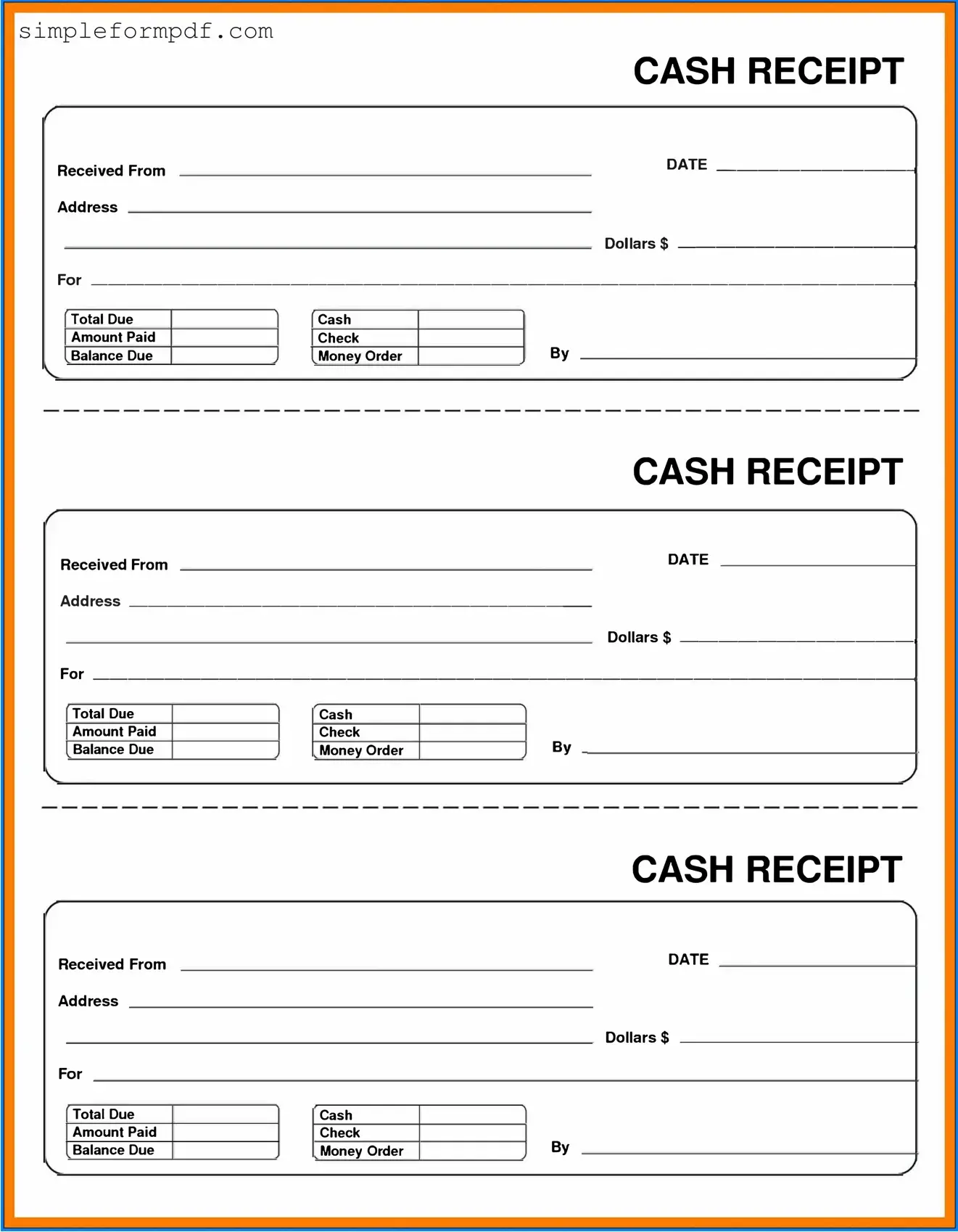

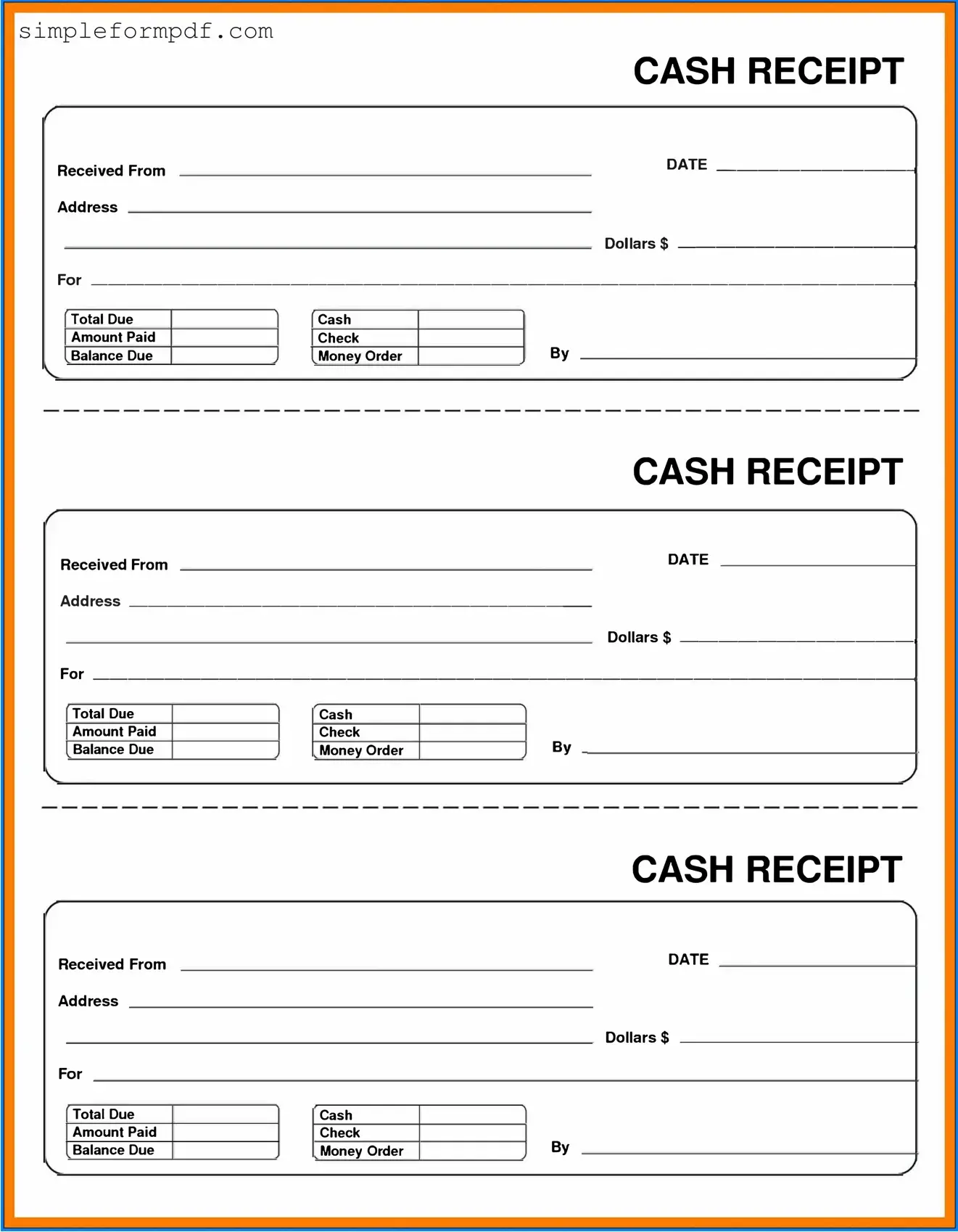

Cash Receipt PDF Form

A Cash Receipt form is a document that records the receipt of cash payments, providing a clear record for both the payer and the recipient. This form is essential for maintaining accurate financial records and ensuring accountability in transactions. To streamline your cash management process, consider filling out the form by clicking the button below.

Launch Editor

Cash Receipt PDF Form

Launch Editor

Need instant form completion?

Finish Cash Receipt online in just a few minutes.

Launch Editor

or

Download PDF