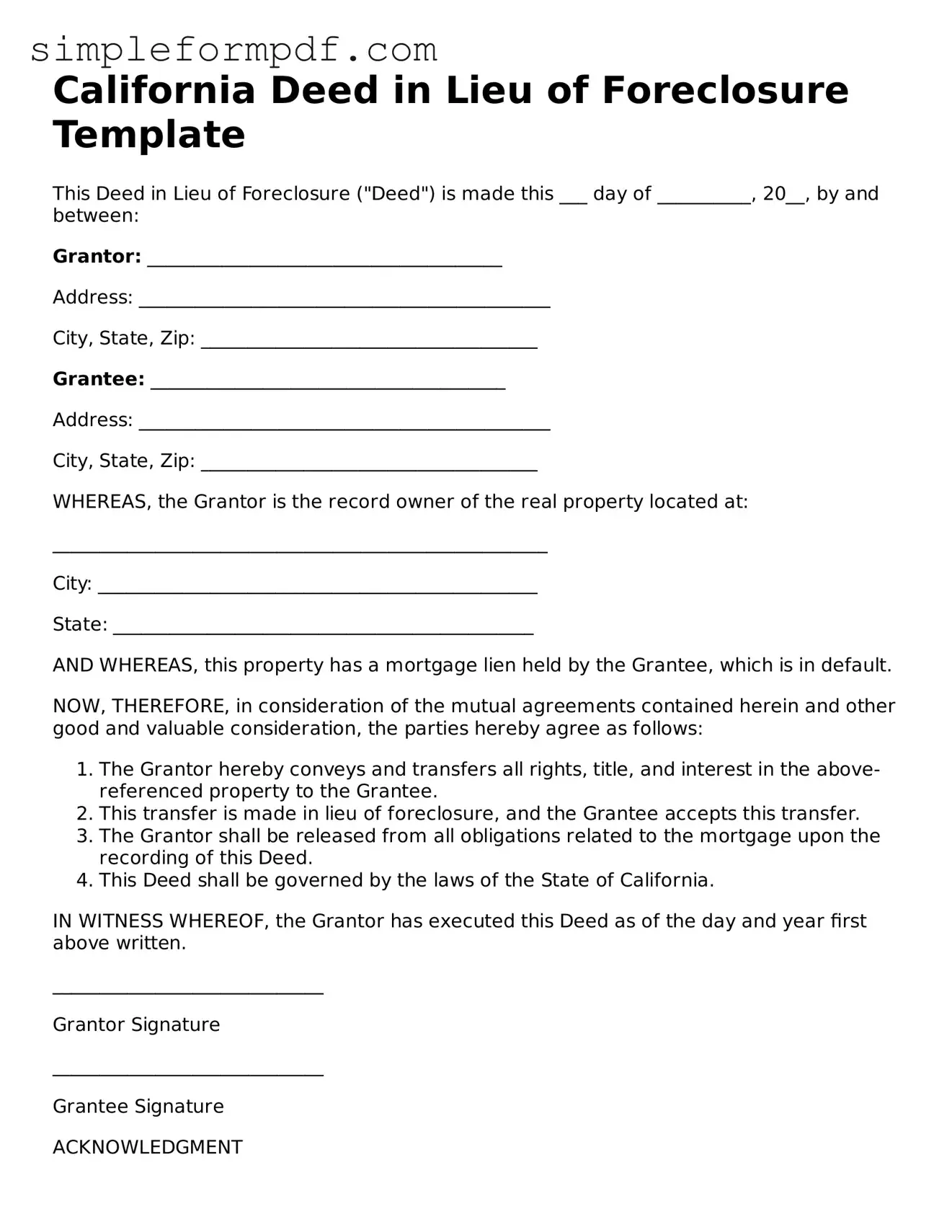

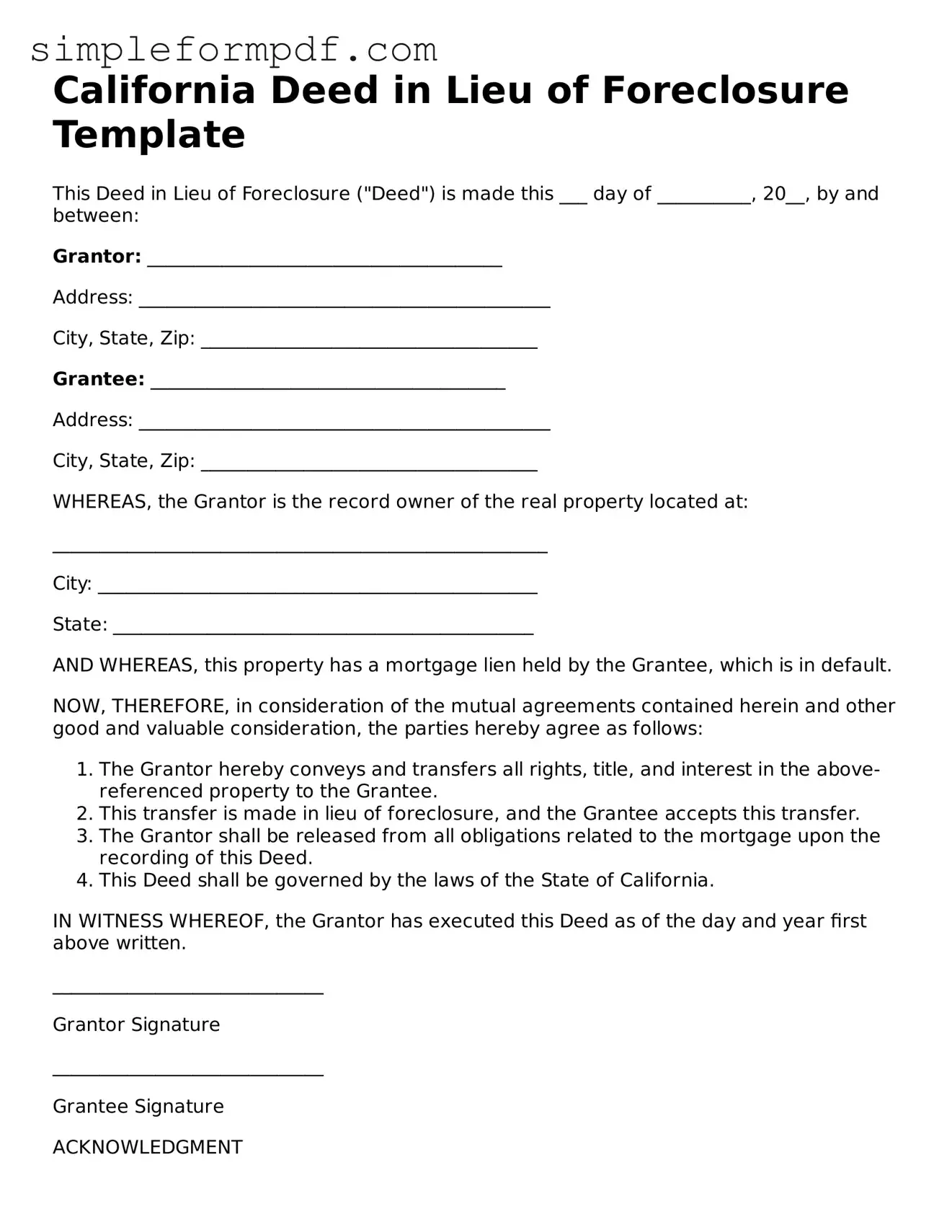

Free Deed in Lieu of Foreclosure Form for the State of California

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid the foreclosure process. This option can provide a smoother resolution for both parties and may help the homeowner mitigate some financial repercussions. If you're considering this option, fill out the form by clicking the button below.

Launch Editor

Free Deed in Lieu of Foreclosure Form for the State of California

Launch Editor

Need instant form completion?

Finish Deed in Lieu of Foreclosure online in just a few minutes.

Launch Editor

or

Download PDF