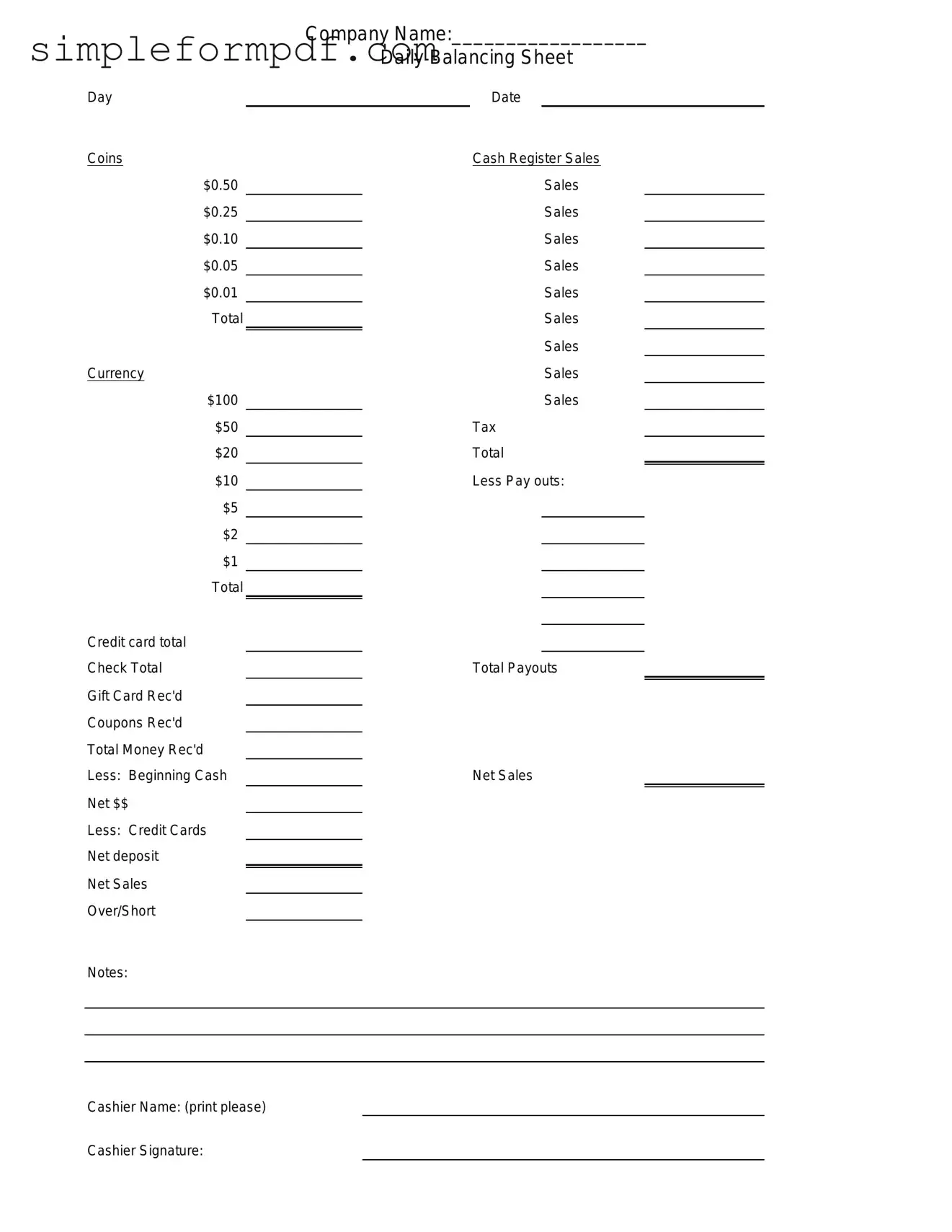

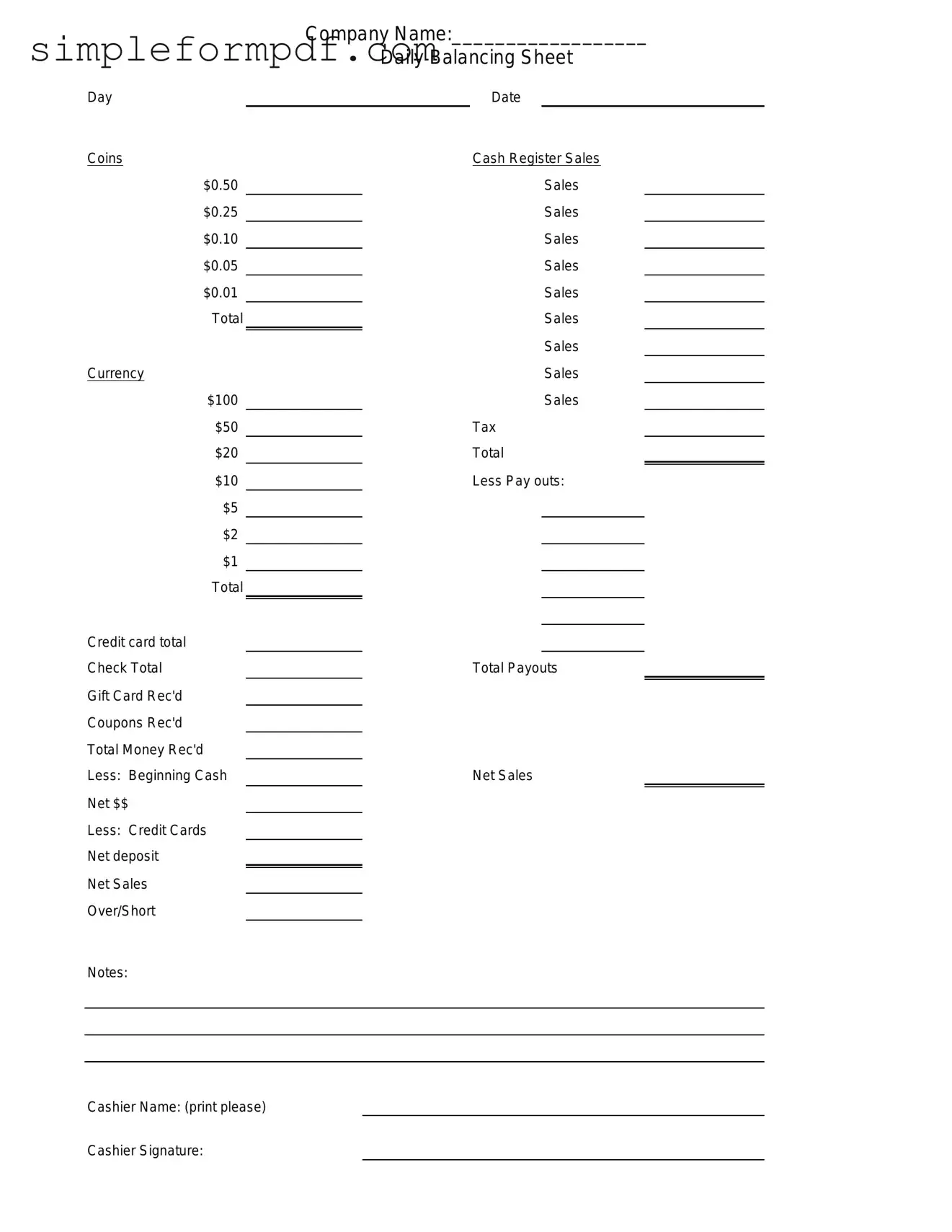

Cash Drawer Count Sheet PDF Form

The Cash Drawer Count Sheet is a financial document used by businesses to track the amount of cash in their registers at the end of a shift or business day. This form helps ensure accuracy in cash handling and aids in identifying discrepancies. To maintain financial integrity, it is essential to complete this form accurately; you can start by filling it out using the button below.

Launch Editor

Cash Drawer Count Sheet PDF Form

Launch Editor

Need instant form completion?

Finish Cash Drawer Count Sheet online in just a few minutes.

Launch Editor

or

Download PDF