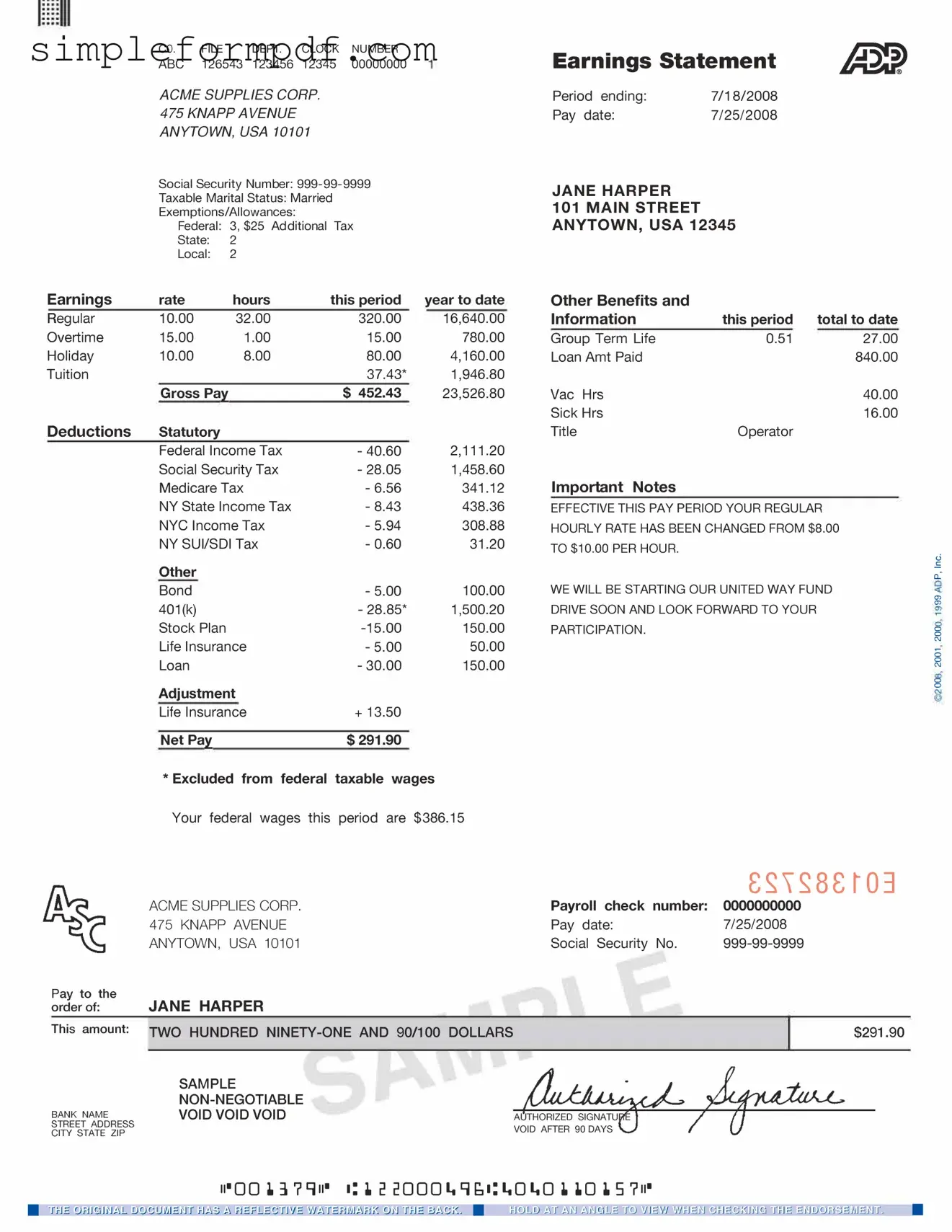

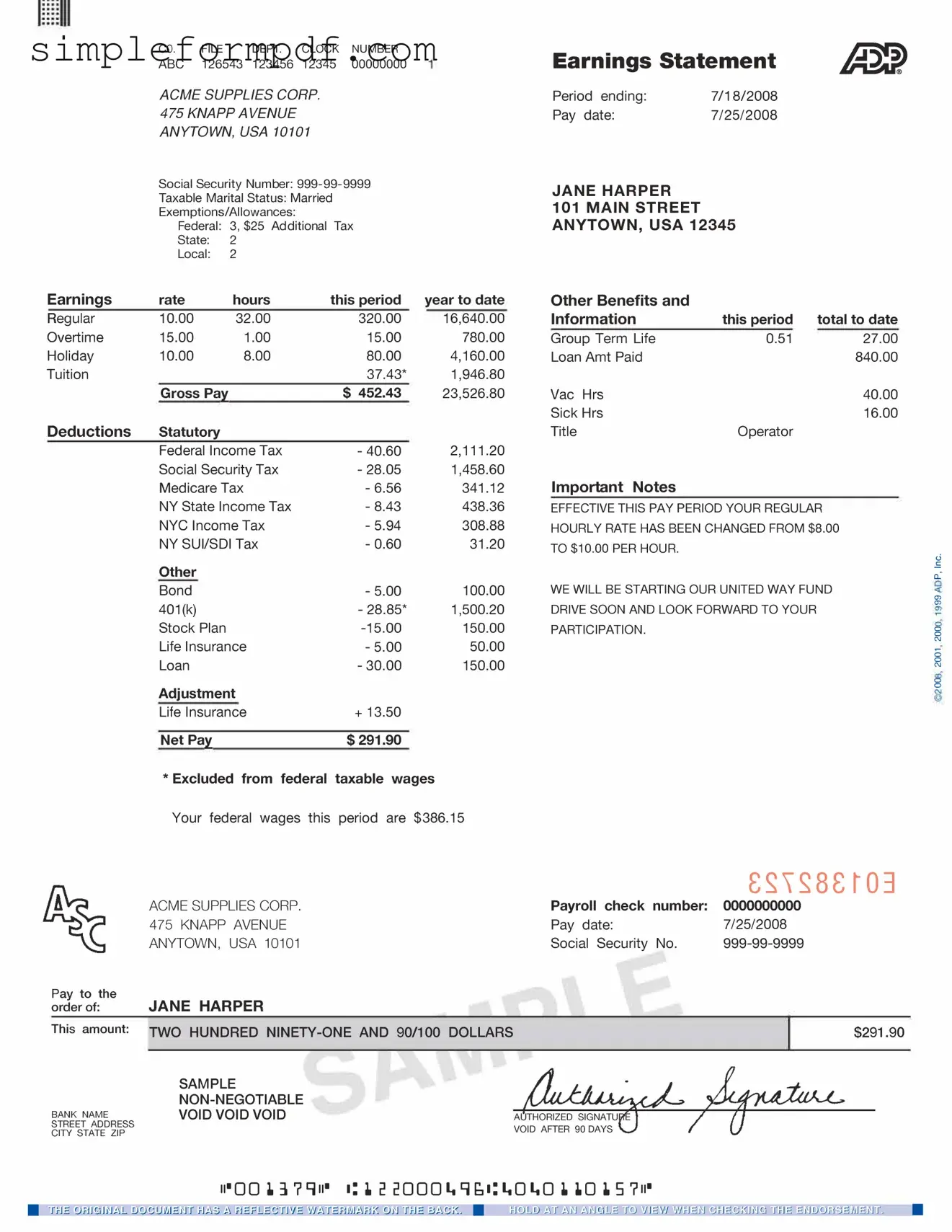

Adp Pay Stub PDF Form

The ADP Pay Stub form is a detailed document that provides employees with a breakdown of their earnings, deductions, and net pay for a specific pay period. It serves as an essential tool for understanding one’s compensation and tracking financial information. For those looking to fill out the form, please click the button below.

Launch Editor

Adp Pay Stub PDF Form

Launch Editor

Need instant form completion?

Finish Adp Pay Stub online in just a few minutes.

Launch Editor

or

Download PDF