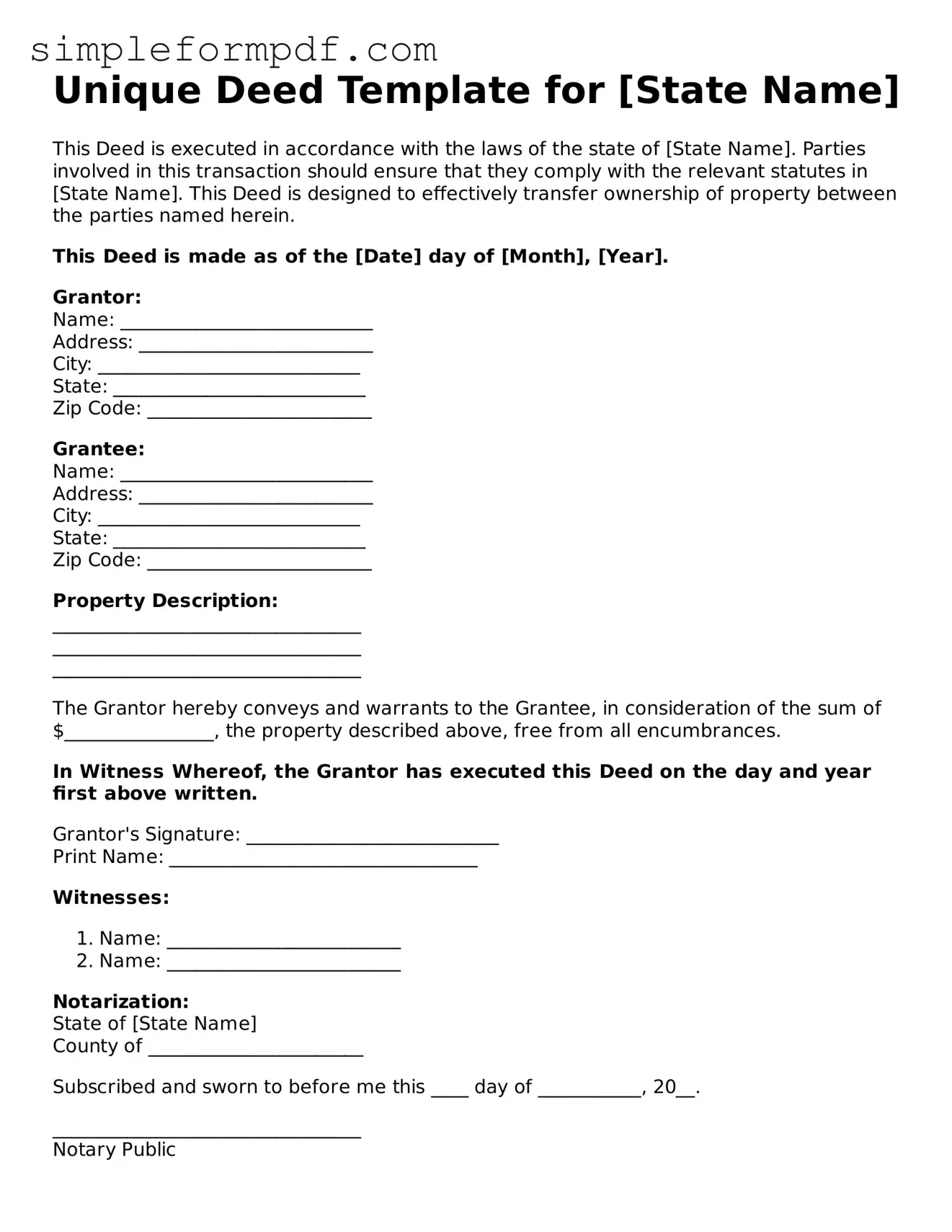

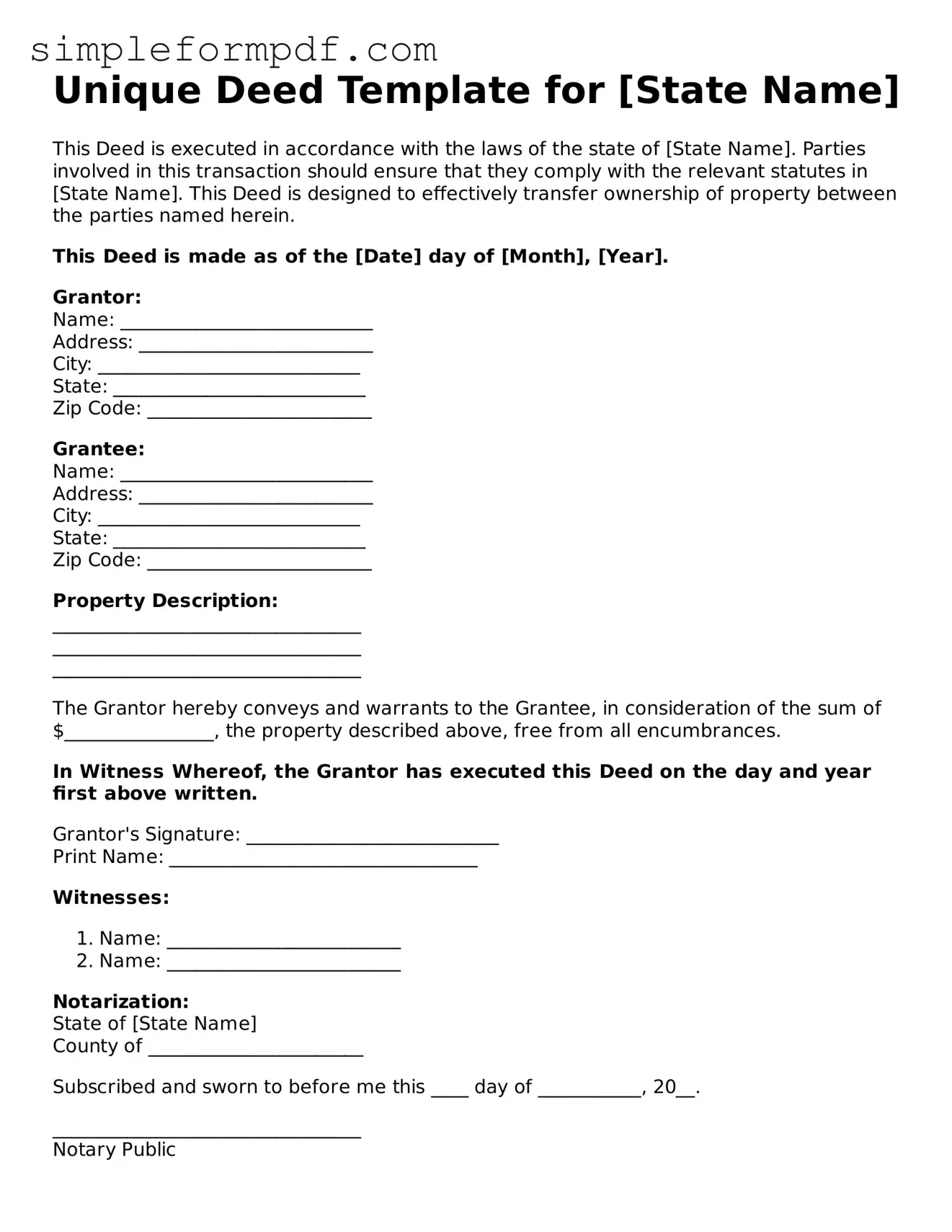

Fillable Deed Template

A Deed form is a legal document that conveys ownership of property from one party to another, ensuring that the transfer is recognized and enforceable under the law. This form serves as a crucial tool in real estate transactions, providing clarity and protection for both buyers and sellers. To begin the process of transferring property ownership, fill out the deed form by clicking the button below.

Launch Editor

Fillable Deed Template

Launch Editor

Need instant form completion?

Finish Deed online in just a few minutes.

Launch Editor

or

Download PDF