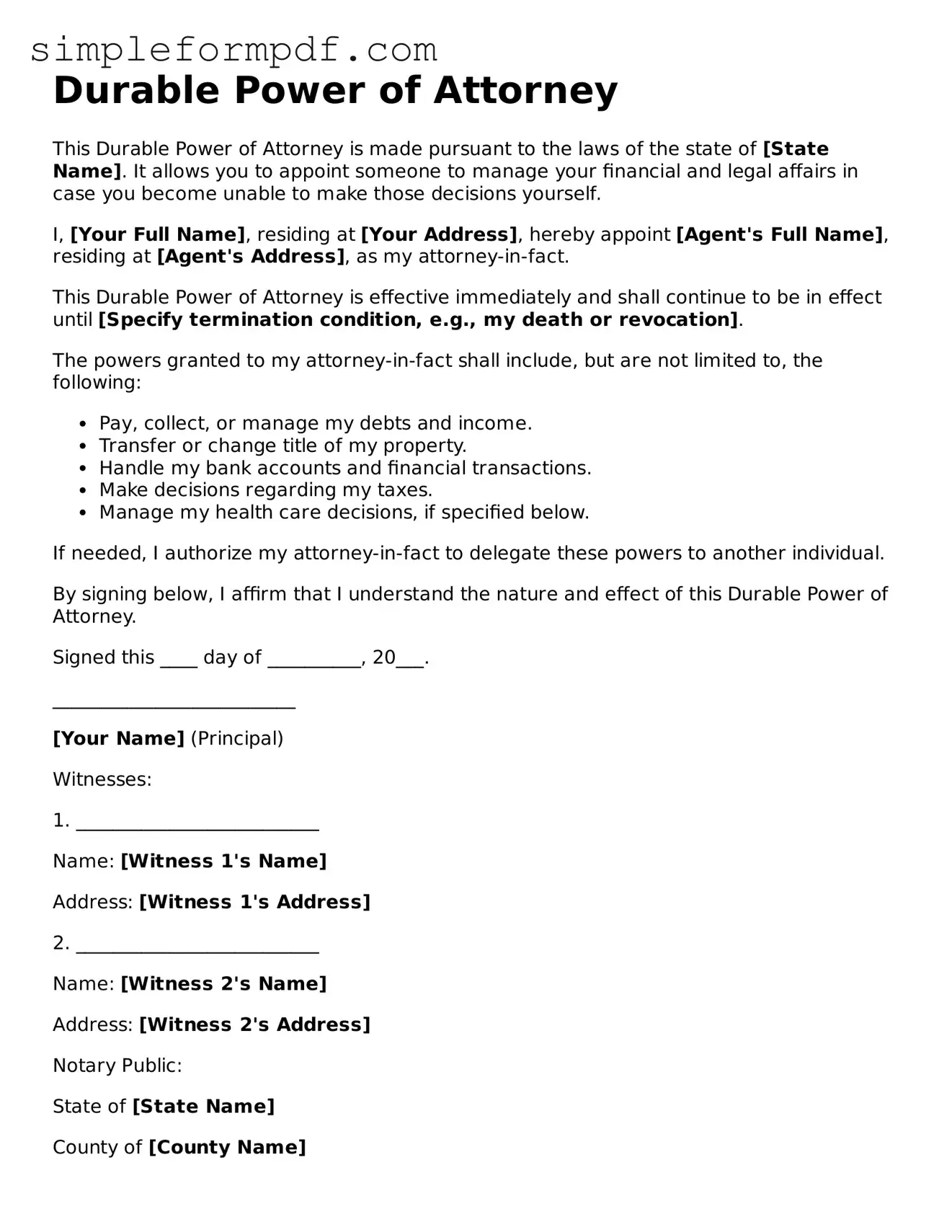

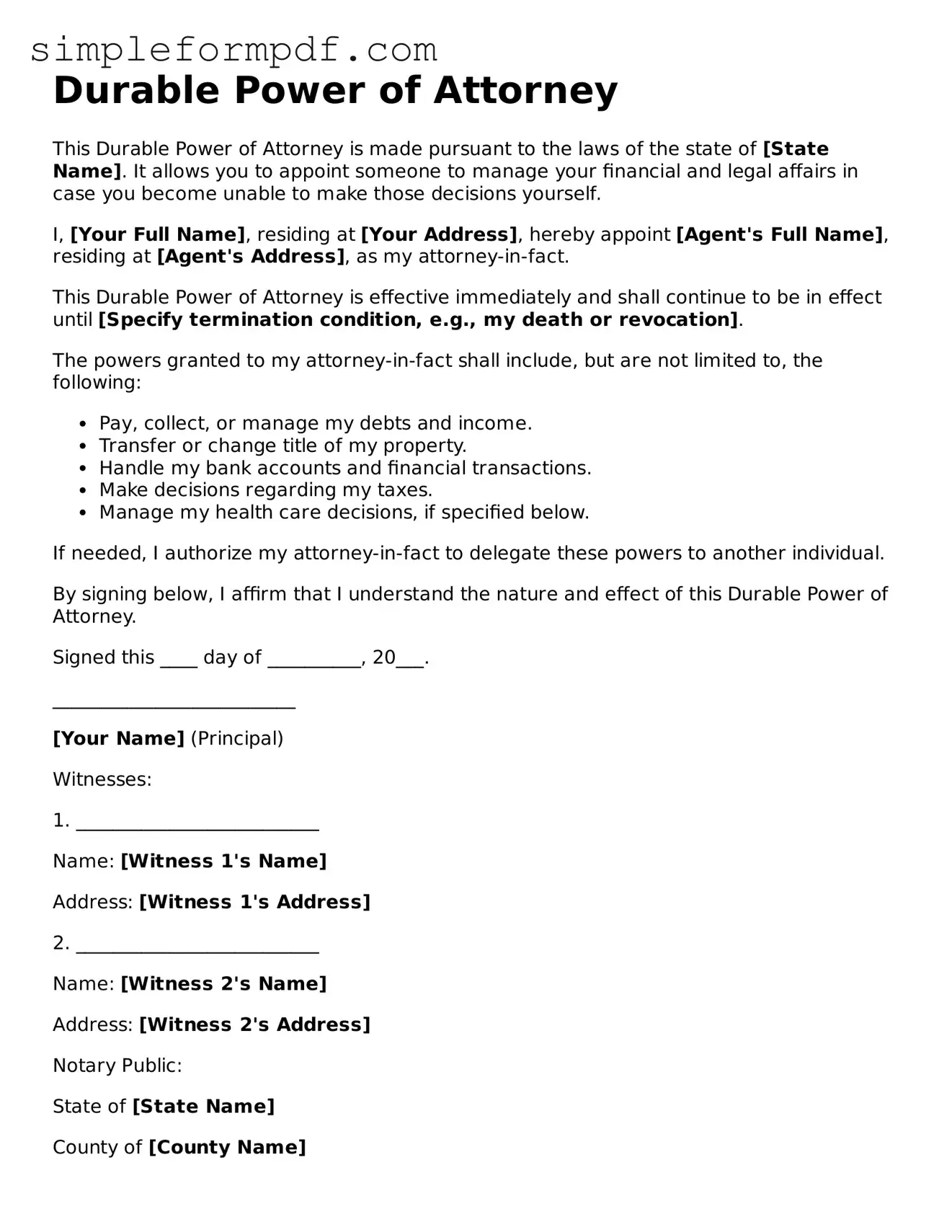

Fillable Durable Power of Attorney Template

A Durable Power of Attorney is a legal document that allows an individual to appoint someone else to make decisions on their behalf, especially in matters related to financial and healthcare choices, should they become unable to do so themselves. This form remains effective even if the person who created it becomes incapacitated, ensuring that their wishes are respected. Understanding the importance of this document can empower individuals to make informed decisions about their future; take the first step by filling out the form below.

Launch Editor

Fillable Durable Power of Attorney Template

Launch Editor

Need instant form completion?

Finish Durable Power of Attorney online in just a few minutes.

Launch Editor

or

Download PDF