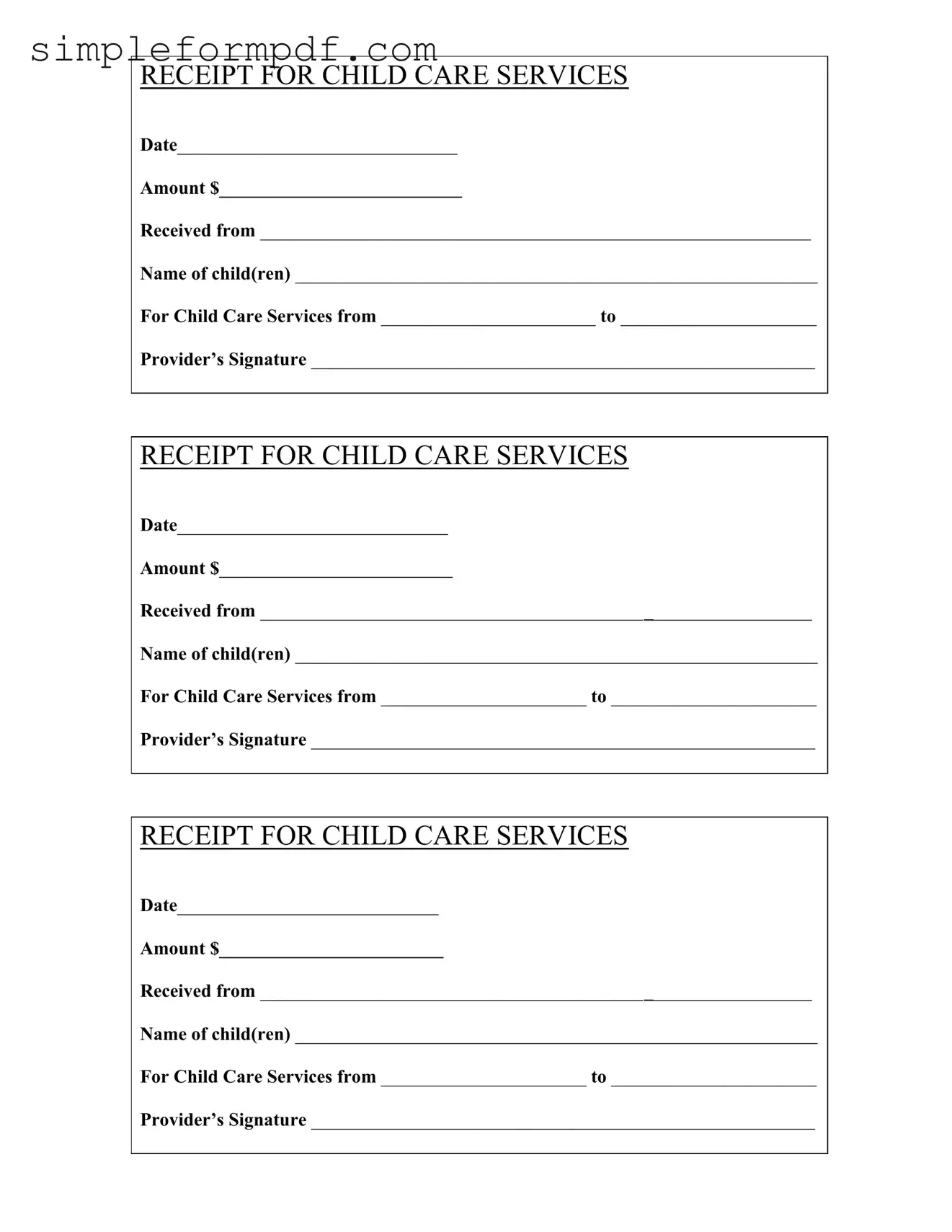

Childcare Receipt PDF Form

The Childcare Receipt form is a document used to acknowledge the payment for childcare services. It includes essential details such as the date, amount paid, and the names of the children receiving care. Ensuring this form is filled out correctly is crucial for both parents and providers, so take a moment to complete it by clicking the button below.

Launch Editor

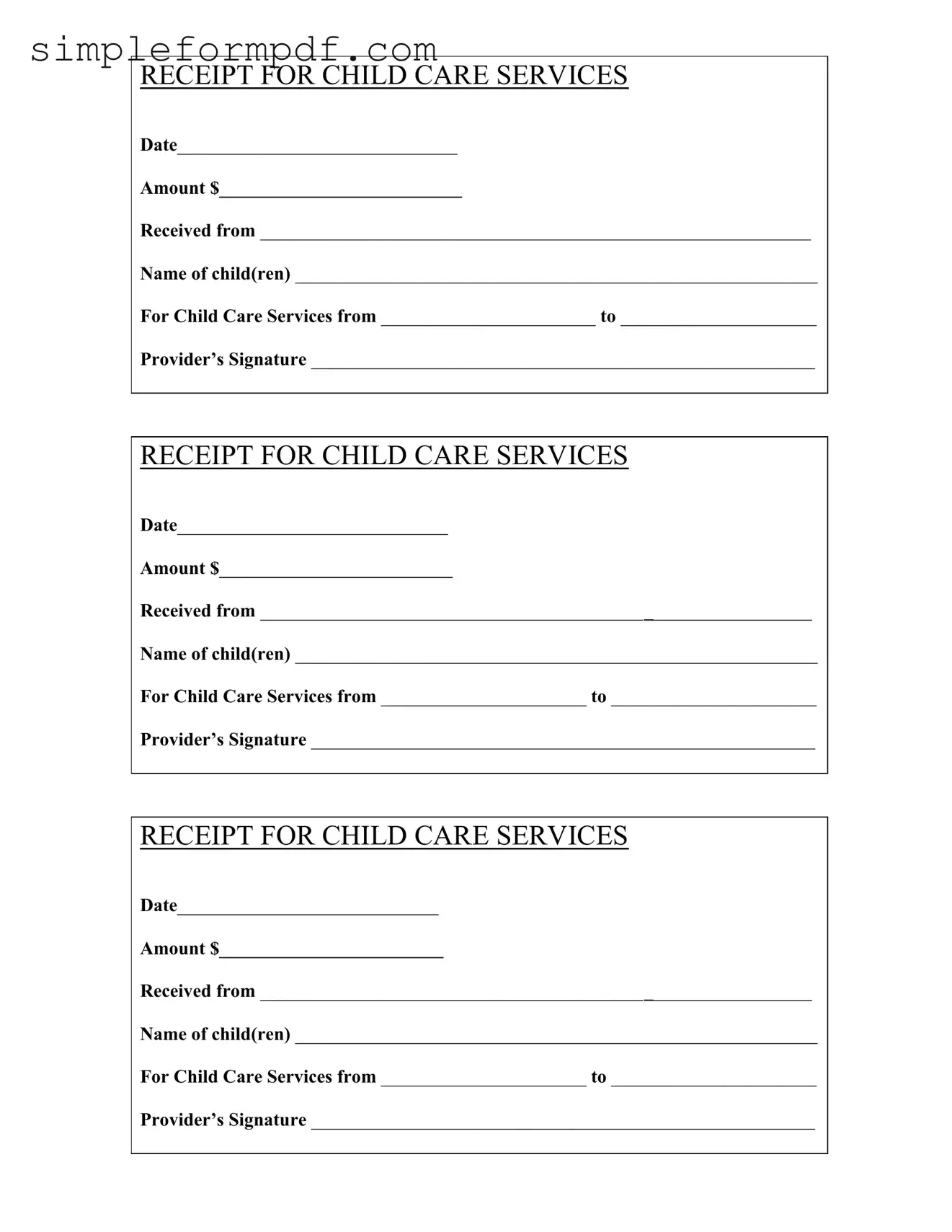

Childcare Receipt PDF Form

Launch Editor

Need instant form completion?

Finish Childcare Receipt online in just a few minutes.

Launch Editor

or

Download PDF