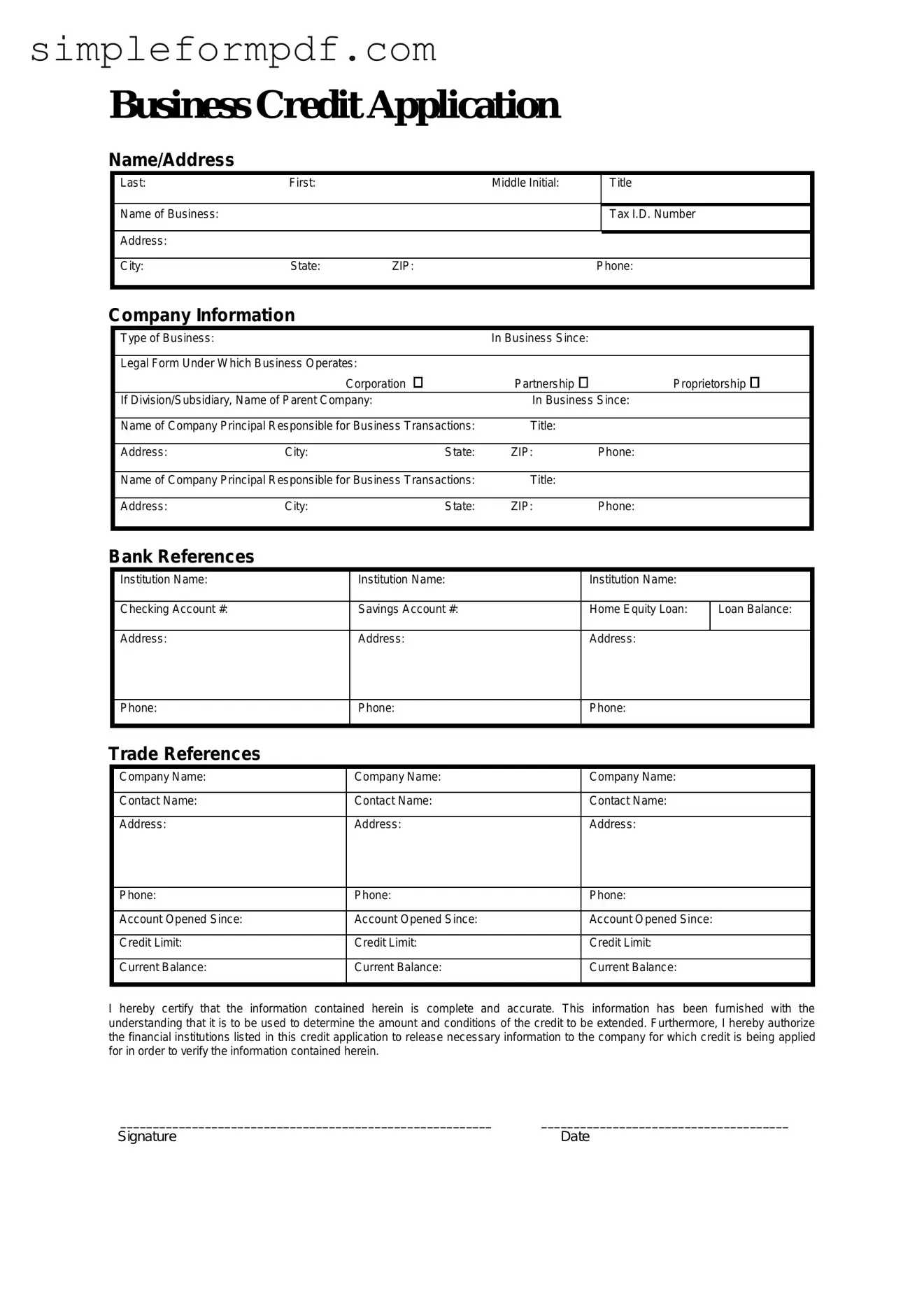

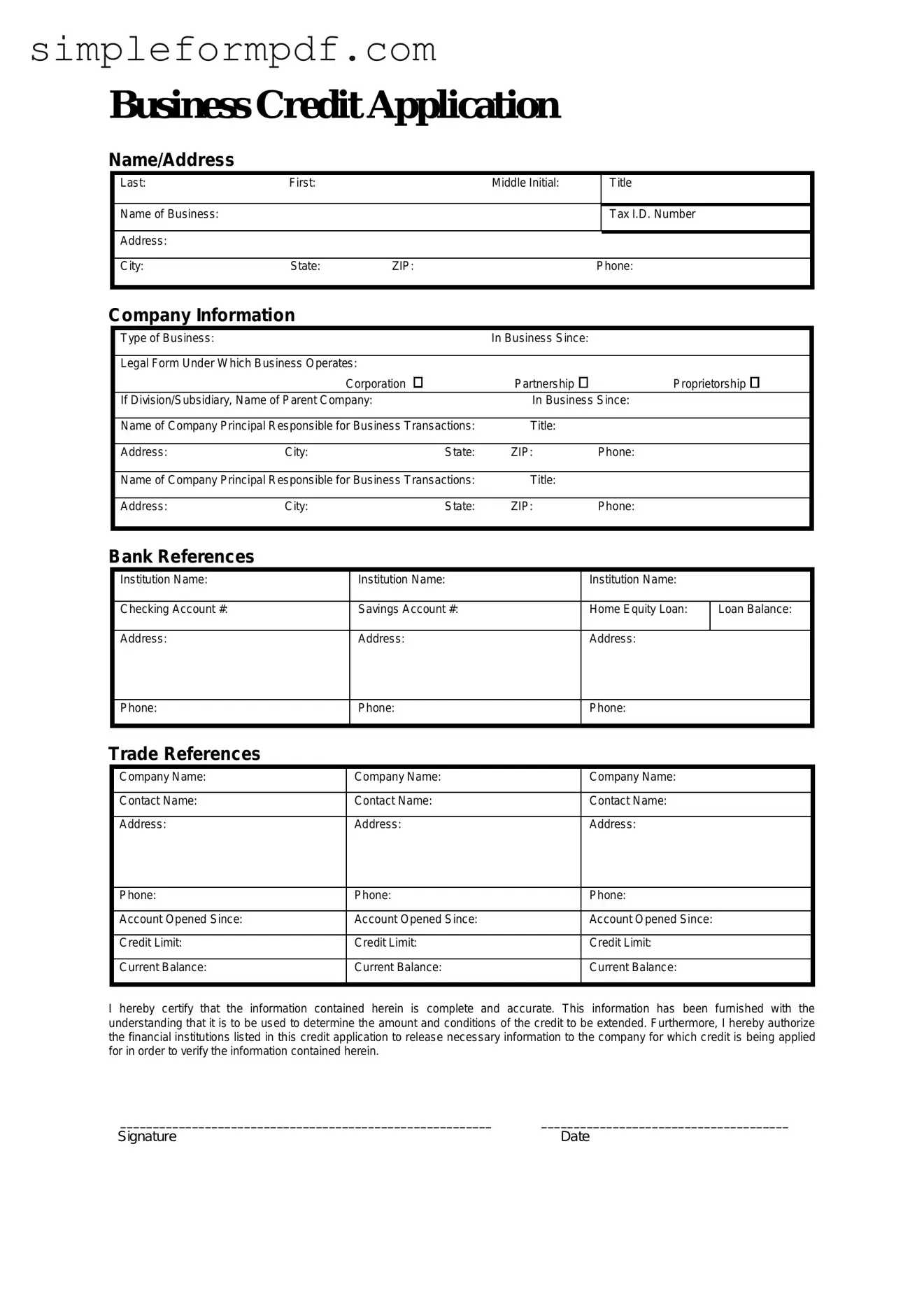

Business Credit Application PDF Form

A Business Credit Application form is a crucial document that allows businesses to request credit from suppliers or financial institutions. This form collects essential information about the business's financial health, ownership, and credit history. Completing this application accurately can pave the way for better financial opportunities and partnerships.

Ready to take the next step? Fill out the form by clicking the button below.

Launch Editor

Business Credit Application PDF Form

Launch Editor

Need instant form completion?

Finish Business Credit Application online in just a few minutes.

Launch Editor

or

Download PDF